What is the maximum mortgage I can qualify for?

Want the exact maximum mortgage you can qualify for in Georgetown, ON — right now? Read this and stop guessing.

Quick hook: what you’ll learn

- The exact steps lenders use to calculate your maximum mortgage in Georgetown, Ontario

- How local prices, taxes, and rates change your buying power

- A clear calculator example you can copy and use now

- Practical ways to increase the mortgage you’ll qualify for

Why this matters in Georgetown, ON

Georgetown (Halton Hills) sits inside the Greater Toronto Area price band. That means prices are higher than smaller Ontario towns and buyers face strict federal mortgage rules. If you overestimate your budget, you risk losing a bid or over-stretching your finances. If you under-estimate, you leave opportunities on the table.

Keywords: maximum mortgage Georgetown, mortgage qualification Georgetown, Georgetown mortgage calculator, mortgage pre-approval Georgetown, Georgetown Ontario mortgage.

The simple rule lenders use

Lenders estimate the largest mortgage you can afford by checking three things:

- Income — how much you earn, steady income counts more.

- Debts — car loans, lines of credit, credit cards.

- Mortgage rules — stress test, down payment, loan-to-value limits.

Two ratios drive the decision: GDS (Gross Debt Service) and TDS (Total Debt Service).

- GDS measures housing costs (mortgage principal & interest + taxes + heating + condo fees) vs gross income.

- TDS adds all other debt payments.

Typical ranges lenders use (rule-of-thumb):

- GDS cap: 35%–39% of gross income

- TDS cap: 42%–44% of gross income

Use the lower of the two to stay safe.

Federal rules that affect every Georgetown buyer

- Stress test: Lenders qualify you at the higher of the contract mortgage rate plus 2% or the Bank of Canada benchmark rate. That usually reduces your allowable mortgage compared to a low contract rate.

- Minimum down payment: 5% for homes up to $500,000, 10% for the portion between $500,000 and $1,000,000, and 20% for properties over $1,000,000.

- Mortgage insurance: Required if down payment <20% (via CMHC or private insurers).

These rules apply across Ontario and are enforced by lenders in Georgetown.

Local market context — Georgetown price ranges (2023–2024)

- Condos: approximately $450,000–$650,000

- Townhouses: approximately $650,000–$950,000

- Detached homes: approximately $950,000–$1.6M (neighborhood and lot size vary)

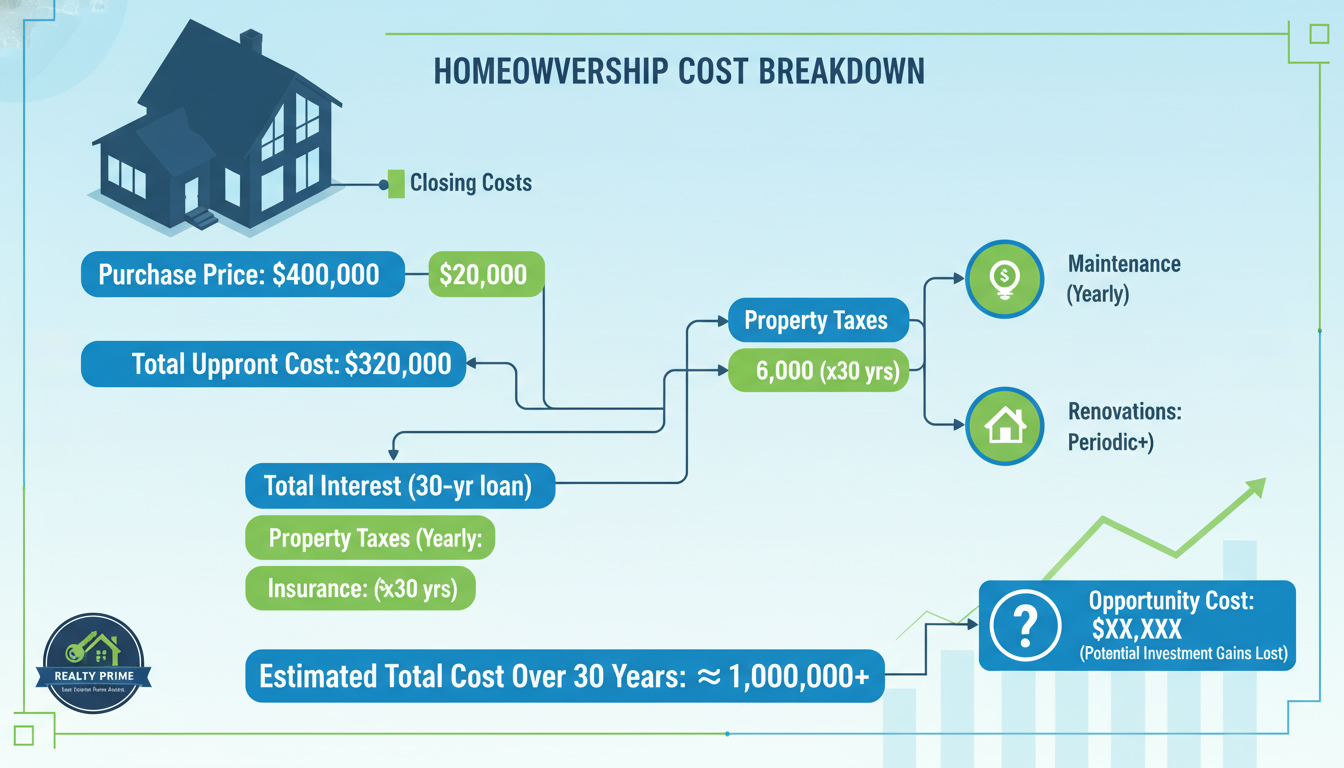

Property tax and condo fees in Georgetown matter. Annual property tax on a $1M house can be $4,000–$6,000 depending on assessment and municipal rates. Condo fees vary widely.

Step-by-step: Calculate the maximum mortgage you can qualify for (copy this)

- Start with gross annual income. Convert to gross monthly income by dividing by 12.

- Pick conservative GDS and TDS caps (use 35% GDS and 42% TDS for safety).

- Estimate monthly property tax, heating, and condo fees.

- Calculate maximum monthly housing payment allowed: Gross monthly income x GDS cap – property tax/12 – heating – condo fees.

- Use a mortgage payment formula or calculator (rate and amortization) to turn that monthly payment into a maximum principal.

- Confirm TDS: subtract other monthly debt payments from gross monthly income x TDS cap. The mortgage payment must also fit under that number.

Example — realistic Georgetown scenario

Assumptions:

- Gross household income: $120,000/year

- Down payment: 10% available

- Interest rate for qualifying (stress-tested): 6.5% (example; actual offers vary)

- Amortization: 25 years

- Property taxes + heat: $500/month

- No condo fees

- Use GDS cap of 35% and TDS cap of 42%

- Gross monthly income = $10,000

- Max housing cost (GDS) = 10,000 x 35% = $3,500/month

- Subtract taxes & heat = $3,500 – $500 = $3,000/month available for mortgage payment

- Mortgage payment at 6.5% for 25 years that equals $3,000/month corresponds to principal roughly $515,000 (use mortgage calculator to check exact number).

- Check TDS: TDS cap = 10,000 x 42% = $4,200. If borrower has $400/month in other debt, allowable mortgage payment under TDS = $4,200 – $400 = $3,800. The GDS limit ($3,000) is lower, so $3,000 controls.

Result: With these assumptions the buyer could qualify for a mortgage around $515,000. Add 10% down = buying power ~ $572,000. That places most townhouse or smaller detached options in reach, but likely below many Georgetown detached listings.

Note: If you can post a 20% down payment, your buying power increases because you avoid mortgage insurance and can afford a larger loan-to-value ratio for the same monthly payment.

How to increase the maximum mortgage you qualify for — practical moves that work

- Raise down payment. Each percentage point lowers required mortgage principal.

- Reduce debt: pay down credit cards, lines of credit, or car loans.

- Increase gross income: add a steady second income, get a raise, or show rental income if acceptable.

- Choose a longer amortization (if you qualify) — 30 years reduces monthly payment and increases the principal for the same payment. Note lenders may limit amortization for insured mortgages.

- Improve credit score: lower rates or more favorable lender decisions.

- Shop lenders: credit unions, banks, and mortgage brokers use slightly different overlays.

Georgetown-specific tactics

- Talk to a local mortgage broker or lender who understands Halton Hills tax rates and local utility costs — small differences in property tax estimates change approved mortgage amount.

- If bidding on a home in Georgetown, get a pre-approval based on the stress-tested rate, not current advertised rates.

- Use comparable local listings to estimate realistic taxes and condo fees for the property type.

Red flags that reduce your maximum mortgage

- Large variable income with no multi-year track record.

- Co-signer income that won’t be counted due to credit history or temporary employment.

- High credit utilization on cards or lines of credit.

- Recent job change without probation period completed.

Quick checklist to get pre-approved and maximize your number

- Collect T4s or Notice of Assessments for two years (if applicable)

- Recent pay stubs and proof of down payment origin

- Bank statements for three months

- List of monthly debt payments and current balances

- ID and SIN for credit check

Get a pre-approval letter with the stress-tested rate. A pre-approval tells sellers you’re serious and shows the exact maximum mortgage a lender will back.

Why local expertise matters

Georgetown is competitive and sits close to transit corridors and major employment hubs. Local realtors and lenders know which neighborhoods command premium offers and which properties have higher carrying costs (higher taxes, special levies, or elevated condo fees). That local insight converts a theoretical mortgage number into a real buying strategy.

Final thoughts — act like a buyer who wins

Stop guessing your maximum. Calculate it. Confirm it with a local lender or mortgage broker who understands Halton Hills taxes and Georgetown markets. Focus on the levers you can control: down payment, debt, and documentation.

FAQ

What is the single fastest way to increase how much mortgage I qualify for?

Raise your down payment or lower your monthly debts. Both move the needle fast.

Does the mortgage stress test apply in Georgetown?

Yes. The federal stress test applies across Canada, including Georgetown. Lenders will qualify you at the higher of the benchmark rate or your contract rate plus 2%.

How much mortgage will I get with $100,000 income?

Roughly: use GDS 35% — monthly housing budget = $2,917. Subtract local taxes/fees, then convert the remainder to principal using your chosen rate and amortization. Example numbers change with rate and debts.

If I have a 5% down payment, can I still buy in Georgetown?

Yes — for homes under $1,000,000. You’ll need mortgage insurance and you’ll be stress-tested. Your buying power will be lower than with a 20% down payment.

Do property taxes in Georgetown reduce my mortgage qualifying amount?

Yes. Property taxes are included in GDS. Higher taxes reduce the available monthly mortgage payment.

Who should I contact for fast, local mortgage help?

For local Georgetown mortgage and real estate guidance, email tony@sousasells.ca or call 416‑477‑2620. Visit https://www.sousasells.ca for more resources.

If you want, send your gross income, current debts, down payment amount, and the type of property you want. I’ll run the numbers and give you a clear maximum mortgage estimate and suggested next steps for Georgetown, ON.