How do property taxes vary within regions?

Want to know why your neighbor pays less property tax than you? Here’s the blunt truth.

Quick answer: taxes change by place, policy, and price

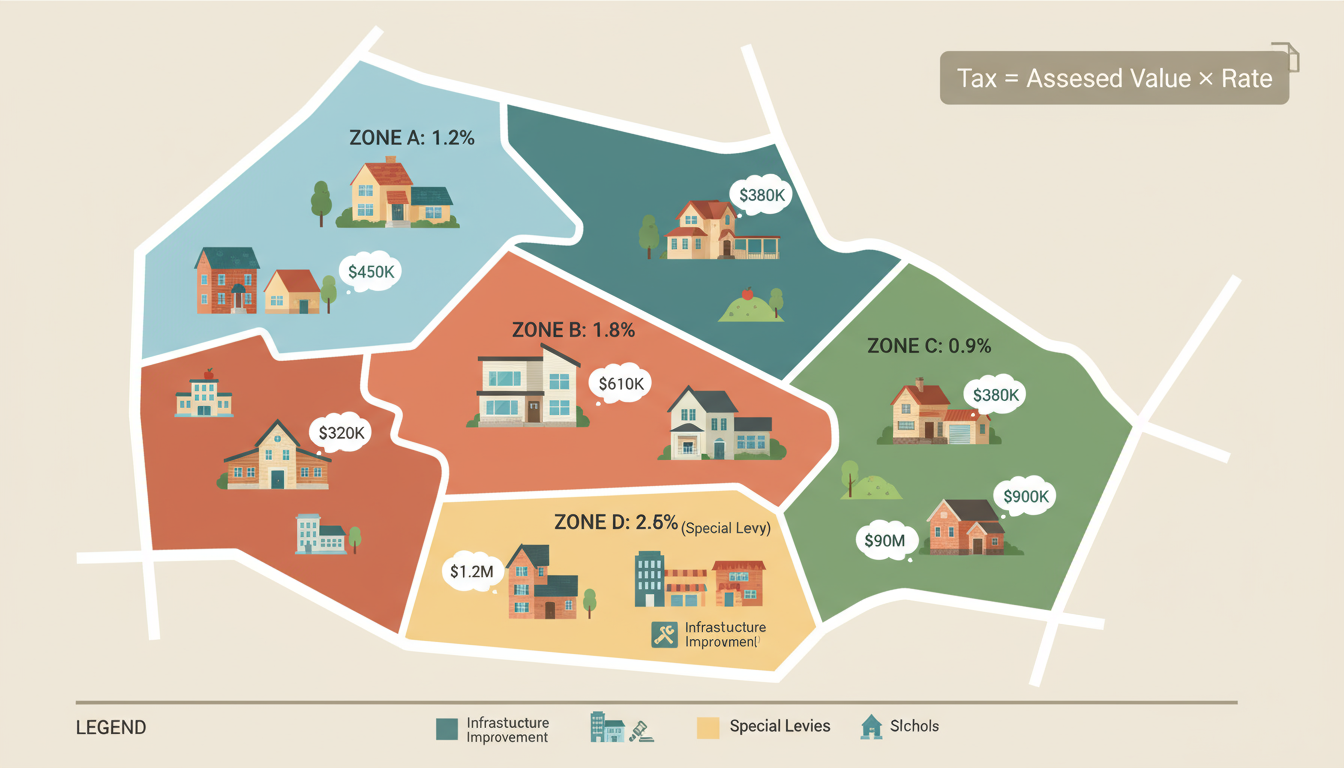

Property taxes vary within regions because of three simple things: assessed value, local tax rates, and policy choices. Those three move the numbers — sometimes dramatically.

How the math works (plain and useful)

Most jurisdictions calculate property tax = assessed value × tax rate (often shown as a mill rate or percentage). Example: a $800,000 home at a 1.2% rate pays $9,600/year. Same home at 1.6% pays $12,800. Small rate changes create big dollar gaps.

Why the rate differs by neighborhood:

- Assessed value differences: High-demand neighborhoods have higher assessed values. If two areas share a rate, the richer neighborhood pays more in dollars.

- Local government policies: City, county, school boards and special districts set separate levies. One neighborhood may fund extra services, parks, or a special levy for infrastructure.

- Regional economics: Declining areas often have lower assessments but may need higher rates to cover fixed service costs.

- Exemptions and discounts: Senior credits, veterans’ exemptions, commercial vs. residential classifications change the net tax.

Real examples that explain the gap

1) Same city, different neighborhoods: Downtown core properties assessed at $1.2M pay far more than a $600k suburban home even if the municipal rate is identical. The difference is driven by assessed value.

2) Different districts in the same metro: A suburb with a high-quality school district may add a school levy raising the effective tax rate by 0.3–0.7 percentage points — easily $2,000–$6,000 on a $800k home.

3) Policy-driven variation: Some municipalities offer tax incentives to attract businesses or to rehabilitate older housing. That lowers taxes for targeted parcels while neighbors see no relief.

Data-driven context

Nationwide averages vary. Effective property tax rates commonly range from about 0.3% to 2.5% depending on the country or state/province. That range explains why a $500,000 home could have taxes of $1,500 in one area and $12,500 in another.

What a buyer or homeowner must do (practical steps)

- Compare effective tax rates (taxes paid ÷ market value) across neighborhoods, not just headline rates.

- Check the assessment schedule and appeal deadlines. A reassessment can cut or raise your bill.

- Identify special levies or business improvement areas that raise local rates.

- Ask for exemptions or credits you may qualify for (seniors, veterans, low-income).

Bottom line: location decides more than you think

Neighborhood desirability drives assessed value; local government choices and regional economics set the rate. Together they produce the wide property tax swings you see. If you want accurate, neighbourhood-level numbers and a game plan to reduce your bill, talk to a local expert.

Tony Sousa — Local Realtor and neighborhood tax guide

Email: tony@sousasells.ca | Phone: 416-477-2620 | https://www.sousasells.ca