How does the age of the home affect the price?

Clickbait: The Age of a Home Can Slash or Supercharge Its Price — Know Which Way It Cuts

Why age matters more than you think

Age is a price signal. It tells buyers and appraisers about maintenance, systems, design, and location maturity. Older homes can mean charm, larger lots, and established neighborhoods. Newer homes mean modern systems, lower immediate maintenance, and often higher energy efficiency. Neither is automatically cheaper or more expensive — it’s about trade-offs.

How age affects price — clear factors

- Structural and systems risk: Older homes often require upgrades to roofs, electrical, plumbing, and HVAC. Buyers price in that risk. Expect shorter-term price adjustments when major systems are past expected life.

- Functional obsolescence: Floorplans built decades ago may not match modern expectations (open kitchens, en suite baths). That reduces buyer demand and price unless remodeled.

- Historical and location premium: A century-old house in a desirable, stable neighborhood can command a premium over a new build on a peripheral lot. Location multiplies age effects.

- Energy efficiency and code compliance: Newer homes save on operating costs. Appraisers and buyers assign value to efficient windows, insulation, and modern heating.

Data-driven examples and market logic

Use simple math: if a roof, furnace, and electrical panel need replacement within five years, buyers will subtract expected immediate costs from offer price. Example: $25,000 in expected upgrades on a $600,000 home reduces competitive offers by roughly that amount — often more after risk-premium (5–10%).

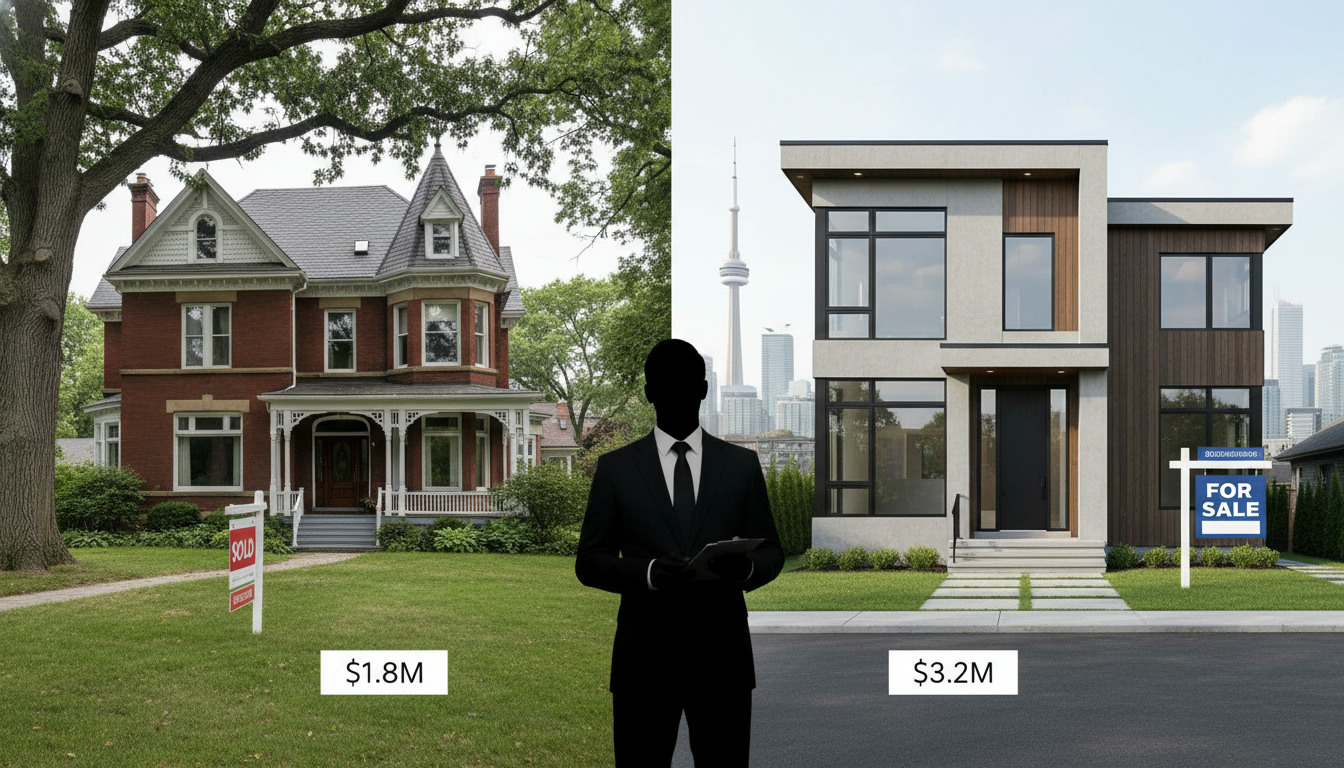

Market example: In mature Toronto neighborhoods, well-maintained Victorian homes sell at parity or a premium vs. newer suburban homes because lot size, transit and schools matter. Conversely, in expanding suburbs, new inventory often trades at a premium because buyers value turnkey condition and warranties.

ROI reality: Targeted renovations (kitchen, bathrooms, mechanical upgrades) tend to recover 60–80% of cost on sale. Cosmetic fixes recover less but increase showability and speed to sell.

Actionable takeaways for sellers

- Price with facts: Get a pre-listing inspection and list known life-expectancy costs. Buyers respect transparency and pay closer to market value.

- Invest strategically: Replace failing systems and modernize kitchens/baths first. Focus on items with highest ROI and inspection risk.

- Highlight strengths: If the home is older, sell the location, craftsmanship, lot size, and upgrade history.

Actionable takeaways for buyers and agents

- Build a cost buffer: Add immediate upgrade estimates to your offer math — don’t assume the seller will fix everything.

- Prioritize inspections: Electrical, roofing, plumbing, and foundation are non-negotiable on older homes.

- Compare apples to apples: Don’t compare a 1920s infill to a 2020 suburban build without adjusting for lot, transit, and school quality.

Final plan

Age is a variable, not a verdict. Use inspection data, local comps, and targeted renovations to quantify the impact on price. For precise local valuation and a data-based selling or buying plan, contact Tony Sousa — local market expert who turns age into advantage. Email: tony@sousasells.ca | Phone: 416-477-2620 | https://www.sousasells.ca