How do I set up home insurance before moving

in?

Want to move in without a financial nightmare? Read this first.

Quick Hook — How do I set up home insurance before moving in?

Short answer: Get your policy in place and effective on the possession date. Name your mortgage lender as a loss payee, add flood/sewer backup endorsements if needed, and confirm coverage for moving day and any vacancy period. Do it 7–21 days before closing. No drama. No claims gaps.

Why this matters in Milton, Ontario

Milton sits under the Niagara Escarpment, has older neighbourhoods near Sixteen Mile Creek, and a fast-growing housing market. As of 2024 Milton’s population is roughly 133,000 and the average home sells near the $1M mark. When property values and local weather risks rise, so does the cost of a claim. Lenders will refuse to fund closing if they don’t see proof of insurance. You need a plan that’s simple, fast, and stamped for closing day.

The single-minded checklist: What you need before closing

- Possession date from your Agreement of Purchase and Sale.

- Mortgage lender name and address (they must be on the policy).

- Property address and details: build year, roof type, heating type, square footage.

- List of upgrades (new roof, electrical panel, furnace) — insurers lower premiums for recent updates.

- Desired coverage amounts: dwelling, personal property, liability.

- Endorsements you may need: sewer backup, overland flood, automatic coverage for renovations.

- Contact for moving company and storage facility (if you’re using either).

Step-by-step timeline (simple, effective)

- 21–30 days before possession: Start getting quotes. Use 2–3 brokers or insurers and request same coverages for apples-to-apples comparison.

- 14 days before: Choose a policy and confirm endorsements. Tell the insurer the exact possession date and time.

- 7 days before: Request an insurance binder or certificate that lists the mortgagee. Make the binder effective at 12:01 AM on possession day.

- 1 day before: Confirm binder arrived with your lawyer and mortgage lender. Confirm moving coverage for the moving company.

- Possession day: Policy active. Take photos of the property at handover.

What lenders in Ontario require — and what sellers/buyers often miss

Mortgage lenders require “evidence of insurance” at closing. That usually means an insurance binder or certificate that names the lender (mortgagee clause) and states the policy start date. Sellers sometimes forget to remove personal items from the policy or to cancel at the right time. Buyers sometimes forget to add the mortgagee. Either mistake can create legal headaches and delay funding.

Common miss:

- Not naming the mortgage lender or using the wrong legal name for the mortgagee.

- Policy start time is after possession time (creates a gap).

- Buying a home in a flood-prone area and skipping sewer backup or overland flood coverage.

Coverage decisions you must make (don’t guess)

- Dwelling coverage: Should reflect rebuild cost, not market value. Get a professional or insurer estimate.

- Personal property: Inventory items and set limits for high-value items (jewellery, art).

- Liability: Standard is $1M in Ontario; consider $2M if you host guests or run a home business.

- Sewer backup: Add this in Milton. Older infrastructure and heavy storms create a real risk.

- Overland flood: Not included by default. If near watercourses or low areas of Milton, buy it.

- Identity theft and home business endorsements: Add if relevant.

Vacant house rules — sellers and buyers beware

Insurers treat vacant homes differently. If the home will be vacant between closing and move-in, you may need special vacancy coverage. If you plan renovations immediately after closing, disclose it. Unreported vacancy or renovations can void a claim.

Local example: Moving from a condo downtown Milton into a detached house requires different vacancy timelines. Condos are often insured differently — check both policies and avoid overlap or gaps.

Moving day coverage — protect belongings in transit

Your homeowner policy often covers personal items while they’re in transit, but limits vary. If you’re moving high-value goods or antiques, buy moving insurance through the moving company or a transit endorsement. Get written confirmation from movers about their liability limits.

Checklist for moving day coverage:

- Inventory and photos of valuables.

- Copies of policies (homeowner + transit insurance) on your phone.

- Receipts for professional movers and storage.

Practical Milton tips — what agents and insurers will ask

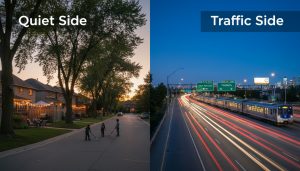

- Is the property on the floodplain near Sixteen Mile Creek?

- Year of roof replacement — older roofs raise premiums.

- Furnace and hot water tank age — replacements lower premiums.

- Security features: monitored alarm, deadbolts, lighting — these lower premiums.

- Renovations history: permitted upgrades vs. DIY repairs.

If your property sits on a slope near the Escarpment, mention that. Insurers will assess landslip and runoff risk.

Sample email to your insurer (copy, paste, send)

Subject: Insurance binder request for possession on [YYYY-MM-DD] — [Property Address]

Hi [Broker Name],

I’m buying [Property Address]. Possession is [Date] at [Time]. Please bind home insurance effective 12:01 AM on the possession date and list [Mortgage Lender Legal Name & Address] as mortgagee. Coverage required: dwelling $[amount], contents $[amount], liability $1,000,000, sewer backup endorsement, and overland flood endorsement (if applicable).

Please send the insurance binder to my lawyer [Lawyer Name & email] and copy me.

Thanks,

[Your Name] | [Phone]

Use this as your template to avoid back-and-forth on closing day.

Cost realities — what to expect in Milton

- Average annual premium: wide range based on home size and risk. For a $1M home in Milton expect roughly $800–$2,000+ annually depending on coverage and endorsements.

- Sewer backup endorsement: $75–$300/year depending on limit.

- Overland flood endorsement: can be several hundred to thousands, depending on location and underwriting.

If you want a ballpark, give an insurer exact property details. Don’t trust online quotes without property specifics.

How a local realtor speeds this up

A local realtor knows the lenders, the lawyers, and common insurer questions for Milton properties. That saves time and removes last-minute friction. They can:

- Provide accurate property facts (year built, upgrades).

- Recommend brokers who move fast with Milton closings.

- Confirm possession timing and communicate with the lawyer.

If you want direct help, contact the Milton realtor below for a rapid checklist and recommended local brokers.

Final playbook — 7 things to do right now

- Pull possession date and mortgage lender name from your APS.

- Get 2–3 quotes with identical coverages.

- Add sewer backup and consider overland flood if property risk exists.

- Request binder effective 12:01 AM on possession day and name mortgagee.

- Send binder to your lawyer and confirm receipt 24 hours before closing.

- Inventory valuables and take moving-day photos.

- If house will be vacant, buy vacancy coverage.

Do these steps and closing day becomes a process, not an emergency.

Call to action

If you’re closing in Milton and want a pre-closing checklist tailored to your property, reach out. I’ll send a one-page binder checklist and names of fast, reliable local brokers and lawyers who know Milton’s quirks.

Contact: Tony Sousa — tony@sousasells.ca | 416-477-2620 | https://www.sousasells.ca

FAQ — Home insurance, closing, and moving in Milton

Q: When should my policy start?

A: The policy should start at 12:01 AM on your possession date or at the exact time you take possession. Confirm with your lawyer and insurer. A time mismatch creates a coverage gap.

Q: Who must be named on the policy?

A: Your mortgage lender must be listed as loss payee or mortgagee. Use the lender’s legal name and address. If you forget, the lender could delay funding.

Q: Do I need flood coverage in Milton?

A: Overland flood is not standard. Check floodplain maps and proximity to Sixteen Mile Creek. Add sewer backup coverage regardless — storms have caused basement claims across Halton Region.

Q: What if the home is vacant between closing and move-in?

A: Notify your insurer. Standard policies often exclude loss during long vacancy. Buy vacancy coverage if the gap exceeds the insurer’s allowed days (typically 30–60 days).

Q: Do movers’ insurance policies cover everything?

A: Movers carry liability but limits vary. Get their valuation options in writing and compare to a transit endorsement on your homeowner policy.

Q: How much liability coverage should I carry?

A: At least $1M. If you host guests, have a swimming pool, or run a home business, consider $2M.

Q: Can I shop last minute?

A: Yes, but start at least 7 days before closing. Brokers can produce binders quickly if they have accurate property facts.

Q: Where can I get local help in Milton?

A: Use local brokers familiar with Milton’s risk profile — roof age, flood zones, and local building code changes matter. Contact your realtor for vetted recommendations.

If you want a Milton-specific binder checklist and a short list of brokers who close insurance fast, email Tony at tony@sousasells.ca or call 416-477-2620. He’ll give you a one-page plan that prevents closing day surprises.