How do I calculate ROI on a property?

Want to know the exact ROI on your Georgetown property? Calculate it fast and sell smarter.

Why ROI Matters for Georgetown Home Sellers

You’re selling a home in Georgetown, Ontario. Market attention from the GTA keeps demand tight. That makes ROI the single number that decides whether to renovate, hold, rent, or sell. Don’t guess. Calculate.

This post gives a clear, repeatable ROI formula, real-world steps tailored for Georgetown, and a decision framework used by high-performing sellers and realtors to extract maximum resale value.

No fluff. No hype. A direct playbook.

The ROI Formulas Every Seller Must Know

Start with these three metrics. Use them to compare options: sell now, renovate, or rent.

-

Net Operating Income (NOI)

-

NOI = Gross Rental Income – Operating Expenses (exclude mortgage principal and income taxes)

-

Capitalization Rate (Cap Rate)

-

Cap Rate = NOI / Property Value

-

Use this to compare rental returns against other local investment yields

-

Cash-on-Cash Return (CoC)

-

CoC = Annual Pre-Tax Cash Flow / Total Cash Invested

-

This shows the return on actual cash you’ve put into the deal

-

Total ROI (when selling)

-

Total ROI = (Sale Price – Purchase Price – Capital Improvements – Selling Costs) / (Purchase Price + Capital Improvements)

-

Express as a percentage. This shows true profit after costs.

-

Annualized ROI (Compound Annual Growth Rate, CAGR)

-

Use to compare performance across different holding periods

Quick Georgetown Example: Plug-and-Play

Imagine you bought a Georgetown townhouse 7 years ago for $550,000. You put $40,000 into upgrades over the years. You plan to sell it for $860,000. Selling costs (closing, realtor fee, legal) total 6%.

1) Net profit before taxes = 860,000 – 550,000 – 40,000 – (0.06 * 860,000)

- Selling costs = 51,600

- Net profit = 860,000 – 550,000 – 40,000 – 51,600 = 218,400

2) Total ROI = 218,400 / (550,000 + 40,000) = 218,400 / 590,000 = 0.370 => 37.0% total return

3) Annualized ROI (CAGR) = ((860,000 / 550,000)^(1/7)) – 1 = (1.5636^(0.1429)) – 1 ≈ 6.5% per year

4) If you’d rented it out instead, calculate NOI and Cap Rate using local rents.

These numbers tell a story: a 37% absolute gain and 6.5% annualized growth. For Georgetown — close to major transit and with growing commuter demand — appreciation often compounds the story when combined with rental cash flow.

What Costs Sellers Often Miss (and Why That Kills ROI)

Sellers forget line items that slice ROI. Account for these:

- Renovation costs beyond cosmetic touch-ups — structural, electrical, HVAC

- Holding costs (insurance, utilities, maintenance) while you wait for the right buyer

- Opportunity cost — what you could have earned if you invested proceeds elsewhere

- Taxes and potential capital gains implications

- Staging, professional photography, pre-listing inspections

Add them up. If your ROI calculation ignores these, it’s fantasy.

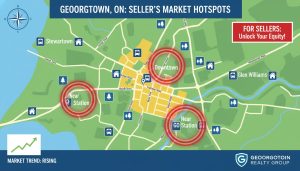

How Georgetown Market Traits Change the Math

Georgetown is part of Halton Hills and within commuter range of the Greater Toronto Area. That creates a few key patterns:

- Strong buyer pool for family homes and commuter-friendly properties

- Demand for renovated kitchens, master ensuite bathrooms, and finished basements

- Limited new inventory in some neighbourhoods, which can compress days on market and push offers above list

- Local comparables (recent sold prices in Georgetown) are the most reliable input for sale-price estimates

These factors raise the effective resale value of homes that are upgraded correctly. That means targeted renovations often produce higher ROI than generic upgrades.

Renovate or Sell As-Is? A Simple Decision Framework

Step 1 — Estimate the lift: How much higher will the sale price be after the renovation? Use local comps for finished vs. unfinished basements, updated vs. original kitchens.

Step 2 — Calculate the renovation ROI: (Price Lift – Renovation Cost – Holding & Selling Costs) / Renovation Cost

Step 3 — Break-even time: How long until the added resale value justifies the renovation? If you’re selling within 3 months, big renovations rarely pay.

Rule of thumb for Georgetown sellers: cosmetic upgrades (paint, flooring, staging) typically give immediate ROI. Structural or big kitchen renovations must be matched to comparable sales in the same street or subdivision.

Rent or Sell: Use Cash Flow to Decide

If you’re considering renting instead of selling, compare annualized ROI from selling with cash-on-cash from renting.

1) Estimate market rent for comparable Georgetown properties

2) Calculate NOI (subtract realistic expenses)

3) Divide NOI by current market value to get Cap Rate

4) Compare Cap Rate + expected appreciation to your sale annualized ROI

If the combined rental yield plus conservative appreciation exceeds your sale CAGR and you want passive income, renting can make sense. If not, sell and redeploy capital.

Data Sources to Use (Local & Accurate)

- Recent Sold Listings in Georgetown (last 6 months) — best indicator of achievable sale price

- Municipal property assessments and taxes (Halton Hills)

- Local rental listings and property managers for rent estimates

- Local market reports from the Toronto Real Estate Board (TREB) and the Ontario real estate board

- Professional inspection and contractor quotes for accurate renovation estimates

Using current local data will make your ROI calculation realistic. National averages don’t help when buyers in Georgetown are paying a premium for commute-friendly family homes.

A Short Checklist You Can Run in 10 Minutes Before Listing

- Get 3 recent sold prices for similar homes on your street

- Add up your purchase price + upgrades

- Estimate selling costs (6% is a practical placeholder)

- Calculate Total ROI and Annualized ROI

- Decide: sell now, invest in targeted upgrades, or rent

- Call your realtor with your numbers and a clear goal

How a Local Realtor Tightens the Math and Gets Higher Sale Prices

A local expert brings three things you can’t replicate from spreadsheets:

- Accurate comparables on your exact street and buyer profile

- Negotiation tactics that convert multiple offers into higher sale prices

- A network of stagers, photographers, and contractors who deliver predictable ROI

If you want the highest ROI, pair your numbers with local execution.

Contact for a Local ROI Review

If you want a clear, no-nonsense ROI calculation tailored to your Georgetown home, email tony@sousasells.ca or call 416-477-2620. I’ll show where you stand, where to invest, and how to maximize resale value.

Website: https://www.sousasells.ca

FAQ — Quick Answers Home Sellers in Georgetown Need

How do I calculate ROI on a property I plan to sell next month?

Use Total ROI: (Expected Sale Price – Purchase Price – Capital Improvements – Selling Costs) / (Purchase Price + Capital Improvements). Plug in recent sold prices from your neighborhood for the sale price estimate. If time is short, use conservative figures for price and 6% for selling costs.

What percentage of sale price should I expect to pay in selling costs?

Plan on roughly 5–7% for realtor commissions, closing adjustments, legal fees, and other closing expenses. Use 6% as a working number.

Should I renovate before selling in Georgetown?

Do targeted, high-ROI upgrades. Kitchens, bathrooms, and curb appeal move buyers in Georgetown. Avoid over-improving beyond neighborhood comparables. Always calculate expected price lift vs renovation + holding costs before starting work.

How do local market trends affect ROI?

Georgetown’s proximity to the GTA and limited inventory can increase resale prices, especially for commuter-friendly and family homes. Use recent sold comps in your neighborhood to capture that premium in your ROI estimate.

Do I need to include taxes in ROI?

Calculate pre-tax ROI first. Then factor in potential capital gains and consult a tax professional for after-tax ROI. Taxes can materially change your net return.

What’s a safe Cap Rate for Georgetown rental properties?

Cap rates vary by property type and location. Use local rents and expenses to calculate NOI, then divide by market value. Compare to similar Halton Hills properties. If you need help, a local realtor can pull accurate rental comps.

How do I compare selling now vs holding for appreciation?

Calculate annualized ROI (CAGR) if you sell now. Compare that to projected annual rental yield + conservative appreciation if you hold and rent. Factor in management hassle, vacancy risk, and potential maintenance.

How accurate are DIY ROI calculations?

D-I-Y calculations can be accurate if you use correct local inputs. Missing costs (like holding or hidden repairs) are the weak point. Get at least one local expert review before making a major decision.

What data should I gather before calling a realtor?

Recent sold prices, your purchase price and dates, receipts for upgrades, current mortgage details, and any inspection reports. This speeds up an accurate ROI assessment.

For a fast, accurate ROI calculation and a clear plan to maximize resale value in Georgetown, contact tony@sousasells.ca or call 416-477-2620. No buzzwords. Real numbers. Real decisions.