How do I sell a parent’s home that needs major renovations?

Want to sell your parent’s home that needs major renovations — and keep the maximum cash in your pocket? Read this first.

Why this matters in Milton

Selling a parent’s home that needs major work is different from a normal resale. Milton’s market has demand, but buyers prefer turnkey properties. That means sellers with a renovation-heavy house must pick the right strategy: spend money to renovate, sell as-is to an investor, or use a hybrid approach.

Get this right and you keep thousands. Get it wrong and you waste time and money.

Quick reality check (one-minute framework)

- Assess the property and the legal situation (POA, estate, liens).

- Estimate repair cost vs. increase in sale price.

- Choose a sale path: as-is to investor, limited repairs + list, or full rehab and list.

- Market the house to the right buyers.

- Close with an experienced local agent who handles estate and fixer sales.

Use this plan. It saves time and reduces emotional mistakes.

Step 1 — Confirm legal authority and title clarity

Before you do anything, confirm you have the legal right to sell.

- Power of Attorney (POA): If the parent is alive but incapacitated, ensure POA is valid in Ontario and grants real estate powers.

- Estate/Executor: If the parent passed away, the executor must follow probate rules.

- Check for liens, outstanding property taxes, or mortgages.

Hire a local real estate lawyer early. It costs less than fixing title problems later.

Step 2 — Fast, practical property audit

Get a realistic picture of costs and risks.

- Contractor inspection: A licensed contractor or home inspector giving a scope and budget beats guesswork.

- Hazard check: Older homes may have asbestos, knob-and-tube wiring, or lead paint. These change buyer pools and costs.

- Curb appeal quick wins: Fix the front steps, clean windows, trim bushes. These small moves matter to buyers.

Don’t over-improve. The goal is to know whether to sell as-is or invest.

Step 3 — Estimate ROI on renovations (real math)

Most sellers pick projects emotionally. Be rational.

- Get two quotes for major work (roof, HVAC, foundation, electrical).

- Ask your agent what similar renovated homes sell for in Milton. How much of that added value is realistic?

- If renovation cost is more than 50–60% of expected price increase, sell as-is.

Example: a house lists at $650K renovated. As-is investor offers $480K. Renovations cost $90K to reach $650K. After realtor fees and carrying costs, you may end up worse off. Do the math before swinging a hammer.

Step 4 — Choose the sales strategy (and who you target)

Option A — Sell as-is to investors or rehabbers

- Pros: Fast, fewer showings, sold with no repair costs.

- Cons: Lower price; investor margin reduces proceeds.

- How to optimize: Get multiple investor bids, share contractor quotes, provide a transparent condition report.

Option B — Make limited, high-ROI repairs and list on MLS

- Pros: Better offers from traditional buyers, higher price than investor offers.

- Cons: Upfront costs, scheduling work.

- Focus on: Kitchen refresh, paint, flooring, fix roof or major systems if they block financing.

Option C — Full renovation and sell move-in-ready

- Pros: Top market price, appeals to the largest buyer pool.

- Cons: Time, management, and risk. You need reliable contractors and budget control.

Which to pick in Milton? If the home is structurally sound but worn, limited repairs often deliver the best net outcome. If major systems (roof, foundation, HVAC) are failing, investors are often the practical buyer.

Step 5 — Price and market like a pro

- Price to attract the right buyer: investors respond to “estate sale” or “as-is” language, while families want “move-in-ready.”

- Use professional photos and a clear condition disclosure.

- Market hard: MLS, targeted social ads aimed at renovators and local contractors, email your investor list.

- Host broker-preview and private showings for investors and contractors.

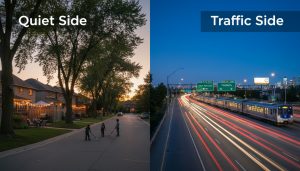

Milton buyers search for schools, commute time to Toronto, and green space. Make those benefits part of your listing copy.

Step 6 — Reduce friction in offers and due diligence

- Provide a recent inspection report or contractor cost estimates — buyers like certainty.

- Be transparent about hazardous materials and repairs.

- Consider a conditional offer time limit to move quickly.

Investors buy speed. Traditional buyers need financing and inspections. Know the difference and set timelines accordingly.

Step 7 — Negotiate smart: net-proceeds first

Focus on net proceeds, not sale price. A $10,000 higher offer with $15,000 in repair credits is worse than a slightly lower clean offer.

Negotiate closing dates that match your needs. Short timelines favor investor offers.

Local Milton tips that change the game

- Market cycles: Milton often sees stronger demand for family homes during spring. But investors are active year-round.

- Commuter advantage: Highlight GO Transit access and highway routes in your marketing copy.

- School district pull: Families pay for top schools—list nearby schools and boundaries.

- Comparable sales: Your agent should know recent as-is investor sales vs renovated sale comps. This distinction matters.

Costs and numbers to expect (ballpark for planning)

- Contractor audit/inspection: $300–$1,000

- Major renovations (roof, electrical, HVAC): $30K–$100K+ depending on scale

- Cosmetic flip: $5K–$25K

- Investor offers: Often 70–85% of renovated market value (depends on repairs needed and market conditions)

These ranges help you decide. Get specific quotes for accurate decisions.

When to call Tony Sousa (and what he’ll do)

If this is complex, don’t DIY. Tony Sousa in Milton specializes in estate and fixer sales. He will:

- Give a free property strategy meeting and net-proceeds estimate.

- Connect you with contractors who give transparent bids.

- Market to investors and traditional buyers with targeted campaigns.

- Handle sensitive family dynamics and legal timelines.

Contact Tony: tony@sousasells.ca | 416-477-2620 | https://www.sousasells.ca

Quick checklist — 7 things to do this week

- Confirm legal authority to sell.

- Book a contractor audit and home inspection.

- Get two renovation quotes for major items.

- Ask a Milton agent for as-is and renovated comps.

- Decide sell-as-is or repair strategy.

- Pick an agent experienced with estate/fixer sales.

- Prepare key documents (title, mortgage info, recent tax bill).

FAQ — Selling a parent’s home in Milton (clear, direct answers)

Q: Do I need probate to sell a parent’s home in Ontario?

A: Not always. If the property is in the estate and the deed is in the deceased’s name, executors commonly need probate to access certain accounts and transfer property. Consult a local estate lawyer early.

Q: Should I remove personal items before listing?

A: Yes. Declutter and depersonalize. It helps buyers visualize the space. You don’t need professional staging for an as-is sale, but clean and clear rooms sell faster.

Q: Can I sell a house with asbestos or knob-and-tube wiring?

A: Yes. Disclose it. Investors will still buy. Some buyers may ask for remediation credits. Provide inspection results and contractor quotes to speed offers.

Q: How much will renovations increase my sale price?

A: It depends. Cosmetic updates (kitchen refresh, paint, flooring) often give the best ROI. Major structural fixes increase marketability but sometimes don’t return full cost. Do a cost vs. return analysis before committing.

Q: Do investor offers mean lowball only?

A: Not necessarily. Competitive investor bids can be strong, especially in tight markets. Always get multiple offers and let them compete.

Q: How long does it take to sell as-is in Milton?

A: If priced correctly and marketed to investors, you can close in 2–6 weeks. Traditional listings often take longer, depending on season and condition.

Q: Are there tax implications when selling a parent’s home?

A: Capital gains tax may apply if the property isn’t the parent’s principal residence at time of death. Speak with an accountant. Tony can connect you with local tax professionals.

Q: Who pays for closing costs and adjustments?

A: Standard closing costs in Ontario are usually paid by the seller (trustee/estate) and include legal fees and adjustments for property taxes. Realtor commissions are negotiable but common.

Q: What if the property has tenants?

A: Tenanted properties add complexity. Ensure leases are respected and provide tenant info to buyers. Talk to an agent who has handled rental-property sales.

Q: How do I get the best net proceeds quickly?

A: Price to the right buyer, avoid unnecessary renovations, provide clear inspection data, and work with an agent experienced in estate and as-is sales.

Selling a parent’s home that needs major renovations is a project. The goal is clear: maximize net proceeds with the least stress and fastest timeline. In Milton, local market knowledge matters. Don’t guess — plan, get professional audits, and pick a path that matches the property’s condition and your timeline.

If you want a fast consult and a clear net-proceeds plan tailored to your property, contact Tony Sousa: tony@sousasells.ca | 416-477-2620 | https://www.sousasells.ca