How do I analyze historical home price trends

in Ontario?

Want a simple, data-backed way to read Ontario home price history and use it to sell your Georgetown house for more? Here’s the exact, no-fluff method that top agents use.

Why historical home price trends matter for Georgetown home sellers

If you’re selling in Georgetown, Ontario, you’re not selling in a vacuum. Buyers compare your house to what sold nearby last month, last year and over the last 5 years. Historical price analysis gives you the context to price confidently, avoid leaving money on the table and time the market to your advantage.

This guide gives you a direct, step-by-step method to analyze historical home price trends in Ontario — focused on what matters to Georgetown sellers: price per square foot, neighbourhood micro-trends, inventory cycles and realistic adjustments for upgrades.

The one-page framework: 6 steps to analyze historical home prices (and set a winning price)

- Pick the right timeframe

- Look at 3 points: short-term (last 3–12 months), mid-term (3 years) and long-term (5–10 years).

- Short-term shows current momentum. Mid-term shows a cycle. Long-term shows appreciation or stagnation.

- Gather authoritative data

- Use: CREA MLS stats, Teranet–National Bank House Price Index, Statistics Canada, CMHC reports, and local MLS sold data for Halton Hills/Georgetown.

- Export sold prices, days-on-market (DOM), list-to-sale ratio, sale date, property type, lot size and living area (sqft).

- Normalize the data

- Compare apples to apples: separate detached, semi, townhomes and condos.

- Convert to price per square foot and price per bedroom for quick parity checks.

- Remove extreme outliers (unique estates or distressed sales) or flag them separately.

- Calculate the essential metrics

- Median sale price (best single snapshot for skewed markets).

- Average price per sqft by property type and neighbourhood.

- Compound Annual Growth Rate (CAGR) over chosen periods: ((End/Start)^(1/years)-1).

- Seasonal adjustment: note monthly/quarterly patterns (spring vs winter).

- Add market health indicators

- Active listings vs sales (months of inventory).

- Sales-to-new-listings ratio (STNL): >60% favors sellers, <40% favors buyers.

- Average DOM and list-to-sale percentage.

- Turn numbers into a clear pricing strategy

- If local median up 6% year-over-year and inventory is tight (STNL >60%), price at market or slightly above with a strong marketing plan.

- If median flat or down and DOM rising, price aggressively to attract demand and avoid long carry costs.

What to check specifically for Georgetown, Ontario

- Neighborhood split: Georgetown downtown behaves differently than Trafalgar or residential subdivisions. Pull data by neighbourhood or postal code.

- Commuter demand: proximity to GO or major highways lifts buyer demand. Factor commute convenience into premium adjustments.

- New developments and listings pipeline: new subdivisions or condo projects increase supply and can cap prices in nearby resales.

- Local sales velocity: Georgetown often moves faster during spring. If you miss spring, plan marketing to offset slower seasons.

Quick, practical calculations you can run today

1) Price per square foot baseline

- Collect 10-15 recent sold comparables (same type, same neighbourhood).

- Calculate price per sqft for each: sale price / finished sqft.

- Use the median of those values and multiply by your home’s sqft for a baseline.

Example: median $475/sqft × 1,800 sqft = $855,000 baseline.

2) Adjust for condition and lot

- Renovations that improve function or add bedrooms: add 3–10% depending on quality.

- Poor condition: subtract 5–12% or set as a buyer-renovation sale.

- Premium lots (corner, deep, view): add 2–8%.

3) Apply market velocity

- If STNL >60% and DOM < local average, add 2–5% to your baseline for competitive pricing.

- If STNL <40% and DOM trending up, reduce baseline by 3–7% to attract offers quickly.

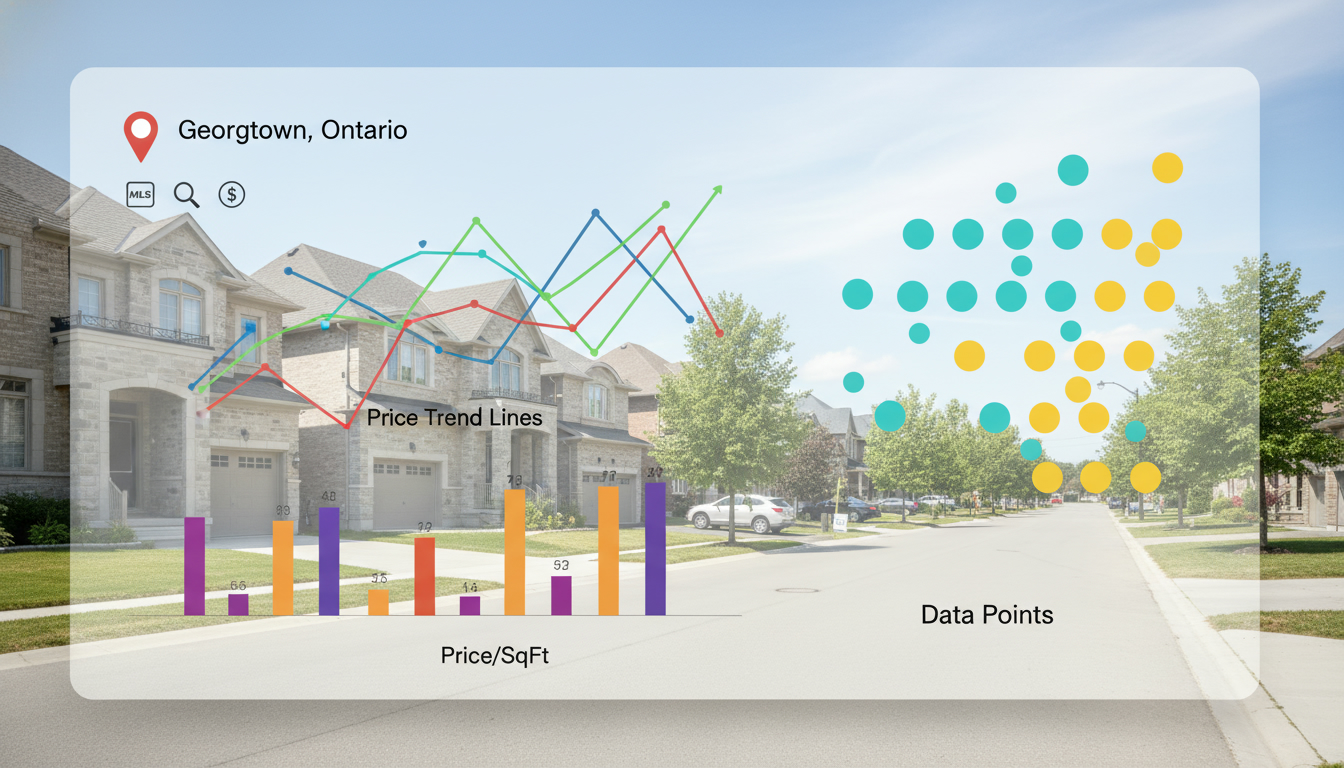

How to use trend charts and what to read off them

- Price trend line: slope tells you momentum. Steep upward slope = strong seller’s market.

- Moving average (12-month): smooths seasonality. If price sits above moving average, market is accelerating.

- Volume bars: rising prices on falling volumes = risky; rising prices on rising volumes = robust demand.

- Price-per-sqft heatmap: identifies micro-areas where value is concentrated.

Ask yourself: are prices rising because fewer homes sell (supply shock) or because demand rose (employment, commute, borrowing)? The cause changes strategy.

Red flags that matter to sellers in Georgetown

- Rising active inventory for 3+ months in a row. That signals buyer leverage.

- Short-term price spikes without volume growth. That can reverse.

- Increasing days on market combined with lower list-to-sale ratios.

- New large developments nearby that add comparable supply.

Address red flags by adjusting marketing, improving staging, or accepting a shorter selling window with a price incentive.

Real-world seller playbook for Georgetown (simple, action-first)

- Pull the last 12 months of solds within 2 km of your address and sort by property type.

- Calculate median price, median price per sqft and the 12-month CAGR.

- Check current active inventory and STNL ratio for Halton Hills/Georgetown.

- Set 3 price points: aggressive list (fast sale), market list (expected timeline), aspirational list (test market with a plan B).

- Launch: high-quality photos, targeted local ads, open-house timing in high-demand weeks, and a clear deadline for offers.

- Measure daily: if you receive no showings in the first 7–10 days, reduce price or increase marketing spend.

This process stops guesswork. It replaces emotion with math.

Example: A short case study (numbers you can replicate)

- Sold comparables (last 6 months) — 10 detached homes in central Georgetown:

- Median sale price: $870,000

- Median price per sqft: $480

- Average DOM: 18 days

- STNL: 65%

Home: 1,700 sqft, good condition, modest lot.

Baseline = 1,700 × $480 = $816,000

Market adjustment (STNL 65% + low DOM): +4% = $848,640

Condition adjustment: +2% for recent kitchen = $865,613

List at $869,900 (market list). If you need speed, list at $849,900 (aggressive). If you want to test the market, list $899,900 with clear marketing and 10–14 day review.

Tools and sources that save time

- MLS export (local Realtor access) — best for accurate solds.

- Teranet–National Bank HPI — provincial price trends.

- Statistics Canada / CMHC — demographic and housing starts.

- Local municipal planning pages — new developments and zoning changes.

- Basic Excel or Google Sheets for calculations; or use free price heatmap tools from local boards.

How a local expert turns data into dollars (what a top agent does differently)

- Pulls local comparables by street and block, not just by town.

- Knows which upgrades buyers in Georgetown actually pay for (kitchen flow, parking, finished basements).

- Times listing to local demand cycles and commuter patterns.

- Writes comparable-backed price ranges that justify negotiation strategy to buyer agents.

This is where a local Realtor converts analysis into higher net proceeds for the seller.

Call to action

If you want a concise, comparables-backed pricing plan for your Georgetown property, I’ll run the numbers and give you three data-backed list prices and a timed marketing play. Schedule a free consult and get a one-page report you can act on today.

Contact: Tony Sousa — tony@sousasells.ca — 416-477-2620 — https://www.sousasells.ca

FAQ — Georgetown seller questions about historical price analysis

Q: What time window is best to price my Georgetown home?

A: Use 12 months for current market, 3 years for cycle, and 5–10 years for long-term appreciation. Combine them: price for today, explain for 3-year trend, and position for long-term buyers.

Q: How many comparables do I need?

A: Aim for 10–15 solds of the same property type in your neighbourhood. If fewer sold, widen the search radius slowly.

Q: Should I use average or median price?

A: Use median for final pricing. Average can be skewed by luxury sales.

Q: How do renovations change historical trend calculations?

A: Treat renovations as separate adjustments. Historical comps reflect the market for typical homes. Add the renovation premium based on comparable renovated sales or use a 3–10% estimate.

Q: How much does seasonality affect Georgetown prices?

A: Expect stronger demand in spring and early summer. Use a 12-month moving average to smooth seasonality for pricing decisions.

Q: Which market indicators do you watch daily?

A: New listings, pending sales, DOM, list-to-sale ratio and mortgage rate signals. For Georgetown, commuter-related demand and local inventory shifts are crucial.

Q: What if the data is mixed: prices up but days on market rising?

A: Mixed signals mean buyers are selective. Improve property presentation, tighten price expectations, and be ready to offer buyer incentives if needed.

Q: Can you guarantee a sale price?

A: No one can guarantee a price. Analysis reduces risk and positions your property to get the best market outcome. A local strategy plus strong marketing maximizes your chances.

Q: What specific value does a local agent add?

A: We provide block-level comparables, interpret municipal changes, and execute targeted marketing. You get faster sales and higher net proceeds.

If you want the actual numbers for your address and a one-page pricing plan for Georgetown, email Tony at tony@sousasells.ca or call 416-477-2620. No obligation. Just clear, local data you can act on.