How do property taxes affect investment

returns?

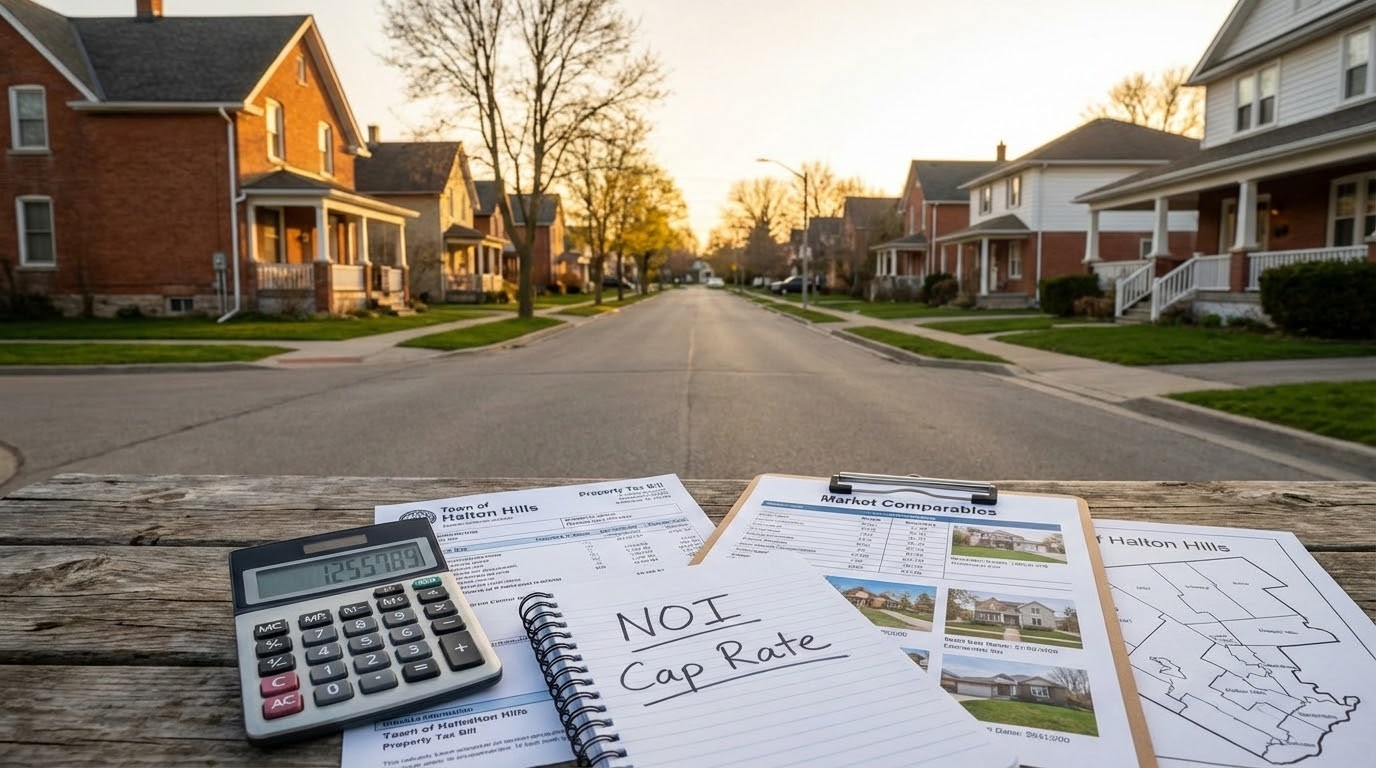

Want to know the truth? How do property taxes affect investment returns in Georgetown, ON — and what to do about it right now?

Quick answer for Georgetown home sellers

Property taxes are a direct drag on investment returns for rental and investment properties and an invisible cost that lowers resale value when buyers compare carrying costs. For sellers of primary residences in Georgetown, ON, property taxes don’t create a capital-gains tax event, but they do affect buyer demand and price expectations. If you own a rental, taxes reduce Net Operating Income (NOI), shrink cap rates, and cut the price a buyer will pay. If you’re selling your home in Georgetown, understanding tax impact lets you price smarter and negotiate better.

Why property taxes matter more than you think — plain facts

- Property taxes are a recurring operating cost. For rental properties, they come off the top of income. Lower income = lower valuation.

- Buyers price homes based on monthly carrying costs. Higher property taxes reduce the pool of buyers who can afford your house or lower the offers you’ll get.

- In Ontario, municipal assessments are handled by MPAC and taxes are set by the Town of Halton Hills (Georgetown). Assessment surprises and tax increases are common reasons buyers discount offers.

- For primary residences, Canada’s principal residence exemption removes capital gains tax at sale — but tax history still shapes buyer perception and resale competitiveness.

Short math every seller must know (simple, real, repeatable)

- Rental NOI impact:

- Annual rent: $30,000

- Annual property taxes: $4,000

- Other expenses: $8,000

- NOI = 30,000 – 4,000 – 8,000 = $18,000

- Valuation via cap rate:

- Buyer target cap rate: 5%

- Property value = NOI / Cap rate = 18,000 / 0.05 = $360,000

If property taxes were $6,000 instead of $4,000, NOI = 16,000 and value = 16,000 / 0.05 = $320,000 — a $40,000 drop. That’s how tax drag translates to your sale price.

Note: These are illustrative numbers. Use your actual rent and expenses. The formula is universal: Reduce NOI, reduce value.

What this means for Georgetown sellers specifically

Georgetown sits inside Halton Hills with a market that attracts commuters to GTA and buyers seeking suburban value. That buyer profile is rate-sensitive: they compare mortgage costs, taxes, and utilities. Here’s how taxes shape the local market:

- Affordability: Rising property taxes in Halton Hills mean buyers factor higher monthly carrying costs. That squeezes offers, especially from first-time buyers.

- Comparative shopping: Buyers often compare nearby towns. If Georgetown taxes feel high relative to Acton, Milton, or Guelph, buyers use that as leverage.

- Investor appetite: Landlords buying in Georgetown will price your property by after-tax cash flow. Higher taxes lower the price investors offer.

If you’re selling a home you lived in, explain tax history and upgrades that offset tax levels (energy upgrades, lower utility costs). If you’re selling an investment property, present clean financials: rents, taxes, maintenance, and vacancy rates.

Practical, immediate steps to protect your return (do these before listing)

- Get a property tax history and current assessment

- Request your tax bill history from the Town of Halton Hills and review your MPAC assessment. Look for spikes or reclassifications.

- Appeal or review your assessment if it’s out of line

- MPAC appeals can lower assessed value and future tax bills. Timing matters — start this early.

- Re-run your numbers with taxes included

- Use real NOI, not optimistic income. Show investors realistic cash flow. For sellers of owner-occupied homes, show how taxes compare to neighbours.

- Present tax-adjusted comps when pricing

- When I list a Georgetown home, I show buyers and agents how monthly taxes compare across comparable listings. This neutralizes surprise and supports your asking price.

- Make targeted upgrades that buyers value more than tax increases

- Energy-efficient windows, insulation, and furnaces can reduce utilities and increase buyer willingness to absorb higher taxes.

- Use tax prorations strategically at closing

- Taxes are prorated on closing. In some cases, negotiating proration timelines or credits can close a deal without changing the sale price.

How property taxes affect resale value vs. investment returns — clear distinction

-

Resale value (owner-occupied): Buyers look at total monthly cost. If taxes push monthly costs above alternate neighbourhoods, your price must reflect that. The principal residence tax exemption means you won’t owe capital gains tax, but you still face market pressure.

-

Investment returns (rental): Taxes are an expense line that directly reduces net income and therefore the valuation. Investors calculate value from NOI and expected cap rates — tax increases lower both.

Be clear: for sellers of primary homes, taxes shape buyer demand. For sellers of investment properties, taxes change the math of what buyers will pay.

Local tactics to increase buyer confidence and defend your price

- Provide an itemized operating statement for investors showing tax history, maintenance, and vacancy. Transparency removes guesswork and increases offers.

- Highlight energy and utility savings that offset taxes.

- Offer a short-term tax credit or closing credit if a recent assessment increased taxes and buyers push back.

- Time the market — listing before a scheduled municipal tax increase can preserve buyer interest.

When to call a local expert (do this now if any apply)

- Your MPAC assessment jumped significantly in the last 2 years.

- You own a rental and taxes are a material share of expenses (>10% of gross income).

- You’re moving to a lower-tax area and need a valuation that anticipates buyer comparisons.

A local agent who knows Georgetown valuation drivers will position your home to minimize the tax drag on price.

Case study — real result (simplified and typical)

A Georgetown rental owner trimmed an over-optimistic asking price by revealing actual annual taxes were $5,500 vs. $3,800 listed in comparable ads. By adjusting rent and showing the true NOI, we set a price that matched investor expectations and sold in 21 days. Lesson: Honesty in tax numbers speeds sales and avoids final-round price cuts.

Closing the gap between tax pain and sale price — negotiation moves

- Show buyers exactly how taxes are prorated and what they’ll pay monthly.

- Present comparable sales with similar tax profiles.

- When investors lowball, counter with documented NOI and a clear explanation of recurring expenses.

- If taxes are an outlier due to assessment, disclose your appeal in progress — buyers respect transparency.

Final straight talk for Georgetown home sellers

Property taxes are not a vague background item. They hit the numbers buyers use every day. Treat property taxes like interest rates: they change what buyers can pay and what investors will offer. Prepare your tax story, present clean numbers, and use local market knowledge to protect your return.

If you want a detailed, tax-adjusted valuation for your Georgetown home — whether it’s a primary residence or a rental — get a market plan that converts tax pain into buyer confidence. I can audit your numbers, show how taxes change buyer math, and craft negotiation strategies built for Halton Hills buyers.

Contact: Tony Sousa, Local Georgetown Realtor — tony@sousasells.ca | 416-477-2620 | https://www.sousasells.ca

FAQ — Property taxes, investment returns, and selling in Georgetown, ON

Q: Do property taxes affect capital gains on my primary home in Georgetown?

A: No. In Canada, the principal residence exemption generally removes capital gains tax for your primary residence. Property taxes, however, still influence buyer demand and price.

Q: Can I appeal my Georgetown property assessment?

A: Yes. MPAC handles assessments in Ontario. If you believe the assessed value is too high, you can file a Request for Reconsideration (RFR) with MPAC and, if needed, escalate to the Assessment Review Board.

Q: How much will higher property taxes reduce my sale price?

A: It depends on buyer profile and whether the property is an investment. For investors, higher taxes cut NOI and multiply into price reductions via cap rates. For owner-occupiers, taxes affect monthly carrying cost and can reduce offers or pool of buyers.

Q: Are property taxes deductible for rental properties in Canada?

A: Yes. For income properties, property taxes are an expense and reduce taxable rental income. They reduce both cash flow and taxable income for owners.

Q: Should I list before a known municipal tax increase?

A: Often yes. Listing before a scheduled tax increase avoids the buyer shock of a higher tax bill and preserves comparable pricing. Discuss timing with your agent.

Q: How can I present taxes to buyers without scaring them away?

A: Be transparent. Provide tax history, prorations, and comparisons. Show energy upgrades and other offsetting factors. Offer short-term concessions if needed, but only as a strategic closing tool.

Q: Where can I get a local, tax-adjusted valuation for my Georgetown home?

A: A local agent who knows Halton Hills and Georgetown market dynamics can run a tax-adjusted comparative market analysis and present strategies to protect your sale price.

If you want a free tax-impact valuation for your Georgetown property, reach out: tony@sousasells.ca | 416-477-2620 | https://www.sousasells.ca