Should I buy and sell in the same market conditions?

Buy and sell in the same market conditions? Don’t guess. Learn the brutal Milton truth and what to do next.

Why this question matters to Milton home sellers

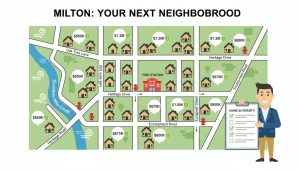

Milton, ON is not generic real estate. It has unique demand drivers: commuters to Toronto, rapid suburban growth, and new developments. Timing your sell and buy in the same market conditions can cost you tens of thousands — or lock you into a deal that works. This post gives a clear, data-driven method to decide whether to act now or wait.

The short answer — context matters

- If both markets (sell and buy) are hot: you may sell fast but pay more to buy. Net outcome depends on price spreads and financing.

- If both markets are cool: you might get a bargain buying but struggle to sell quickly.

- If sell-market is hot and buy-market is cool (or vice versa): you can create a win, but logistics and timing are everything.

Don’t rely on emotion or headlines. Use measurable indicators below.

Key Milton market indicators to watch (and why they matter)

- Inventory (active listings)

- What it shows: supply level. Low inventory = seller power.

- How to use it: calculate months of inventory = active listings / average monthly sales. Under 3 months favors sellers.

- Absorption rate (sales per month)

- What it shows: demand speed. Higher absorption = faster sales.

- Days on Market (DOM)

- What it shows: buyer urgency and price resistance.

- Median sale price vs list price ratio

- What it shows: negotiating power and price compression.

- Mortgage rates and buyer pool

- What it shows: affordability. Rising rates reduce purchase power; falling rates expand buyers.

- New construction and local employment growth

- What it shows: future demand. Milton’s commuter profile and development pipeline change demand fast.

Collect these every month. Small changes compound over 60–90 days.

How to run a quick Milton market health check (use this weekly)

- Pull the past 3 months of sold data in Milton (median price, DOM, sales count).

- Pull active listing count today.

- Calculate months of inventory and list-to-sale ratio.

- Compare median price change vs 3 and 6 months prior.

If months of inventory < 3 and list-to-sale ratio > 98% — the market is hot.

If months of inventory > 6 and DOM rising — the market is cooling.

If you want, I run this exact check for you and provide a one-page Sell vs Buy timing plan for Milton homes.

Practical decision rules — when to sell and buy in the same market conditions

Rule 1 — If you can’t afford the same-class property after selling, don’t sell without a plan

- Example: You sell a $700k house and most similar homes now cost $900k. That $200k gap is the problem. You need bridge financing, a contingent purchase, or rent-back.

Rule 2 — If market is hotter for sellers than buyers, sell first; buy after you lock cash

- Advantage: you sell at peak pricing.

- Risk: you might pay more when buying; mitigate by having cash, mortgage pre-approval, or buying in adjacent neighborhoods.

Rule 3 — If buyers have advantage, buy first (if you can) and then sell strategically

- Advantage: buy lower, then list when you’re ready.

- Risk: carrying two mortgages. Use contingency clauses and short-term financing.

Rule 4 — If both are hot, use pricing strategy and move fast

- Price competitively to create bidding when selling. Use aggressive offers and inspection timelines when buying.

Rule 5 — Use local timing windows: school cycle and commuting patterns matter

- Spring and early summer often drive more buyer traffic in Milton. Listings in late Jan-Feb can beat inventory peaks.

Numbers that matter — back-of-envelope math every seller should run

1) Selling costs (estimate): agent fees + legal + adjustments. Common rule: plan 4–6% of sale price.

2) Purchase premium: how much more you’ll likely pay for replacement home. Use recent comps.

3) Carrying cost: mortgage, utilities, insurance, taxes if you buy before selling.

Break-even calculation

- Extra purchase premium + carrying costs + transaction costs = total crossover cost.

- If your sale premium (higher sale price because market favored sellers) > crossover cost, selling and buying in same market can still be a win.

Example (approximate, Milton scenario):

- Current home sells at $800,000. Selling costs 5% = $40,000.

- Replacement home costs $950,000 (purchase premium = $150,000).

- Additional monthly mortgage on extra $150k at 5% ≈ $800/month before tax. Six months carrying = $4,800.

- Total immediate extra = $40,000 + $150,000 + $4,800 = $194,800 (this mixes sale drops; use net proceeds instead).

That’s why local pricing comps and your exact mortgage details matter. I build these numbers for Milton sellers so decisions are rational, not emotional.

Tactical strategies Milton sellers use to win the timing game

- Bridge loans and HELOCs: Short-term liquidity to buy before selling. Use only with a clear exit plan.

- Seller rent-back agreements: Sell, then rent your former home for a fixed short term while you buy.

- Contingent offers: Ask the seller to accept your offer subject to your sale. Less attractive in hot markets.

- Two-step sale: List as ‘coming soon’ then price to create a bidding window aligned with your purchase timing.

- Geographic arbitrage inside Milton: Move to a nearby neighborhood that’s cheaper per square foot but still meets needs.

Each has pros and cons. Pick one based on local inventory and DOM trends.

Negotiation tactics tied to market timing

- In seller’s market: use clean offers, larger deposits, shorter conditions to win a buy. When selling, price to create urgency — multiple offers beat waiting longer.

- In buyer’s market: use inspections, conditional timelines, and extended closing to stretch the market.

If both sides are hot, you must be surgical: pre-inspect properties, have financing locked, and accept quick closings.

How Tony Sousa helps Milton sellers time the market (short, direct proof)

- Local focus: Milton-only listing and buying playbook.

- Real-time numbers: weekly inventory and absorption reports I deliver to clients.

- Execution: negotiated quick closings, rent-back deals, and access to vetted lenders for bridge financing.

If timing is the difference between a good outcome and a great outcome, you need a local plan produced by someone who runs these numbers daily.

Contact Tony for a free one-page Sell vs Buy Timing Plan for your Milton property: tony@sousasells.ca | 416-477-2620 | https://www.sousasells.ca

Comprehensive FAQ — Milton sellers ask these first

Q: Should I sell now if Milton market feels hot?

A: Don’t base it on feeling. Run the numbers: months of inventory, median price trend, and buy-side comps. If selling premium outweighs replacement cost and you have financing strategies, sell. If replacement cost is much higher, consider delaying or using bridge financing.

Q: How long after selling can I reasonably expect to buy a comparable Milton home?

A: That depends on inventory and price band. In a hot market, comparable homes may be scarce for months. Ask your agent for a 30/60/90-day availability forecast in your price range.

Q: Will I owe tax on the gain from selling my home in Milton?

A: If the property is your principal residence, you generally qualify for the principal residence exemption in Canada. Talk to your accountant for specifics.

Q: What are realistic selling costs in Milton?

A: Plan 4–6% for agent fees and closing costs, plus minor legal adjustments. Exact costs vary; get a written estimate.

Q: Is a rent-back safe after I sell?

A: Yes, when contract terms are clear and deposits secured. Rent-backs solve timing friction but require strong legal terms.

Q: What’s the single biggest mistake Milton sellers make with timing?

A: Selling emotionally to chase headlines. People list because they fear missing out, not because math supports it. Always run the break-even.

Q: How do interest rates change the decision to buy and sell together?

A: Higher rates reduce buyer power, which may cool the buy-side and make selling harder later. Lower rates expand buyer power and can push replacement prices higher. Lock mortgage pre-approval with rate protection when possible.

Q: Can I sell for top dollar and still win when buying?

A: Yes — if you plan liquidity, use bridge financing, or buy in a neighborhood with better value. The sale price alone doesn’t guarantee a successful buy.

Final checklist — 7 actions to take today if you’re considering selling and buying in Milton

- Request a local market health report for your price band (30/60/90 days).

- Get a written net-proceeds estimate that includes likely purchase price ranges.

- Get mortgage pre-approval and explore bridge loan options.

- Identify 3 target neighbourhoods for replacement and track new listings daily.

- Decide acceptable carry time (how long you’ll hold two properties).

- Prepare your home to hit the market with a 7–14 day sale window strategy.

- Contact a Milton-focused agent who runs these numbers every week.

If you want that market health report and a custom Sell vs Buy Timing Plan for Milton, reach out: tony@sousasells.ca | 416-477-2620 | https://www.sousasells.ca