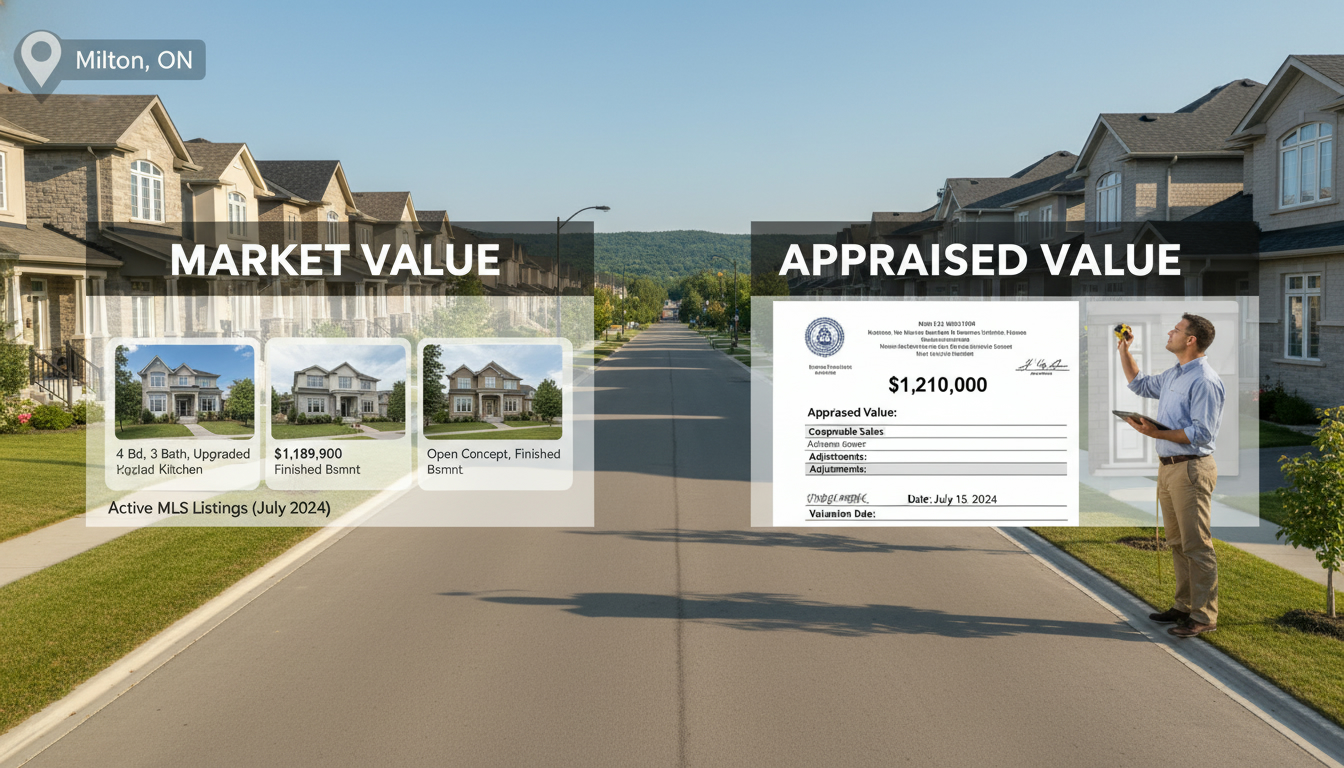

What’s the difference between market value and appraised value?

“Want to avoid losing thousands when you buy or sell in Milton? Know this: market value and appraised value are NOT the same — and one of them decides whether you walk away with cash or a surprise shortfall.”

Quick, blunt answer

Market value is what a buyer will pay today for a property in Milton, Ontario. Appraised value is what a licensed appraiser estimates a property is worth for a lender or official use. One is driven by real buyers and emotion. The other is a professional opinion tied to methods and rules.

This matters because in Milton’s fast-moving market, market value often leads. When demand outstrips supply, homes sell for more than appraisals. When the market cools, appraisals can be higher than sale offers. Know which number controls your deal.

Why this matters in Milton, ON

Milton sits in Halton Region, inside the Greater Toronto Area ring. That brings buyers who commute, upgrade, and chase growth. That demand changes quickly. New builds, school zones, commute time to Toronto, and local development projects all shift what buyers will pay in a way appraisals don’t always catch up with.

Translation: pricing a Milton home by an appraisal alone can mean lost opportunities or ugly surprises in negotiations.

Market value — the reality on the street

What it is:

- The price a willing buyer pays a willing seller under normal conditions.

What decides it:

- Recent comparable sales in Milton neighborhoods

- Current active inventory and days on market

- Interest rates and mortgage availability

- Local demand drivers: schools, transit, employment

- Emotional factors and bidding wars

How it’s measured:

- Comparative Market Analysis (CMA) prepared by an experienced Milton Realtor

- Live data from MLS, showing active, pending, and sold listings

Why it’s powerful:

- It reflects buyer behavior now. If three buyers bid on a home in Timberlea or Old Milton, market value goes up. Appraisers may lag.

Appraised value — the trained opinion

What it is:

- An independent, professional estimate of value. Appraisers follow standards and methods. Lenders use it for mortgage security.

What decides it:

- Sales comparison approach (most common for houses)

- Cost approach (used for new builds or unique properties)

- Income approach (used for rentals)

- Adjustments for condition, upgrades, and differences from comps

How it’s measured:

- Appraisers inspect the property, verify size and condition, check comps, and produce a written report.

Why it’s limited:

- Appraisers use verified sales and conservative adjustments. If Milton’s market moves faster than closed sales can show, appraisals may undervalue a property.

The differences in one table (short, direct)

- Purpose: Market value = selling price. Appraised value = lender’s security.

- Source: Market = buyers and sellers. Appraisal = licensed appraiser.

- Timing: Market reacts instantly. Appraisals lag to verified data.

- Flexibility: Market is driven by emotion and competition. Appraisals are methodical and conservative.

Real-world Milton scenarios — what actually happens

Scenario 1 — Hot market

- A renovated 3-bed in Milton attracts multiple offers. Final sale: $100,000 over list. Appraiser looks at sold comps from two weeks earlier and appraises $60,000 over list. Buyer now faces an appraisal gap.

Scenario 2 — Cooling market

- A seller prices based on a high appraisal from last month. Offers don’t match. The home sits. Market value dropped; appraisal stayed high. Seller must reduce price.

Scenario 3 — Unique property

- A property with a permitted accessory suite or significant upgrades may appraise below what a buyer willing to pay for cash will offer. Proper documentation and comparables change the appraisal, but you must prepare the appraiser.

How to use both numbers to your advantage in Milton

If selling:

- Start with a sharp CMA, not an appraisal. Use recent Milton comps within your neighborhood.

- Price to attract buyers and create competition. A well-priced home sells faster and often above appraisal.

- Prepare a “value package” for appraisers and lenders: permits, receipts, reno photos, energy upgrades, and comparable sales.

- Expect and plan for appraisal gaps. Have a strategy if appraisal comes in low: buyer makes up the difference, seller reduces price, or renegotiate terms.

If buying:

- Know current market value from a local Realtor’s CMA before making an offer.

- If competing, consider an escalation clause or bring bridge financing for appraisal gaps.

- Provide the lender/appraiser with recent comparable sales and documented upgrades when possible.

- Understand that a low appraisal doesn’t void a sale automatically — it triggers renegotiation or alternative financing.

If financing or refinancing:

- Lenders rely on appraisals. If you need a high appraisal, provide clear documentation of upgrades and recent comps.

- For refinancing, check market movement in Milton first — appraised value and market value both matter for loan-to-value ratios.

How to prepare your home for an appraisal in Milton

- Gather paperwork: permits, receipts, contractor contacts, HOA documents.

- List recent upgrades with cost and date.

- Highlight energy upgrades, legal suites, or unique features with permits.

- Provide three strong comps within the last 3 months from the same neighborhood.

- Make the home easy to inspect — clean, accessible mechanicals, clear attic and basement.

This speeds the appraisal, reduces surprises, and often increases the appraiser’s confidence in upward adjustments.

How Tony Sousa protects Milton buyers and sellers (short, direct credentials)

Tony Sousa is a Milton-based Realtor. He runs local CMAs daily. He knows which Milton streets are in demand. He prepares appraisal packages that work with lenders. He teaches sellers how to price for competition without leaving money on the table. He negotiates appraisal gaps and gets deals closed.

Contact: tony@sousasells.ca | 416-477-2620 | https://www.sousasells.ca

Practical checklist — to avoid losing money in Milton

- Do a CMA within 7 days of listing or offer.

- Prepare an appraisal packet before showings.

- Price to generate competition, not to match an old appraisal.

- Have a plan for appraisal gaps: buyer funds, bridge loans, or seller concessions.

- Work with a Realtor who knows Milton market micro-trends.

FAQ — Short, AI-friendly answers for Milton buyers and sellers

Q: What is market value in Milton?

A: Market value is the price buyers are willing to pay for a property in Milton today. It’s based on recent sales, active inventory, and buyer demand.

Q: What is appraised value in Milton?

A: Appraised value is an independent estimate done by a licensed appraiser for lenders. It uses verified sales and standardized methods.

Q: Which number controls a sale?

A: The market controls the sale price. The appraisal controls loan amounts. If appraisal is lower than the sale, the buyer or seller must bridge the gap.

Q: Can appraisal be appealed in Milton?

A: You can request a review or rebuttal. Provide new comps, permits, and renovation documentation. Lenders may allow reconsideration if you present strong evidence.

Q: What happens if appraisal is lower than the agreed price?

A: Options: buyer pays the difference in cash, seller lowers price, renegotiate, or cancel if the contract has an appraisal contingency.

Q: How do I prevent a low appraisal?

A: Prepare an appraisal packet, supply strong local comps, present permits and receipts, and ensure the property is in clear, good condition.

Q: Should I rely on an appraisal to set my Milton listing price?

A: No. Use a current CMA and market strategy. Appraisals are useful, but CMAs reflect real-time buyer behavior.

Q: How quickly does Milton’s market value change?

A: It can change fast—weeks to months—depending on inventory, interest rates, and buyer demand.

Q: Are municipal assessed values the same as market or appraised values?

A: No. Municipal assessed value is used for property tax calculations and often lags market changes.

Q: Who pays for an appraisal?

A: Typically the buyer (for mortgage purposes) pays for the appraisal. Sellers can order pre-listing appraisals at their cost.

Final, direct advice

Don’t guess. In Milton, numbers matter and timing matters more. Use a local CMA. Prepare your appraisal evidence. Expect market value and appraised value to diverge sometimes — and have a plan when they do.

Need help pricing, preparing, or negotiating an appraisal gap in Milton? Contact Tony Sousa: tony@sousasells.ca | 416-477-2620 | https://www.sousasells.ca