What if the sale price doesn’t cover the mortgage?

What if your house in Milton sells for less than your mortgage — and you still owe thousands? Don’t panic. Read this and act.

Quick reality check

If the sale price doesn’t cover the mortgage, you face a shortfall. In Ontario that shortfall can become a real debt to your lender. That sounds scary. It is. But you have options. Most sellers in Milton never explore them. They panic and make costly mistakes. This guide lays out clear steps, legal realities, local market factors, and exactly what to do next — fast.

Why this matters for Milton sellers

Milton is close to Toronto, with fast-changing prices, rising carrying costs, and commuting demand. That can push sales fast — up or down. If you bought at a market peak or carried a high mortgage through higher interest rates, a single sale can leave a gap between your mortgage balance and the sale proceeds.

Here’s why Milton’s local context matters:

- Inventory swings: Fewer homes listed can lift prices; oversupply pushes prices down quickly.

- Commuter market: Price sensitivity among buyers who commute to Toronto or Burlington.

- Carrying costs: Higher taxes and maintenance can force hurried sales.

- Demand for move-in ready homes: Sellers who don’t invest in staging or repairs get lower offers.

Know these factors so you can negotiate from strength — or avoid a bad sale.

The core legal truth (short and sharp)

In Ontario, most mortgages include a power of sale clause. If your lender sells your home and proceeds don’t cover the mortgage, the lender can seek the shortfall (deficiency) from you. That can lead to a statement of claim and a judgment. That’s a debt on your record.

Key consequences:

- Lender can pursue the deficiency in court.

- Bankruptcy or insolvency changes the dynamic — but it has long-term cost.

- Registered liens (property taxes, construction liens, condo arrears) can complicate closings and reduce sale proceeds further.

Don’t ignore this. But also don’t assume the worst. Lenders prefer resolution, not court battles.

Immediate steps if an offer won’t cover your mortgage

- Stop. Don’t sign anything yet. Understand your numbers.

- Get a clear mortgage statement showing the payoff amount today (include penalties and interest).

- Get a net proceeds estimate from your lawyer that includes realtor fees, legal fees, discharge penalties, and liens.

- Talk to your lender immediately. Ask for options: short sale approval, mortgage restructure, or temporary forbearance.

- Talk to a real estate lawyer in Milton. Local law matters. You need a Lawyer who understands power of sale and deficiency actions.

- Talk to an experienced Realtor who sells in Milton and gets top bids. Small pricing and staging changes can close gaps.

Do these in the first 48–72 hours.

Options you can pursue (real, practical moves)

- Bring cash to close: If you can, pay the deficiency at closing. It’s the cleanest way.

- Negotiate with the lender for a short sale: In Canada, lenders sometimes accept less than the mortgage if convinced the sale is the best outcome. This requires lender approval.

- Deed in lieu / voluntary transfer: Rare in Ontario but possible in special cases. The lender takes the property and agrees not to pursue you — only with negotiation.

- Refinance or private loan: If a co-signer or private lender covers the shortfall, you avoid a deficiency. Expensive, but may protect credit.

- Delay the sale: If market conditions suggest a short-term recovery, renting the property out may be better than a fire sale.

- Negotiate liens down: Some lienholders (contractors, municipalities) will negotiate for partial payment or payment plans.

Each option has pros and cons. Use a local Realtor and lawyer to pick the fastest, most cost-effective path.

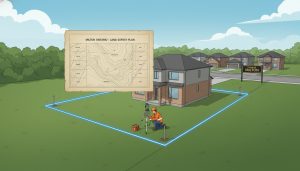

How liens change the math

Liens are recorded claims against a property. Common ones in Milton: municipal property tax arrears, construction (mechanic’s) liens, condo common expense arrears, and judgment liens.

- Priority: Municipal tax liens often jump to the front. They can wipe out proceeds fast.

- Unknown liens: Always order a title search and municipal tax report before listing.

- Negotiation: Many lienholders will accept partial payment rather than chase a small claim.

If your sale can’t cover mortgage plus liens and costs, lenders expect you to be aware — and they may pursue the deficiency.

Pricing and sales strategy that reduces the risk

You can still control the outcome. A better sale price removes the problem. Here’s how Milton sellers protect value:

- Price to current comps, not emotion. Use a Realtor who knows Milton neighborhoods.

- Fix the must-fix items. Buyers penalize deferred maintenance.

- Stage and market aggressively. Professional photos and 24-hour listing work.

- Target the right buyers: commuters, young families, investors.

- Time the market: small delays can produce significant gains in Milton’s volatile market.

A $10,000–$30,000 improvement in sale price is common if you follow a smart plan.

Mortgage penalties and payout fees to watch

If you break a mortgage early you may owe a penalty. In Canada that could be an interest rate differential (IRD) for closed fixed-rate mortgages or a few months’ interest for variable-rate mortgages. Ask your lender for a written payoff figure before listing. Without that figure you cannot calculate the true net proceeds.

Negotiating with the lender — how to win the room

Lenders want to minimize losses. They dislike court. Present a solution:

- Full payoff plan (cash or loan) — fastest.

- Short sale with proof of fair market listing and expected sale price.

- Temporary deferral with a realistic repayment plan.

Bring an agent and lawyer to negotiations. Be factual, fast, and reasonable. Emotional pleas rarely work; numbers do.

If the lender sues for deficiency

If a lender issues a statement of claim, you must respond. Options include:

- Negotiate a settlement or payment plan.

- Defend on procedural or valuation grounds (require evidence of fair market sale process).

- Consider insolvency options if the debt is unmanageable — consult a licensed insolvency trustee.

Court outcomes vary. That’s why early negotiation is better than waiting for litigation.

When a short sale is realistic in Milton

Short sales are realistic if the lender believes the sale price is fair and the borrower has a reasonable hardship. Evidence helps:

- Recent appraisal or market analysis.

- Proof of genuine efforts to market and sell at fair market value.

- Financial statements showing inability to pay the deficiency.

In Milton’s market, sellers who present clean documentation, smart pricing, and a plan often persuade banks to accept a short sale.

Cost checklist before you accept a low offer

- Mortgage payoff (include penalty)

- Realtor commission (typically 3–5% in Canada)

- Legal fees and discharge costs

- Outstanding municipal taxes and utility arrears

- Any registered liens or judgments

- Moving costs and any repairs required by buyer

Get the actual numbers in writing. Don’t rely on guesses.

Practical Milton example (realistic scenario)

You owe $700,000. Market value is $660,000. You list and get $650,000 net after commissions and legal costs. You also have $5,000 in municipal arrears and a $10,000 mechanic’s lien.

Net shortfall = $700,000 – $650,000 + $5,000 + $10,000 = $65,000.

Options: negotiate with lender for a $65,000 shortfall settlement, raise cash, or ask lienholders to reduce claims. Each path needs documents and quick action.

Final play: control the sale, don’t let it control you

The best outcomes come from preparation. Don’t put a poorly priced home on the market and hope for a miracle. Know your mortgage payout, clear title issues early, and use a selling strategy built for Milton buyers.

Contact for fast help (local and immediate)

If you’re in Milton and facing a potential shortfall, get local, experienced help now. I refer sellers to top local real estate lawyers and get the best market price for homes across Milton neighborhoods.

Contact: Tony Sousa, Local Milton Realtor

Email: tony@sousasells.ca

Phone: 416-477-2620

Website: https://www.sousasells.ca

Reach out before you accept a low offer. A quick call can save tens of thousands.

FAQ — Mortgages, Liens and Selling in Milton, ON

Q: Will the bank automatically forgive the shortfall if I sell for less than I owe?

A: No. In Ontario, lenders can pursue the deficiency. They can sue for the shortfall after a power of sale. However, lenders may negotiate settlements or accept short sales when presented with proof the sale is fair and the borrower has hardship.

Q: What is a power of sale and why does it matter?

A: Power of sale is a contractual right in most Ontario mortgages allowing the lender to sell the property to recover the loan. If sale proceeds are insufficient, the lender may pursue the balance as a debt.

Q: Can liens block the sale?

A: Yes. Registered liens (tax arrears, mechanic’s liens, judgments) must be resolved at closing. They reduce net proceeds and can make a sale impractical until addressed.

Q: How long can a lender sue me for a deficiency?

A: Time limits and procedures are complex. Lenders often pursue deficiencies, but the timing depends on many factors. Consult a real estate lawyer in Milton right away.

Q: Is bankruptcy a solution?

A: Bankruptcy can eliminate unsecured debt, but secured debts (mortgages) are treated differently. Bankruptcy is a serious step with long-term consequences — get professional advice from a licensed insolvency trustee before deciding.

Q: How often will lenders accept short sales in Canada?

A: It varies. Canadian lenders may accept short sales when the evidence shows the sale price is fair and a sale is the least-loss option. Organized documentation increases the chance of approval.

Q: What if there are two mortgages?

A: Second mortgages are junior to the first. If proceeds don’t cover both, the second lender may be left unpaid and can pursue the borrower for the deficiency. Negotiations with both lenders may be necessary.

Q: How can I avoid this situation?

A: Know your mortgage balance and penalties before listing. Fix title issues, stage the home, hire a Realtor who knows Milton pricing, and avoid panic selling. If you suspect a shortfall, start lender talks and legal review immediately.

Q: Who should I call right now in Milton?

A: A local Realtor and a real estate lawyer. For immediate assistance, contact Tony Sousa at tony@sousasells.ca or 416-477-2620.

If you want a free payoff check and an honest market evaluation for your Milton home, call today. We map the fastest path to the best net outcome — and stop lenders from dictating your future.