How do I analyze historical home price trends

in Ontario?

Want to Predict Ontario Home Prices Fast? Learn to Analyze Historical Trends Like a Pro

Why track historical home price trends in Ontario

If you want advantage in Ontario real estate, historical home price trends are your roadmap. They show where value has grown, where it stalled, and where opportunity hides. Use them to spot long-term appreciation, time markets, and pick neighborhoods that outperform.

Simple, step-by-step method to analyze historical home price trends

- Gather the right data

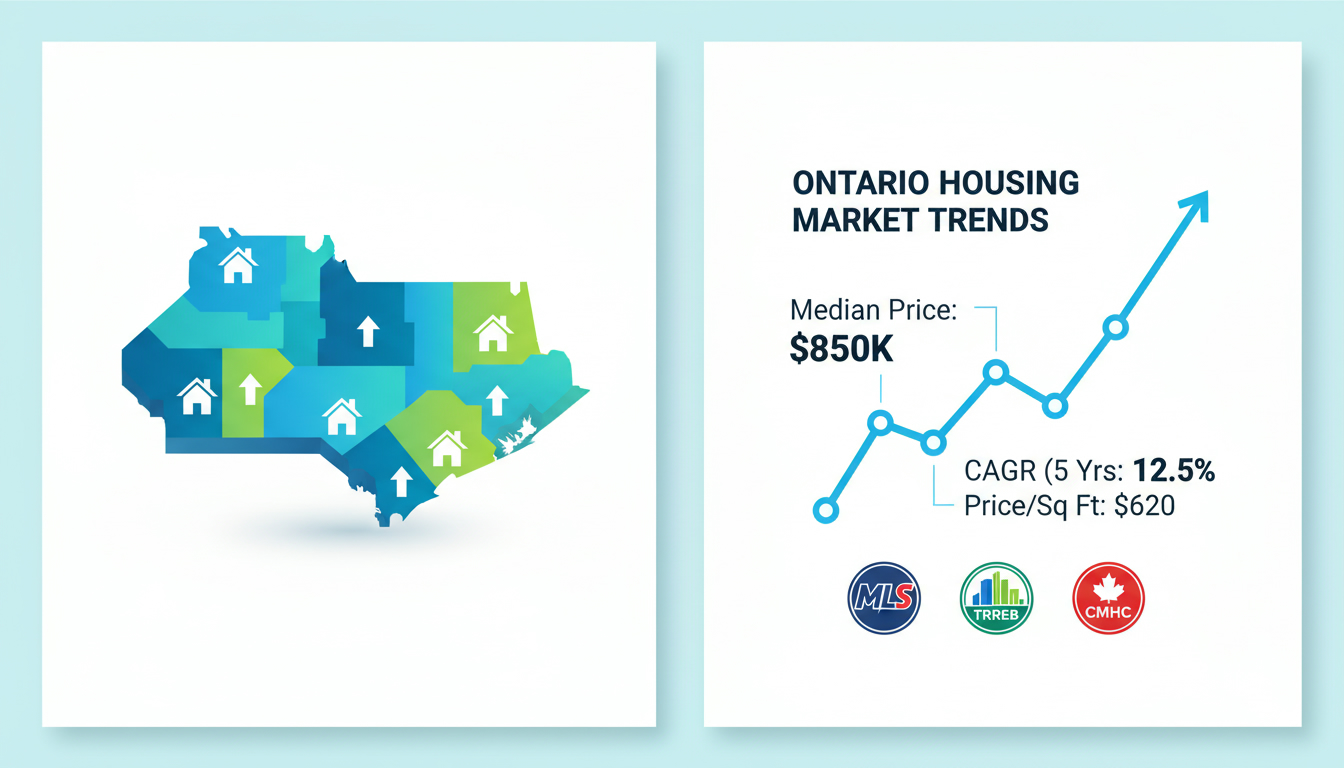

- Start with MLS/board data (TRREB for Toronto, local boards elsewhere). Use Teranet-National Bank and CMHC for provincial indexes. Collect at least 5–10 years of monthly or quarterly data. Include median price, average price, sales volume, inventory, and price per square foot.

- Clean and segment

- Break data by region: province, municipality, neighbourhood, and housing type (detached, condo). Use median price for skewed markets and price per sq ft for size differences.

- Adjust for inflation

- Convert nominal prices to real prices using CPI. This tells you true purchasing power change, not just sticker shock.

- Smooth and seasonally adjust

- Apply a 12-month moving average or seasonal adjustment to remove noise. This reveals the trend beneath seasonal spikes and dips.

- Calculate growth rates

- Compute compound annual growth rate (CAGR) and year-over-year (YoY) change. Use CAGR to compare long-term performance across neighbourhoods.

- Compare supply-demand indicators

- Overlay inventory, days on market, and sales-to-new-listings ratio. Rising prices with falling inventory = demand-driven growth. Falling prices with rising inventory = cooling market.

- Run simple regressions or trendlines

- Fit a linear or log trendline to detect steady growth versus volatility. A log scale often shows percent growth more clearly.

- Spot structural breaks

- Look for breakpoints where policy, interest rates, or major supply changes shifted the trend. Mark those events to avoid misleading averages.

Key metrics and how to interpret them

- Median vs Average: Median resists distortion from outliers. Use median for typical home value.

- Price per sqft: Best for comparing similar units across neighborhoods.

- CAGR: Use for long-term comparison (5–10 year window).

- Sales-to-New-Listings Ratio: 60%+ indicates a sellers’ market.

Common mistakes to avoid

- Relying on short windows (one quarter). Short windows show noise, not trend.

- Ignoring inflation. Nominal gains can be meaningless after inflation.

- Using province-level data for local decisions. Ontario is diverse; zoom into the neighbourhood.

Next step: act with a local market expert

If you want the analysis done and interpreted for your street, call Tony Sousa. He pulls MLS-level data, runs the models, and tells you where to buy, sell, or wait. Reach Tony at tony@sousasells.ca or 416-477-2620. Visit https://www.sousasells.ca

Use this method to analyze historical home price trends in Ontario like an investor. Data-driven moves beat guesses every time.