What if I’ve rented part of my home?

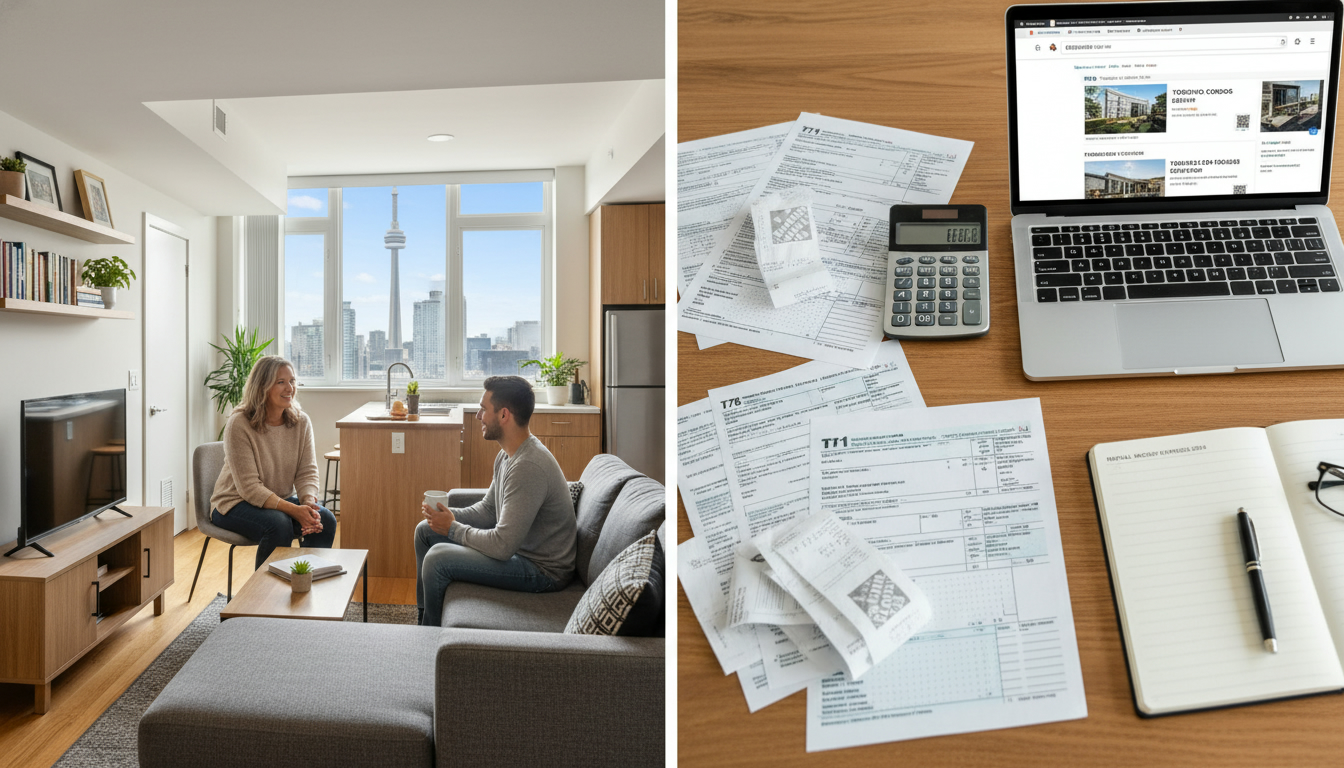

Renting Part of Your Home? How to Keep Tax Bills Low and Avoid a CRA Surprise

If you’ve rented part of your home, this is the short, blunt playbook to keep your money and stay legal.

The bottom line

Renting a room or a basement suite creates taxable rental income. But it also gives you legitimate deductions. Do it right: report income, track expenses, pick smart tax moves, and protect your principal residence exemption when you sell.

What you must report

- Report all rental income to the CRA. Even occasional Airbnb earnings count.

- If you collect rent regularly, it’s business income; if it’s incidental, it’s rental income. Either way, declare it.

Deductible expenses — use the rented portion

You can deduct a fair share of common costs. Typical deductible items include:

- Utilities, heat, electricity

- Property taxes and insurance

- Repairs and maintenance related to the rental area

- A portion of mortgage interest (Canada) when income is earned from that space

- Management fees and advertising

How to allocate: use the area method (square footage) and time rented. Example: rented 25% of house all year = claim ~25% of utilities, insurance and taxes. Rented a basement for 6 months = claim 25% × 50% = 12.5%.

Capital Cost Allowance (CCA) — use caution

You can claim CCA (depreciation) on the rental portion. But claiming CCA creates an “income-producing use” and can reduce or eliminate your principal residence exemption on sale. If you want to keep the full exemption later, avoid claiming CCA and instead deduct current expenses only.

Capital gains and principal residence exemption

When you sell, CRA may treat the rented portion differently. If part of your home was used to earn income, that part may not qualify for the principal residence exemption for the period it produced income. Strategy: talk to your accountant before claiming CCA and before sale to plan an election or track years of use.

Short-term rentals and GST/HST

Short-term rentals with hotel-like services may trigger GST/HST obligations. If annual taxable supplies exceed the small supplier threshold (~$30k), you must register and collect HST. Keep records and consult a tax pro.

Records and proof

Keep receipts, lease agreements, payment records, photos of space allocation, and a clear calculation method. Keep records for at least six years.

Quick checklist to take action today

- Record all rental payments and deposits. 2. Measure the rented area and document dates rented. 3. Separate expenses and calculate the rental share. 4. Decide on CCA with an accountant. 5. Keep detailed receipts and a rental ledger.

Tony Sousa is a local real estate expert. If you’re renting part of your home and want tailored advice that protects tax outcomes and property value, contact Tony for a practical plan.

Email: tony@sousasells.ca | Call: 416-477-2620 | https://www.sousasells.ca

Disclaimer: This post explains general tax principles in Canada. It’s not tax or legal advice. Consult a qualified accountant or tax lawyer for decisions affecting your taxes or sale.