Can a buyer sue me after closing?

Can a buyer sue me after closing? You bet — unless you do these 7 legal moves first.

Quick answer: Yes — but it’s not automatic

A buyer can sue you after closing in Ontario. Lawsuits usually come from hidden defects, misrepresentations, unpermitted work, or missing paperwork. But most seller lawsuits are avoidable. Follow a tight plan and you’ll cut your legal risk to almost zero.

This post explains exactly when a buyer can sue, the Ontario laws that matter, what commonly triggers claims in Milton, ON, and step-by-step actions sellers must take to protect themselves. Read it, act on it, and sell with confidence.

Why buyers sue after closing — plain and simple

Buyers sue because they discover something costly they weren’t told about. Common triggers:

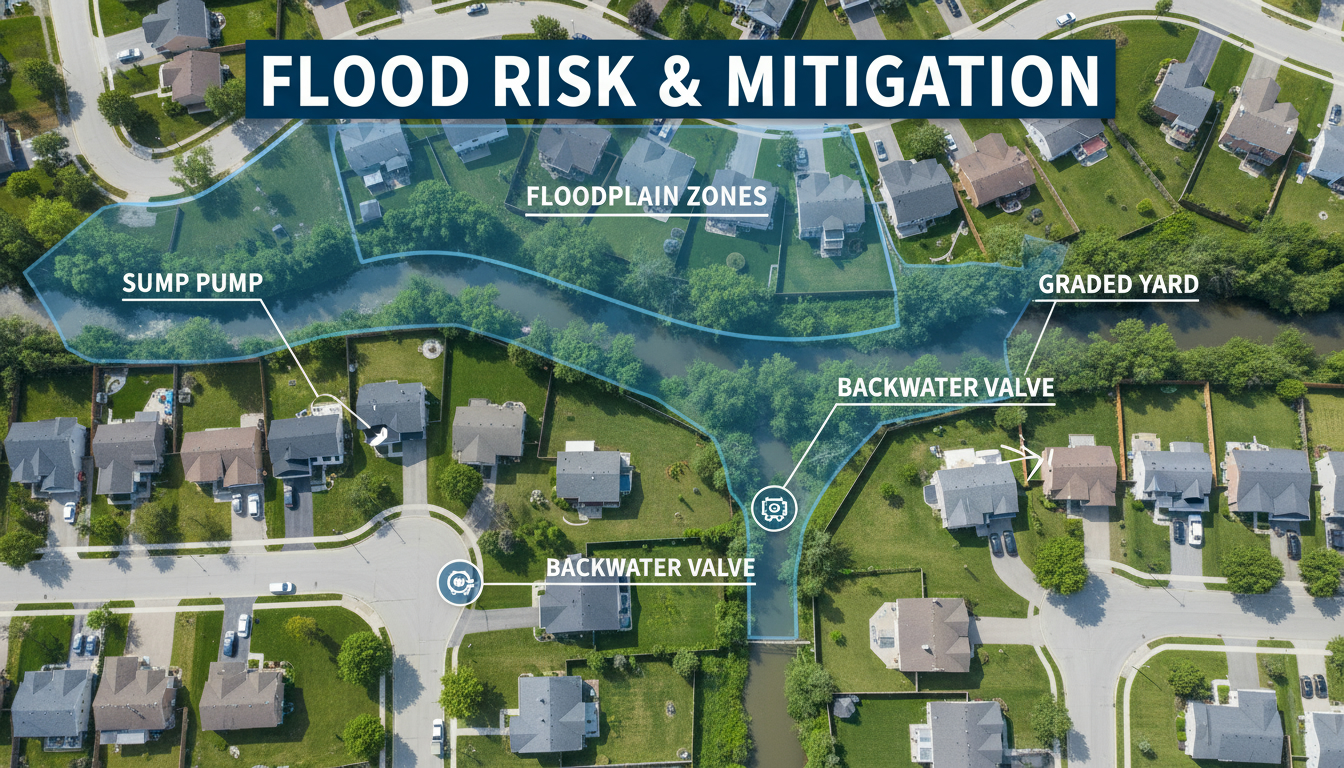

- Water damage or mould that was hidden

- Structural or foundation problems

- Unpermitted renovations or additions

- Boundary or survey disputes

- Missing permits for electrical, plumbing, or decks

- Misstated square footage or condition

Sellers often think an “as-is” clause or a signed agreement protects them. It helps — but it doesn’t shield you from fraud, deliberate concealment, or proven misrepresentations.

Key Ontario laws every Milton seller must know

-

Limitation Act, 2002: Most civil claims must be started within two years of when the buyer discovered the problem. That means a claim can arrive months or years after closing. There is also an ultimate limitation in many cases of 15 years.

-

Real Estate and Business Brokers Act (REBBA) and RECO rules: These govern industry conduct. If you mislead through your agent or documents, you could face regulatory complaints in addition to a civil suit.

-

Condominium Act, 1998: Condo sellers must provide accurate information and the buyer can rely on status certificates and disclosure documents.

-

Municipal permit rules (Town of Milton / Halton Region): Unpermitted work that violates municipal bylaws is a common legal exposure. Buyers can sue if they rely on your claim that work was permitted or if the lack of permits affects value or safety.

-

Title insurance & property law: Buyers often carry title insurance which can limit actions against sellers for certain title defects, but title insurance is not a substitute for honest disclosure.

This is not legal advice. For legal strategy, talk to a real estate lawyer licensed in Ontario.

Common Milton-specific scenarios that lead to lawsuits

Milton is growing fast. Older homes, new infill developments, renovations, and condo conversions create specific risks:

- Older houses with hidden water or foundation issues from poor grading or past floods.

- Renovations done without Town of Milton building permits, especially for basements, decks, or garage conversions.

- Infill lot boundary disputes where fences, driveways, or retaining walls encroach on neighbours.

- Condo sellers failing to disclose ongoing board disputes, pending special assessments, or inaccurate unit measurements.

- Sellers who hire contractors without final permits or occupancy certificates.

Every Milton sale has a local flavour. Understand those risks and document everything.

How buyers can sue you — legal theories in simple terms

Buyers can claim:

- Fraudulent misrepresentation: You knowingly lied or hid facts. Courts punish this.

- Negligent misrepresentation: You made a false statement carelessly.

- Breach of contract: You broke a term in the Agreement of Purchase and Sale.

- Breach of warranty: You gave a specific promise in writing and it was false.

- Concealment: You actively hid defects (painting over rot or ripping out evidence).

If a court finds you liable, remedies can include damages (money), rescission (return of the purchase), and sometimes punitive damages for intentional fraud.

Simple, high-impact steps to eliminate most risk (do these now)

- Get a pre-listing inspection

- Hire a qualified inspector. Fix major issues or disclose them in writing.

- Keep every document

- Permits, receipts, contractor warranties, past inspection reports, septic or well paperwork, and any emails or texts about condition.

- Complete the Seller Property Information Form accurately

- Be truthful and specific. Don’t guess—use receipts and records.

- Disclose unpermitted work upfront

- Put it in writing. If a buyer accepts knowing the risk, you reduce exposure.

- Use experienced real estate and legal pros

- A Milton realtor and an Ontario real estate lawyer familiar with Halton’s rules will structure your contract properly.

- Don’t alter the property before closing

- Avoid removing evidence of defects or doing last-minute projects.

- Consider a pre-listing survey for boundary-sensitive properties

- Clears up lot lines, avoids later disputes.

- Get receipts and permits for every repair

- If you repair before listing, keep proof a licensed contractor did it.

- Include clear contract language — but don’t rely on boilerplate

- “As-is” clauses and waiver language help but don’t protect against fraud.

- Recommend the buyer obtain home and title inspections

- Encourage buyers to inspect; cooperative transparency reduces claims.

A practical checklist to hand your lawyer and agent before listing

- Completed Seller Property Information Form

- Pre-listing inspection report

- All building permits and final inspection certificates

- Contractor invoices and warranties

- Survey or title documents

- Records of past insurance claims for the property

- Any written communications about property condition

Handing this to your lawyer and agent before you list gives you leverage and lowers exposure.

If a buyer sues after closing — immediate actions

- Call your real estate lawyer immediately.

- Preserve all documents and communications; do not throw anything away.

- Notify your insurer (homeowner’s and E&O if relevant) — don’t wait.

- Don’t communicate directly with the buyer’s lawyer without counsel.

- Collect evidence you relied on: inspections, permits, and sales documents.

Act fast. Delays can hurt your defence and increase damages.

Why disclosure beats denial every time

Two simple facts:

- Buyers are more likely to sue when they feel they were kept in the dark.

- Full, documented disclosure reduces both lawsuits and settlement costs.

Be proactive. Disclosure is the cheapest legal protection.

Real-world example (short)

A Milton seller hid a basement leak and painted over stains. The buyer discovered mould after closing and sued for remediation and damages. The court found concealment because the stains were deliberately covered and the seller had prior repair receipts. A large settlement followed. That’s avoidable with a proper inspection and honest disclosure.

Frequently asked questions (Milton sellers) — quick answers

Q: Can a buyer sue me years after closing?

A: Yes. Under Ontario’s Limitation Act, most claims must start within two years of discovery, but the discovery can be years after closing. Some claims have longer or different timelines. Consult a lawyer.

Q: Does an “as-is” clause protect me?

A: It helps but isn’t absolute. It won’t protect you from fraud, deliberate concealment, or false written warranties.

Q: What if I didn’t get permits for renovations years ago?

A: Disclose it. Unpermitted work can lead to rescission, fines, or lawsuits. Getting retroactive permits or providing written disclosure reduces risk.

Q: Should I get a pre-listing inspection in Milton?

A: Yes. It gives you negotiating power, identifies problems you can fix or disclose, and reduces post-closing claims.

Q: What about title insurance?

A: Title insurance protects the buyer’s title, not the seller from misrepresentation. It’s not a substitute for disclosure.

Q: Do condo sellers have special rules?

A: Yes. Condo sellers must provide accurate status certificates and relevant condo documents. Misleading or hiding board issues or special assessments can trigger claims.

Q: Can I be sued for items a contractor did wrong?

A: Potentially. If you represented work as completed properly or didn’t disclose the contractor’s unpermitted work, you could face claims. Keep invoices and permits.

Q: How much can a buyer recover?

A: Damages depend on actual loss — repair costs, diminution in value, or in rare cases rescission. Courts look at proof. Settlements vary.

Final word — sell smart or pay later

You can avoid most post-closing lawsuits with one rule: document and disclose. Use a pre-listing inspection, collect permits, keep receipts, and work with a real estate lawyer. Transparency kills claims before they start.

Tony Sousa is Milton’s local real estate expert focused on protecting sellers during the legal and paperwork process. For tailored guidance, contact Tony directly: tony@sousasells.ca | 416-477-2620 | https://www.sousasells.ca

Disclaimer: This article explains common legal risks but is not legal advice. For a legal strategy, consult a licensed Ontario real estate lawyer.