What’s the difference between market value and appraised value?

Market Value vs Appraised Value — Which one will cost you real money when selling in Georgetown? Read this before you price your home.

Quick Answer — Don’t Guess, Price With Purpose

Market value is what a buyer will pay for your home in the current Georgetown market. Appraised value is what a licensed appraiser reports—usually for a lender—based on defined standards. One drives what you list and sell for. The other often sets loan limits and can block deals. Confusing them costs sellers time, money, and negotiation power.

What Market Value Really Means

Market value = the price a ready, willing, and able buyer will pay today in Georgetown, ON, under normal conditions.

- It’s determined by supply and demand, local sales, buyer sentiment, and competition.

- It moves fast in hot markets and drops quickly when buyers pull back.

- For Georgetown sellers, market value is what sets the realistic list price and what your home will likely sell for.

Key drivers for Georgetown:

- Recent sold prices in nearby neighborhoods

- Days on market (DOM) trends in Georgetown and Halton Hills

- Inventory levels and new listings

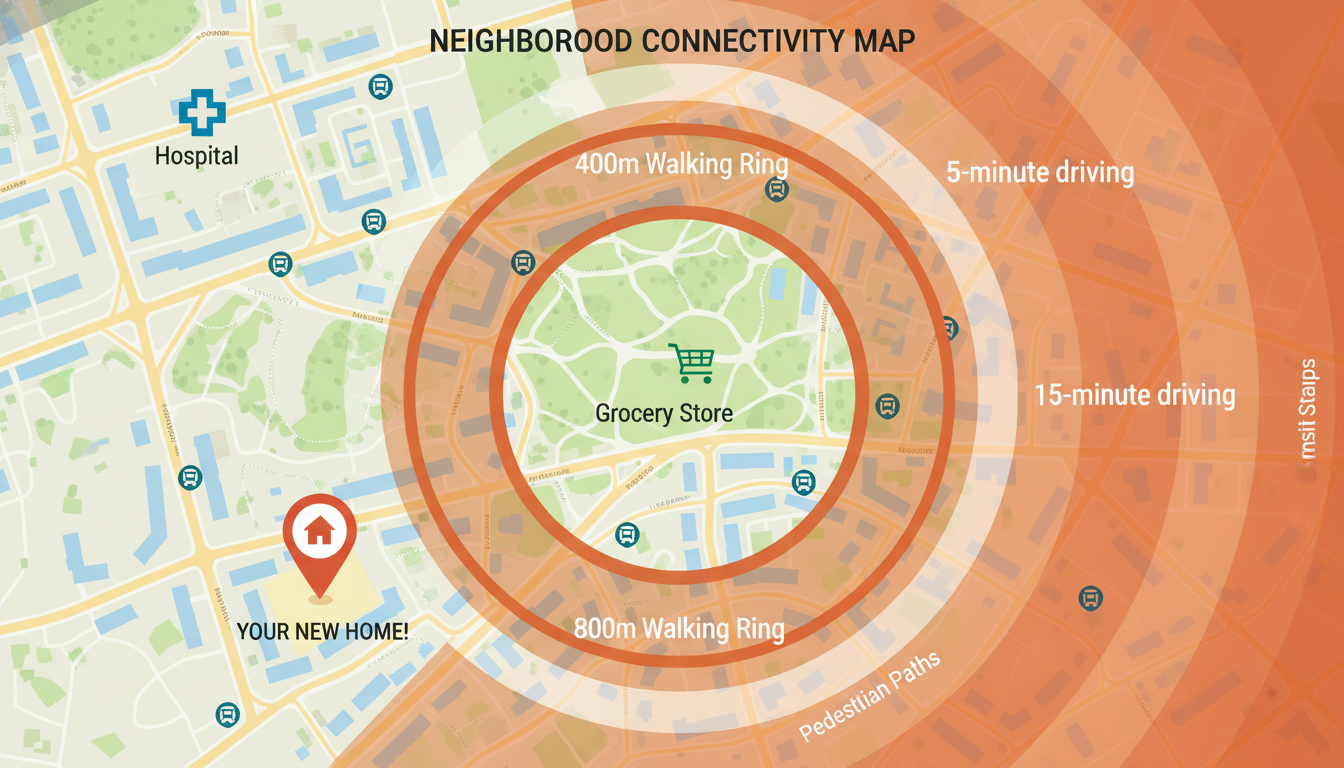

- Local amenities, schools, transit connections, and commuter demand to Toronto

What Appraised Value Really Means

Appraised value = a professional appraiser’s opinion of value, produced using standard methods. Lenders use it to decide how much they will finance.

- Appraisals follow strict guidelines: comparable sales, depreciation, replacement cost, and income approaches if applicable.

- Appraisers focus on objective measurements and verified comps.

- An appraisal can come in below the contract price — that can kill a mortgage approval or force renegotiation.

Common reasons appraised value and market value differ:

- Rapid market shifts after the appraisal date

- Unique homes with few true comps

- Appraiser relied on older comps or conservative adjustments

- Seller upgrades that don’t increase appraised value dollar-for-dollar

7-Point Breakdown: How They Differ (So You Can Use Both to Win)

- Purpose

- Who sets it

- Timing

- Evidence

- Market value: recent sales, current offers, competition.

- Appraised value: verified comps, measurable factors.

- Flexibility

- Market value: negotiation can push it up or down.

- Appraised value: less flexible — tied to reported data.

- Impact on financing

- Market value: influences buyer demand and offers.

- Appraised value: affects loan amount and mortgage approval.

- Emotional premium

- Market value: can include buyer motivations (location, sentiment).

- Appraised value: strips out emotion and focuses on facts.

Why This Difference Matters for Georgetown Home Sellers

Because Georgetown is a commuter town with pockets of high demand, prices can swing. If you list based on what you think the market should pay without solid comps, two things happen:

- You overprice and your home sits. Buyers assume stale pricing and skip your listing.

- You underprice and leave money on the table.

Appraisals can interrupt deals. If you accept an offer above the appraised value, the buyer’s lender may not fund the full amount. The buyer may be forced to:

- Increase their down payment;

- Negotiate a lower purchase price; or

- Walk away.

That’s why smart pricing combines market value thinking with appraisal expectations.

Pricing Strategy That Wins in Georgetown (A No-Nonsense Playbook)

- Start with a Comparative Market Analysis (CMA)

- Get an agent who pulls 6–12 similar solds in the last 90 days within the same micro-neighborhood.

- Adjust for real, verifiable differences

- Size, lot, renovations, garage, bedrooms, washrooms, and permitted vs unpermitted upgrades.

- Check pending and active listings

- Active listings set competition. Pending sales show what buyers actually pay right now.

- Consider buyer profile

- Is your home targeting commuters, downsizers, or families? Tailor price to demand.

- Set a list price tied to a tactical goal

- Attract multiple offers? Price slightly below market to drive traffic.

- Maximum net proceeds? Price at or just above market, but expect longer DOM.

- Prepare for appraisal gaps

- Keep a backup plan: offer a cure (seller credit), include appraisal gap coverage, or have evidence package ready.

- Document upgrades and costs

- Compile receipts, permits, and before/after photos to strengthen appraisal support.

How to Avoid an Appraisal Shortfall — Tactical Moves That Work

- Provide an appraisal packet to the appraiser: recent comparable sales, permit copies, and a list of upgrades with costs.

- Time your listing to market momentum: appraisals lag value changes.

- Price with lender appraisals in mind in slower markets — lenders can be conservative.

- Offer appraisal gap coverage in hot markets (be specific about the amount you’ll cover).

Real-World Example — Numbers That Explain the Risk

Assume your Georgetown home has a market-driven offer of $850,000 because two similar homes sold recently at $840k and $860k.

- If the appraiser uses the $840k comp and adjusts conservatively, appraisal = $835,000.

- Appraisal shortfall = $15,000.

Outcome options:

- Buyer covers $15k out of pocket (often unlikely).

- Seller reduces price by $15k.

- Deal falls through.

That’s real money. Avoid it by preparing comps and evidence before offers arrive.

Step-by-Step Pricing Checklist for Georgetown Sellers

- Order a local CMA and price band (3 realistic price points).

- Collect permits, receipts, and photos for upgrades.

- Stage, fix obvious issues, and complete minor repairs.

- Launch with marketing: pro photos, floor plans, and targeted ads.

- Monitor first 7–10 days: strong interest = possible bidding; weak = rethink.

- If subject to financing, include a clear appraisal-contingency strategy in the offer.

- Keep buyer communication open; provide appraisal packet when lender orders appraisal.

Final Takeaway — Be Proactive, Not Reactive

Market value tells you what buyers will pay. Appraised value tells a lender what they will support. For Georgetown sellers, the winning approach is to price from market value while preparing for appraisal reality. Do both well and you maximize sale price, minimize surprises, and close deals faster.

Frequently Asked Questions (Georgetown Sellers)

How close should my list price be to market value?

Price within 1–3% of market value when the market is stable. In a hot market, you can price slightly below to drive offers. In slow markets, price at market or a touch below to attract buyers.

What happens if the appraisal comes in low?

Buyer and seller must negotiate. Options: buyer pays the difference, seller reduces price, seller offers credit, or the buyer walks. Always have a backup plan.

Can I challenge a low appraisal?

Yes. You can provide additional comps, evidence of upgrades, permits, and recent sales the appraiser may have missed. An appraisal rebuttal can succeed if you provide solid, objective data.

Should I get a pre-listing appraisal?

Sometimes. If you expect appraisal issues (unique home, heavy renovations, or volatile market), a pre-listing appraisal can reduce risk and support your price.

Do renovations always increase appraised value?

No. Cosmetic upgrades may improve market value but not always appraised value dollar-for-dollar. Structural improvements and permitted updates with receipts carry more weight.

How do mortgage rules in Canada affect appraisals?

Lenders often require appraisals (or AVMs) to protect their loan. Conservative lending can mean appraised values lag market value, especially in fast-moving markets.

How does Georgetown’s market affect pricing strategy?

Georgetown’s commuter links, school zones, and new developments create micro-markets. Work with an agent who understands local comps down to the street level.

How much should I rely on online estimates (AVMs)?

Use them as a starting point, not gospel. AVMs lack nuance—lot orientation, upgrades, and local demand. Combine AVMs with a CMA for a realistic price.

What’s the smartest move if I get multiple offers?

Review all terms, not just price: financing, closing timelines, appraisal gap coverage, and conditions. A solid financed offer with appraisal coverage can beat a higher but risky offer.

Ready to Price Smart in Georgetown?

If you want a precise, street-level pricing plan and an appraisal-proof listing, I can help. Tony Sousa is a local Georgetown real estate expert who prices homes to sell for top dollar while minimizing appraisal risk.

Contact: tony@sousasells.ca | 416-477-2620 | https://www.sousasells.ca

Act now. Price with evidence, not hope. Close faster. Keep more of your money.