How do assessments affect my condo value?

Will a condo assessment sink a sale — or become your bargaining chip?

Quick hook: Why this matters now

If you own a condo in Georgetown, Ontario, and your condo board announces an assessment, you need a plan — fast. Assessments change buyer psychology, affect appraisals, and shift negotiation power. Do this right and you protect your price. Do it wrong and you lose thousands.

Why condo assessments matter for Georgetown sellers

Assessments are a trigger. They change how buyers value your unit. In Georgetown, where condo stock is limited and buyer demand is local and specific, an assessment can either slow a sale or give you an opportunity to close faster if you handle it strategically.

There are two assessments you must know about:

- Municipal/property assessment (MPAC): affects property tax class and long-term taxes. Less immediate impact on sale price but still relevant.

- Condo corporation assessment (special assessment or increased common fees): immediate cash call from the condo board. This is the assessment buyers notice and react to.

Search terms buyers and sellers use: Georgetown condo assessments, special assessment impact, selling condo Georgetown ON, reserve fund study. Use these when you market your unit and when you review comparables.

The real ways assessments change condo value

Assessments affect value through three channels:

- Buyer affordability: A $5,000 special assessment reduces a buyer’s cash-on-hand and increases their immediate cost. For many, that knocks them out of the bidding pool.

- Perceived risk: Buyers see a special assessment and think the building has hidden problems. That perception lowers offers even if the assessment pays for an upgrade that will increase future value.

- Financing and appraisal: Lenders and appraisers review condo status certificates and reserve fund studies. A weak reserve fund or large pending assessment can lower appraised value or slow mortgage approvals.

Example math (simple):

- List price: $500,000

- Special assessment: $10,000

- Buyer’s perceived adjustment: 2–4% discount = $10,000–$20,000

Net effect: seller may need to reduce price or negotiate a concession if buyer deducts perceived cost.

Types of condo assessments you’ll face

- Planned reserve fund top-up: Often shows responsible management. Buyers react better when the board communicates the reason.

- Emergency special assessment: Repairs from sudden issues (roof, parking structure). Buyers see higher risk and demand discounts.

- Phased assessments: Spread out over time. Easier for buyers because it’s predictable.

Knowing the type changes your strategy.

Immediate steps to protect your sale value (action plan for sellers)

Follow this checklist the day you learn about an assessment:

- Get documentation: minutes, engineer reports, reserve fund study, payment schedule.

- Ask your condo board for a clear reason and timeline. Buyers want clarity more than excuses.

- Update your listing: disclose the assessment and include the documentation link. Transparency preempts low-ball offers.

- Reprice smart, not emotional. Use a targeted reduction if buyers truly need cash flow relief — or keep price steady and offer a concession at closing.

- Prepare negotiation scripts and alternatives (see below).

Pricing strategy: three options that work in Georgetown

Option A — Full transparency, same price, credit at closing

- Disclose the assessment up front.

- Keep the list price competitive based on comparables.

- Offer a credit at closing equal to the buyer’s portion of the assessment.

Why this works: Buyers know the cost is accounted for. You keep your headline price for marketing and MLS searches.

Option B — Price reduction up front

- Lower the asking price by the assessment or a portion of the assessment.

Why this works: Attracts buyers who don’t want to deal with credits or negotiations. This may reduce offers but speeds the sale.

Option C — Split the cost

- Negotiate to split the assessment or allow the buyer to assume payments with a lower price.

Why this works: Splitting reduces buyer resistance and keeps more bargaining room.

Which to pick: test buyer pool and time-on-market. In a hot Georgetown market, sellers keep price and offer credits. In a slow market, price reduction gets attention.

How to sell the story: messaging for listings and showings

Buyers buy confidence. Craft messaging that addresses the assessment quickly and positively:

- Lead with facts: what the assessment is for, cost, and payment timeline.

- Emphasize improvements: “Assessment funds repair X to improve building safety/value.”

- Use local comparables: show similar sold properties in Georgetown and how building health impacts prices.

- Provide financial context: reserve fund numbers and how the board mitigates future calls.

Sellers who hide assessments get punished in inspections and negotiations. Transparency wins listings.

Negotiation scripts that close deals

If a buyer asks for a discount because of an assessment, use these direct lines:

- “We disclosed the assessment and the condo has provided the engineer’s report. We can offer a credit at closing equal to your share.”

- “The board reviewed options and chose a phased plan to protect owner equity. If you’d like, we can estimate monthly fee changes to fit your mortgage approval.”

- “Price is set based on market comparables in Georgetown. This assessment finances long-term improvements that protect resale value.”

Keep it factual. Buyers respect numbers and clarity.

When an assessment actually reduces resale value (and when it doesn’t)

Will an assessment lower your property’s market value? Yes, but not always by the full assessment amount.

Factors that mitigate loss:

- Strong local demand in Georgetown.

- Positive communication from condo board and good supporting documentation.

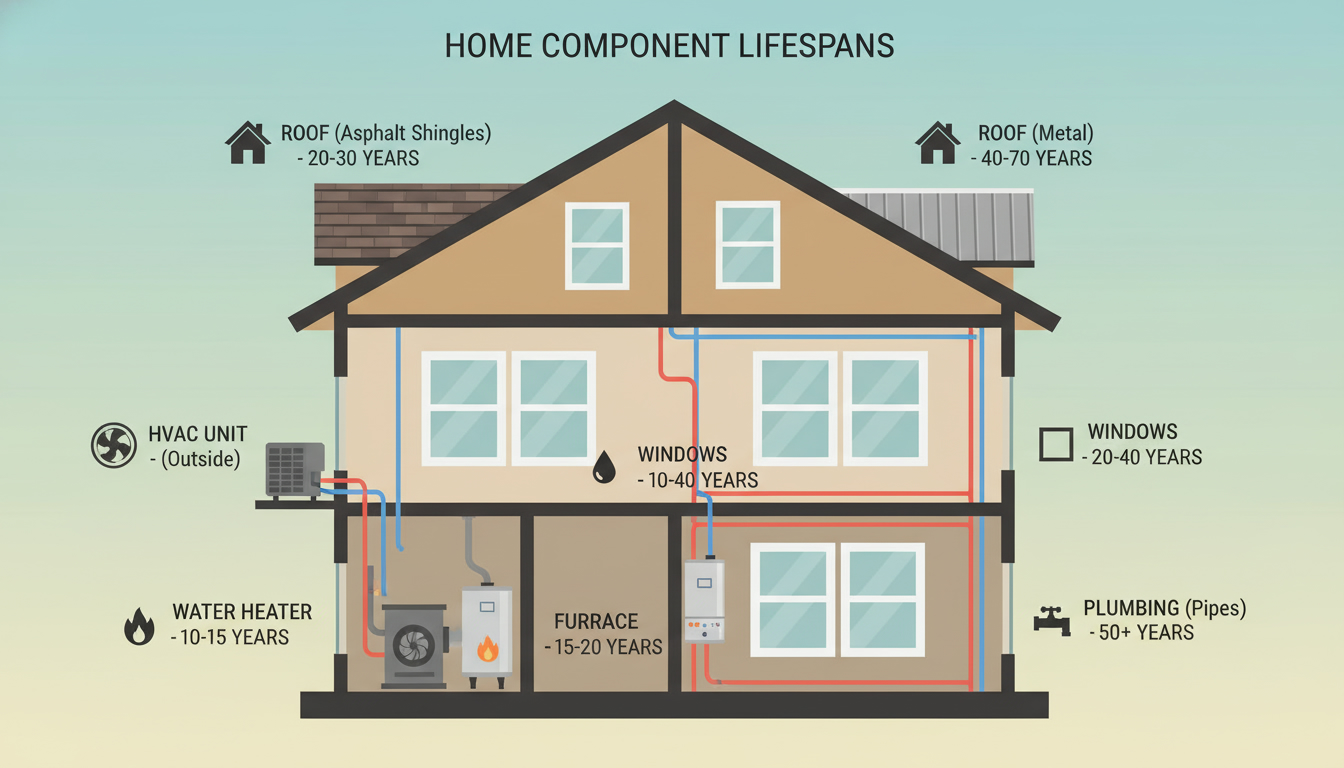

- Assessments tied to visible, value-adding projects (replacement windows, balcony repairs).

Red flags that amplify loss:

- Surprise emergency assessments.

- Poor condo management and weak reserve fund studies.

- Multiple assessments in a short period.

Checklist for sellers in Georgetown before you list

- Pull the status certificate and review recent minutes.

- Confirm reserve fund study date and projected shortfalls.

- Ask the board for any upcoming assessments and timelines.

- Get a competitive market analysis that factors in the assessment.

- Decide upfront pricing strategy and concessions.

- Prepare disclosure packet for buyers with clear documentation.

Case study—what I’ve seen in Georgetown (practical example)

A 2-bedroom condo listed for $420,000. A surprise $8,000 assessment was announced during listing. The seller chose full disclosure with a $6,000 credit at closing. Result: two offers within 10 days. Final sale at $417,500 with the credit applied. Buyer felt protected. Seller kept price visibility and sold quickly.

Why it worked: transparency, clear paperwork, and the credit made the buyer comfortable while preserving listing psychology.

Final moves: timing and closing tactics

- If possible, delay listing until the board finalizes the plan and communication. Certainty helps price.

- If timing forces a sale, disclose and use credits or price adjustments to keep buyers engaged.

- Work with a local Realtor who knows Georgetown condo lenders and appraisers.

FAQs — Seller concerns about condo assessments in Georgetown, ON

Q: Do I have to disclose a condo special assessment to buyers?

A: Yes. Provide the documentation. Hiding it will backfire during due diligence and can lead to legal exposure.

Q: Will a special assessment kill my sale?

A: Not always. How you disclose and what concessions you offer matters more than the dollar amount alone.

Q: Should I lower the list price or offer a credit?

A: Test the market. In stable Georgetown demand, offering a credit while keeping list price often preserves buyer interest and search visibility.

Q: How do lenders view condo assessments in Georgetown?

A: Lenders review condo status certificates and reserve fund health. A large assessment may trigger additional lender scrutiny or conditions, which can delay closing.

Q: Can the condo board force a sale if owner won’t pay an assessment?

A: Boards can place liens for unpaid common expenses and assessments. Check the declaration and consult a lawyer for specifics.

Q: What documents should I have ready for buyers?

A: Status certificate, reserve fund study, minutes showing the assessment, engineer reports, and the condo budget showing fee changes.

Q: How much can an assessment reduce my sale price?

A: There’s no fixed number. Often buyers price in 1–4% depending on perceived risk and cash impact. Local demand and condo condition matter most.

Need help? Local expertise matters

If you’re selling a condo in Georgetown, Ontario and an assessment just hit or is coming, get expert, local guidance. I help sellers translate assessments into a clear listing strategy and strong negotiation plan.

Contact: Tony Sousa — Local Realtor, Georgetown condo specialist

Email: tony@sousasells.ca

Phone: 416-477-2620

Website: https://www.sousasells.ca

Quick recap (what to do next)

- Get the paperwork. 2. Decide your pricing and disclosure strategy. 3. Present facts, not fear, to buyers. 4. Use credits or splits to keep offers competitive.

Do this and an assessment becomes a transaction detail — not a deal killer.