How do insurance premiums vary by location?

Shocking Truth: Could moving one street over in Milton double your home insurance? Read this before listing.

Quick answer: yes — location changes premiums

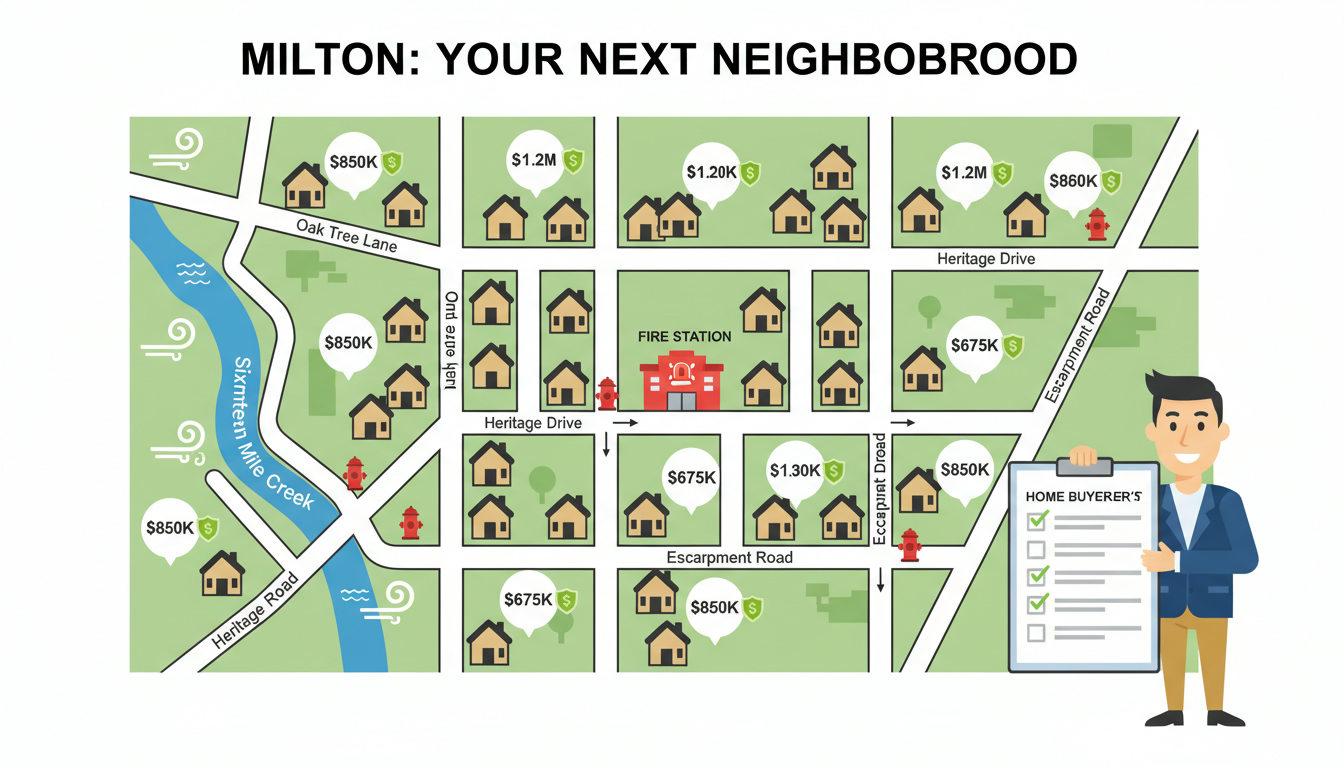

Insurance premiums vary by location because insurers price risk by geography. They look at where a house sits, what surrounds it, and the local damage history. For home sellers in Milton, ON, location isn’t just about curb appeal — it’s a direct line to what buyers will pay to insure the home.

How insurers use location to set premiums

Insurers don’t guess. They use data and maps. Key location-driven factors include:

- Postal code and rating territory: Canadian insurers use postal code clusters to set base rates. Small shifts in postal code boundaries can change the rating territory.

- Local claim frequency: If an area has had many claims for water damage, fire, or theft, insurers raise rates for new policies in that area.

- Weather and natural hazards: Flood zones, severe storm paths, and ice or wind exposure increase premiums.

- Proximity to emergency services: More than curb appeal — how close is the nearest fire station and hydrant? Longer response times = higher risk.

- Crime rates and vandalism: Higher theft or break-in statistics mean higher premiums.

- Infrastructure and municipal differences: Local bylaws, sewer systems (combined vs separated), and building codes affect loss severity and repair costs.

- Construction age and type by neighborhood: Older neighborhoods with original wiring or wooden framing can attract higher rates than newer subdivisions built to modern code.

- Local rebuild cost and real estate value: If local labor and material costs are high, replacement costs rise and so do premiums.

Every one of those factors is tied to place. Insurers map them. That’s why two identical houses in Milton can carry different premiums.

Milton-specific risks that affect insurance premiums

Milton has seen rapid growth. Growth changes risk profiles. Here’s what matters for Milton home sellers and buyers:

- Fast development and mixed housing stock: New subdivisions sit beside older neighborhoods. New builds often qualify for lower premiums. Older homes may need updates — electrical, plumbing, roofs — and insurers charge for that.

- Local waterways and ravines: Properties close to creeks or low-lying areas face higher water and flood risk. Insurers price water damage and sewer backup exposure accordingly.

- Proximity to major routes and transit: Access to highways and commuter lines improves price appeal but can also increase theft and vehicle-related claims in nearby pockets.

- Municipal services and response times: Milton’s fire and emergency services perform well in many areas, which helps rates — but distant pockets or new developments with longer response times can see higher premiums.

- Claim history and community trends: If a pocket of Milton has seen repeated water losses or wind damage claims after storms, underwriters react by raising rates for that micro-area.

How location affects buyers and sellers in Milton — practical examples

1) Two similar bungalows, one near a ravine and one on higher ground: the ravine home may get higher premiums for water damage and sewer backup.

2) A newer townhome in a planned subdivision vs. century home downtown: the older home may face higher premiums due to aged systems and higher likelihood of replacement cost surprises.

3) Homes close to commercial corridors or busy highways: higher risk of theft, vandalism, and vehicle damage to property. Expect insurers to load the premium.

These are not hypotheticals. Insurers price with data. If you’re selling a Milton home, location-based insurance costs are a selling point or a leverage point in price negotiations.

What home sellers in Milton must do now (a direct plan)

- Get an insurance pre-check before listing. Ask your broker for a location-based rate estimate. Put it in your seller packet.

- Fix high-impact items: replace old roofs, update wiring, clear gutters, add backflow valves. These reduce insurer concerns and quotes.

- Document municipal details: show recent property tax assessments, proof of upgrades, distance to fire hydrant and station, and any municipal flood mitigation measures.

- Share claims history and repairs transparently. Buyers and insurers both value honesty; hiding claims causes problems later.

- Add mitigation features: sump pumps, monitored alarms, impact-resistant roofing, and landscaping to divert water. These lower premiums and make the home cleaner to sell.

- Price with insurance in mind. If your neighborhood has higher rates, factor that into the asking price and show comparative market data.

Do those six steps and you’ll reduce friction for buyers and speed closing.

How buyers use location-based premiums to negotiate in Milton

Smart buyers do the math. They compare estimated annual insurance costs across comparable homes. A $300 annual premium difference equals $9,000 over 30 years (discounted value aside). Buyers often use this to negotiate price or ask sellers to complete specific repairs.

If you can present a low-insurance estimate for your property, you improve perceived value and reduce buyer resistance.

How to shop and compare insurance quotes for Milton homes

- Use a local broker who knows Milton postal code nuances.

- Request quotes based on the exact civic address (not just the city) — many insurers use street-level or postal-segment pricing.

- Compare replacement cost vs. market value: make sure quotes reflect replacement costs, not market price.

- Ask about discounts for home updates and bundled policies.

A broker who knows Milton can identify carriers that price certain Milton neighborhoods more competitively.

What moves premiums up — and what brings them down

Raises premiums:

- Flood and sewer backup exposure

- High local claim frequency

- Older construction and outdated systems

- Long distance to fire/hydrant

- High local crime or vandalism rates

Lowers premiums:

- Modern upgrades (roof, wiring, plumbing)

- Monitored alarm systems and security

- Proactive flood mitigation and backflow preventers

- Proof of low claim history and good maintenance

- Bundling home and auto policies

Final thoughts: Location is a top-line expense buyers think about

For Milton home sellers, location matters beyond curb appeal. It’s a financial factor buyers use to decide. If you list without understanding your home’s insurance story, you leave money and negotiating power on the table.

I work with sellers in Milton to surface these insurance realities and turn them into selling points. Share a clear insurance estimate, show recent upgrades, and present mitigation plans — those moves close deals faster.

Contact for a local review and ready-to-use insurance checklist: tony@sousasells.ca | 416-477-2620 | https://www.sousasells.ca

FAQ — Common questions from Milton sellers about insurance and location

Q: How much can insurance vary across Milton neighborhoods?

A: Variation depends on local factors but can be significant. Expect differences of several hundred dollars per year between low-risk and high-risk pockets. For some high-risk properties, premiums can be double compared to lower-risk areas.

Q: Do insurers use my postal code or exact address?

A: Both. Insurers start with your postal code or rating territory and then refine pricing by address-level data like proximity to water, hydrants, and historical claims.

Q: Will upgrading my roof or wiring reduce my premium immediately?

A: Often yes. Insurers typically offer lower rates for modern systems. Keep invoices and permits to prove upgrades. Ask for updated quotes after work is done.

Q: Does flood insurance work the same in Milton as elsewhere in Canada?

A: Standard home insurance often excludes overland flood. Coverage for sewer backup or overland flooding may be optional. Check policy details and consider additional flood protection if you’re in a low-lying or creek-adjacent area.

Q: Should I disclose past claims when selling?

A: Yes. Disclosing past claims builds trust and prevents issues later. Buyers will do their own checks; being transparent speeds negotiation.

Q: How can a realtor help with insurance concerns?

A: A local realtor understands the neighborhood risks and can connect you with trusted brokers, recommend mitigation upgrades, and help show buyers how insurance costs fit into total ownership costs.

Q: Where can I get a quick insurance estimate for my Milton home?

A: Contact a local insurance broker or request an address-specific estimate from carriers. For help lining up local professionals and interpreting estimates, email tony@sousasells.ca or call 416-477-2620.

Contact Tony Sousa — Local Realtor, Milton specialist

Email: tony@sousasells.ca | Phone: 416-477-2620 | Website: https://www.sousasells.ca

If you’re selling in Milton, know your insurance story before listing. It’s one of the fastest ways to remove buyer objections and close at a stronger price.