How do interest rates affect home prices?

Would a 1% rate hike cost you $50K on your home’s price? Here’s the real math.

Quick answer

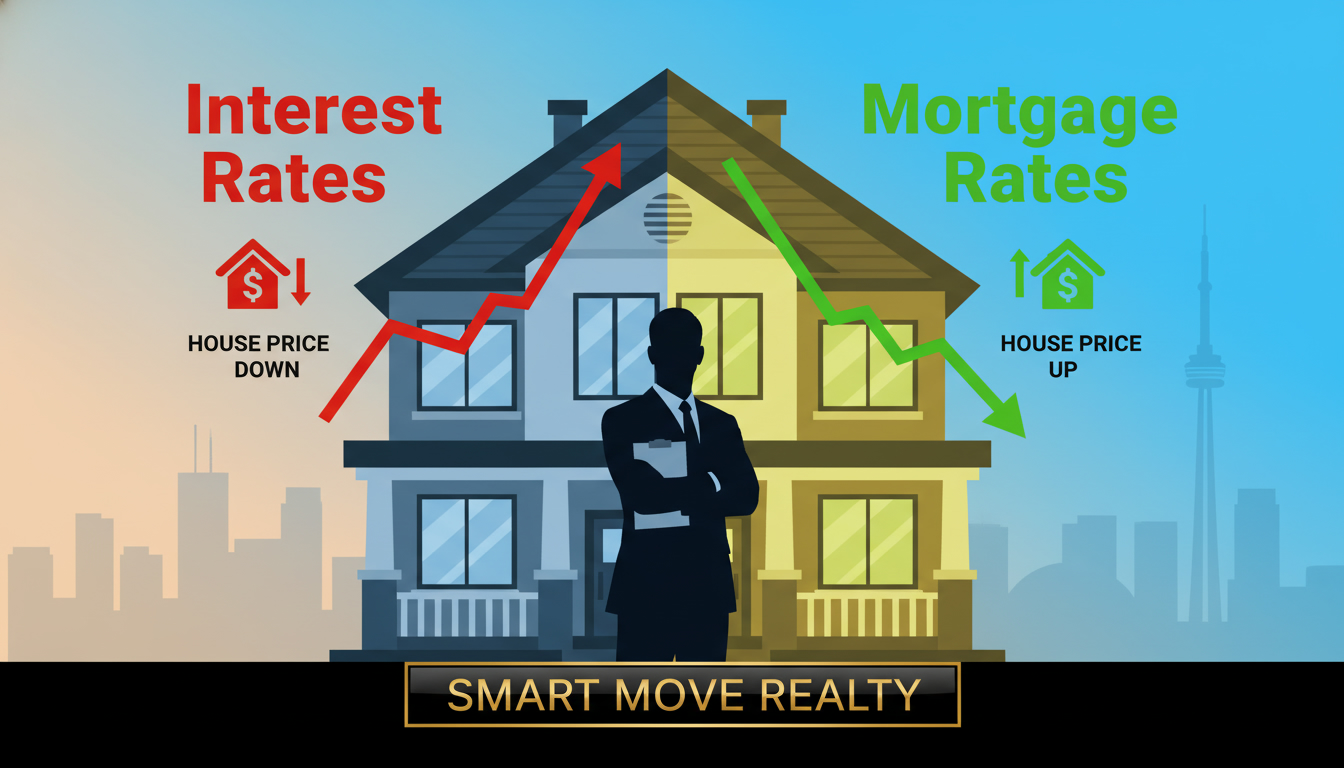

Interest rates affect home prices directly by changing buyer demand and monthly payments. Higher mortgage rates reduce how much buyers can afford, cooling prices. Lower rates boost buying power and push prices up. For sellers and buyers focused on Pricing & Market Value, watch rates — they move market value faster than most factors.

Why interest rates move home prices (plain and fast)

- Mortgage payment math: Home price × mortgage rate × loan term = monthly payment. Small rate changes change monthly cost significantly.

- Buying power: A 5% mortgage on a $500,000 home costs far less monthly than a 6% mortgage on the same home. That gap forces buyers to bid lower or walk away.

- Demand shift: Higher rates shrink the buyer pool; fewer bidders means softer pricing. Lower rates increase competition and push prices up.

- Timing and expectations: When buyers expect rates to rise, they act now — short-term spikes can accelerate sales, long-term increases cool value.

Real example (simple numbers)

If a buyer has $2,800/month for mortgage principal and interest:

- At 4% on a 30-year loan, that buys roughly a $588,000 mortgage.

- At 5% same terms, it buys roughly $524,000.

That’s a 10.9% drop in buying power from a 1% rate increase. Home prices adjust to match what buyers can pay.

What this means for Pricing & Market Value strategy

- Sellers: Price with rate-adjusted comps. Don’t use sales from a period of much lower rates without adjusting for buying power.

- Buyers: Calculate true buying power using current mortgage rates, not list price anchors.

- Agents and appraisers: Use rate-aware valuation models. Adjust comparable sales to reflect rate differences.

Actionable steps (do this now)

- Run payment-adjusted comps: Convert comparable sale prices to a standardized mortgage rate to compare apples-to-apples.

- Stress-test your price: Model home value with a 0.5–1% rate swing to see sensitivity.

- Communicate clearly: If rates rose, be ready to show how demand changed and adjust time-on-market expectations.

- Lock or wait: If you’re buying and rates look like they’ll rise, locking a rate can protect your buying power.

Final takeaway

Interest rates are a primary dial that sets the housing market’s thermostat. They change buyer affordability fast and force price adjustments across neighborhoods. For anyone focused on accurate Pricing & Market Value — buyer, seller, or agent — monitoring rates and adjusting valuations is not optional.

For a rate-adjusted market valuation or quick pricing strategy for your home, contact Tony Sousa, Local Realtor and Pricing & Market Value expert.

Email: tony@sousasells.ca | Call: 416-477-2620 | https://www.sousasells.ca

Keywords: interest rates and home prices, mortgage rates, home valuation, pricing & market value, housing market, buyer demand, pricing strategy, market value adjustment