How do I calculate total cost of ownership?

Want to avoid a $50,000 surprise when you buy a house? Here’s the simple math that shows the real cost of ownership.

Why this matters

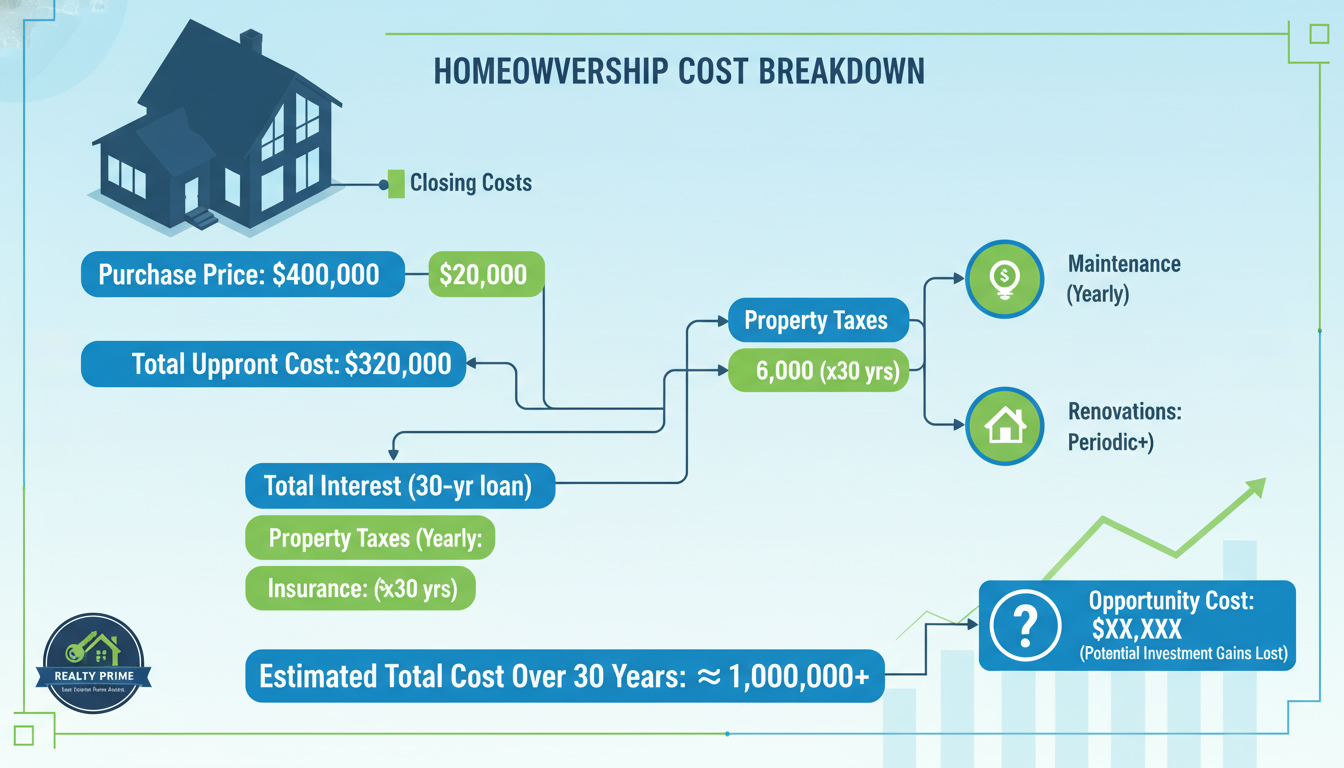

Buying a home is not just the purchase price. Lenders, taxes, insurance, maintenance and time all add up. If you only focus on the down payment or monthly mortgage payment, you’ll be surprised down the road. This post gives a clear, step-by-step way to calculate Total Cost of Ownership (TCO) so you can make smart financing decisions.

Quick definition

Total Cost of Ownership (TCO) = all cash outflows tied to owning the property over a chosen time horizon (usually 1, 5, or 30 years), minus any direct cash inflows (tax savings, rental income, resale proceeds).

Step-by-step calculation

1) Choose your time horizon

Decide how long you’ll own the property (1, 5, 10, 30 years). Short-term vs long-term changes the math.

2) Start with the purchase price

Purchase Price + Down Payment + Closing Costs (typically 2–5% of price).

3) Add financing costs

Total Interest Paid = (Monthly Mortgage Payment × Number of Payments) − Loan Principal.

Use an amortization calculator. This gives the exact interest paid over your chosen horizon.

4) Add recurring ownership costs (annual, then multiply by years)

- Property taxes (annual % of assessed value)

- Home insurance

- Mortgage insurance (if applicable)

- HOA/condo fees

- Utilities (if you want to include)

- Maintenance and repairs (use the 1% rule: 1% of home value per year as a baseline)

5) Add one-time and occasional costs

- Major renovations or upgrades

- Appliance replacement

- Landscaping

6) Subtract tax and income offsets

- Mortgage interest deduction (where applicable)

- Property tax deductions

- Rental income if you lease a room or unit

7) Add opportunity cost (optional, but powerful)

Calculate what the down payment could have earned invested elsewhere. Opportunity Cost = Down Payment × expected annual return × years.

Simple formula (summary)

TCO = Purchase Price + Closing Costs + Total Interest Paid + (Annual Ownership Costs × Years) + One-time Costs + Opportunity Cost − Tax Benefits − Resale Net Proceeds

Quick example (5-year horizon)

- Price: $600,000

- Down payment: $120,000

- Closing costs: $12,000 (2%)

- Loan: $480,000, 3.5% fixed, 30 years

- Total interest paid in first 5 years (use amortization) ≈ $78,000

- Annual ownership costs (taxes $6,000 + insurance $1,200 + maintenance $6,000) = $13,200 × 5 = $66,000

- One-time repairs: $10,000

- Tax benefits ≈ $20,000

5-year TCO ≈ $12,000 + $78,000 + $66,000 + $10,000 + Opportunity Cost − $20,000 = ~ $146,000 (plus the down payment and any resale or appreciation effects)

Action steps you can use now

- Run an amortization schedule to get exact interest numbers.

- Use 1% rule for maintenance, adjust for age and condition.

- Estimate closing costs at 2–5% of price.

- Build a 10–20% renovation buffer for older properties.

- Compare mortgage offers by total interest, not just rate.

Why trust this method

This is practical math, not hype. It shows financing costs, hidden fees, and ongoing expenses that distort the “affordability” of a mortgage. Use it before you commit.

Need help with mortgage numbers or financing strategy? Tony Sousa is the local expert in Financing & Mortgages — he translates lender math into clear action and finds the right loan for your goals. Contact: tony@sousasells.ca | 416-477-2620 | https://www.sousasells.ca

Keywords: total cost of ownership, calculate total cost of ownership, mortgage costs, financing, homeownership costs, TCO, closing costs, property taxes, maintenance costs, mortgage amortization