How do condo fees affect retirement income?

Is a condo fee going to wreck your retirement income? Read this first.

Quick answer — yes they matter. Here’s how to control them.

You are 55+. You are thinking about selling your house in Georgetown, Ontario. You want less work and steady money in retirement. Condo living looks easy. But condo fees change your monthly cash flow. They change how much retirement income you really keep.

This post tells you, in plain words, how condo fees affect retirement income. It gives real numbers, a step-by-step plan to check a condo before buying or selling, and local tips for Georgetown, ON home sellers aged 55+. Follow this and you will make a smart move without surprises.

What are condo fees? Short and simple

- Condo fees (also called maintenance fees or common element fees) pay for building upkeep, insurance for common areas, snow clearing, landscaping, elevators, and shared utilities.

- They are set by the condominium corporation budget. They can go up.

Why condo fees matter for retirement income

When you retire, you live on fixed income: pensions, RRIFs, CPP, savings, maybe the money from selling your house. Condo fees are a recurring monthly bill. They reduce how much money you can spend on travel, health care, and daily life.

Example: If your retirement income is $40,000 per year and condo fees are $600/month ($7,200/year), that is 18% of your income gone before taxes and other costs. That matters.

Compare owning a house vs. a condo in retirement (money view)

- House costs: property taxes, utilities, upkeep, lawn care, roof and furnace repairs. These costs can vary a lot, but plan $4,000–$8,000/year in mid-sized Ontario towns.

- Condo costs: condo fees (cover many repairs and some utilities), plus property taxes and some utilities. Fees often look high but they buy convenience and predictability.

Use this quick math:

- House: income $40,000 — home costs $6,000 = $34,000 left

- Condo: income $40,000 — condo fees $7,200 — taxes $2,500 = $30,300 left

Numbers change by property. The point: condo fees can be equal to or higher than house upkeep. But condos cut chores and unexpected big bills.

Hidden condo fee risks you must know

- Special assessments: If the reserve fund is low, owners may face a one-time big fee to fix roofs, pipes, or balconies. That can be thousands.

- Reserve fund shortfall: A low reserve fund increases future fee hikes.

- Fee increases: Older buildings often need higher fees to pay for repairs.

- Utilities not included: Some condos do not include hydro or water. Read the budget.

- Rules that affect lifestyle: Age rules, pet rules, rentals. These affect resale and daily life.

Local note for Georgetown, ON sellers

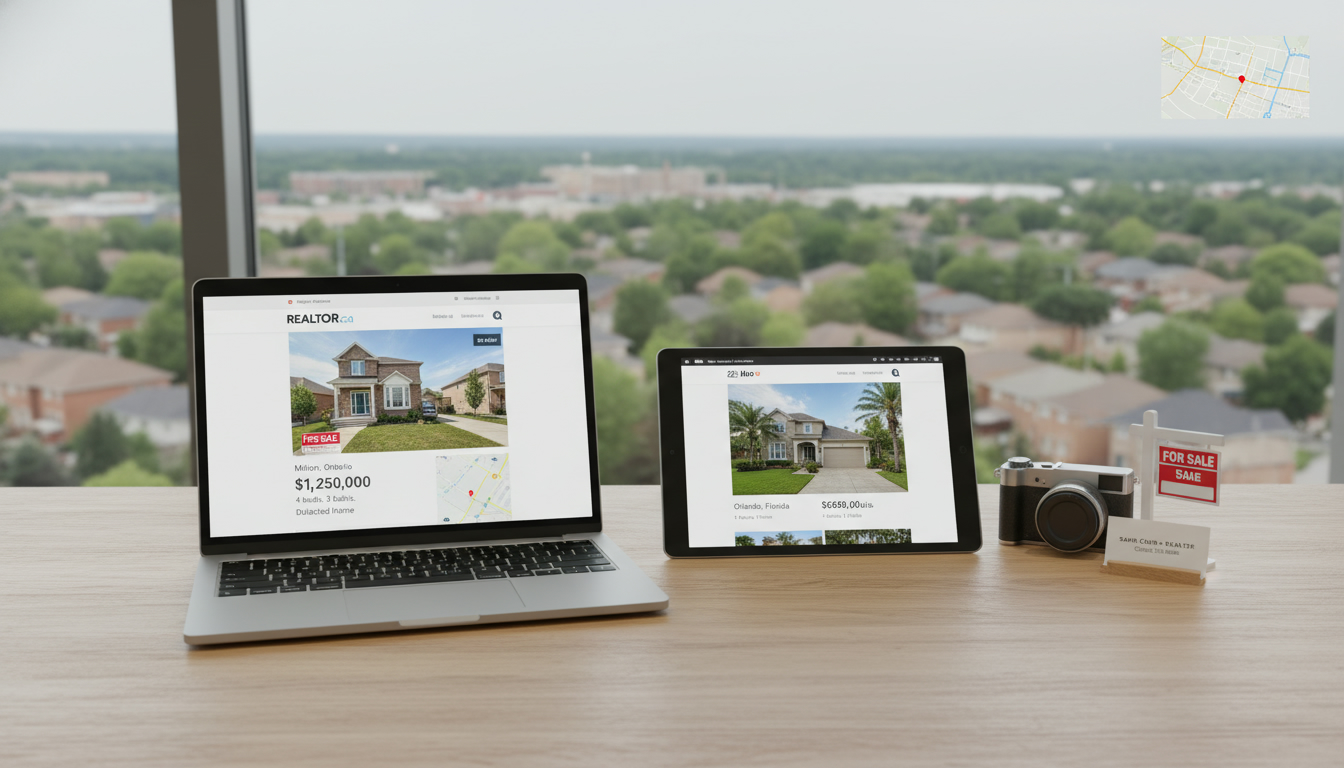

- Georgetown is part of Halton Hills. It attracts 55+ buyers who want easy access to Toronto by GO Transit and local services. That makes move-in-ready, low-fee condos sell well.

- Older condo buildings near downtown Georgetown may have lower fees now but need repairs soon. Newer buildings near the GO station often charge higher fees but have modern systems and better reserve funds.

- School zones and family neighborhoods are less relevant to 55+ buyers. Focus on walkability, transit access, medical services, and low-maintenance living.

How condo fees reduce the proceeds from selling a house (practical view)

When you sell your house, you often use the sale money to buy a condo or add to retirement savings. High condo fees lower your monthly cash flow. That can change how much you can safely draw from your savings each year.

Example decision:

- House sale net proceeds: $300,000

- Option A: Buy condo with low price but $700/month fees

- Option B: Buy condo with higher price but $350/month fees and better reserve fund

Which is better? Option B may cost more up front but protect your retirement income from fee hikes and special assessments.

Simple calculation you must do before you buy

- Find the condo fee per month. Multiply by 12 = annual fee.

- Add property taxes estimate for similar condos in Georgetown.

- Add utilities not included.

- Subtract the total from your expected retirement income.

If the total leaves you with less than your required monthly budget, do not buy.

Documents to demand before you buy (or evaluate before selling)

Ask the condo board or the seller for:

- Latest condo budget

- Reserve fund study and balance

- Minutes from the last 12 months of board meetings

- Any planned special assessments

- Insurance details and deductible amounts

- Recent financial statement and audit

Read them. If you see big line items for repairs or a small reserve fund, expect fee increases.

How to protect retirement income when choosing a condo in Georgetown

- Buy into a condo with a healthy reserve fund. A funded reserve reduces the risk of big special assessments.

- Prefer buildings with transparent budgets and active boards.

- Check recent fee history: steady small increases is better than jumps.

- Ask about included utilities: heat and water included can save money.

- Choose condos close to transit, clinics, and shops to reduce driving costs.

Selling your house in Georgetown? Use condo fee thinking to set price and plan

- When pricing your house, show the math. Buyers aged 55+ compare the cost of house upkeep vs condo fees. Show them the local monthly costs and highlight benefits: no yard work, easier access to services, security.

- If you plan to buy a condo, get pre-approval that includes condo fees in the affordability calculation.

- Time the sale: Georgetown demand for 55+ housing rises when nearby condos list with clear budgets and low unexpected fees.

Action plan: 7 steps for 55+ sellers in Georgetown

- Estimate your retirement income clearly. Include CPP, OAS, pensions, RRSP/RRIF withdrawals.

- Get a clear budget for any condo you consider (monthly fees + taxes + utilities).

- Request reserve fund and meeting minutes from the seller or listing agent.

- Run the numbers: fees and taxes subtracted from income. Make sure your lifestyle fits.

- Check the condo’s location: GO access, doctor, pharmacy, grocery store.

- Talk to a local realtor who works with 55+ sellers and buyers in Georgetown.

- If fees look risky, consider staying in a small house or buying a condo with higher purchase price but lower fees.

Local selling tip: use the sale to buy peace of mind, not just lower price

Many sellers chase the cheapest condo and later pay more in surprise fees. Sell your house for the best price. Then buy a condo with strong finances. A slightly higher price that protects your retirement income is worth it.

Final checklist before you sign

- I have the condo budget and reserve fund study

- I asked about past and planned special assessments

- I know which utilities are included

- I ran the monthly cost vs my retirement income

- I checked walkability and transit in Georgetown

If you can tick all boxes, move forward.

FAQ

Q: How much do condo fees usually run in Georgetown, ON?

A: Fees vary. Small buildings can be $300–$500/month. Larger buildings with amenities are often $500–$900/month. Always check the specific building budget.

Q: Are condo fees tax deductible in retirement?

A: Not for a principal residence. Condo fees are not tax-deductible for regular homeowners. If you rent out the unit, part may be deductible against rental income. Ask your accountant.

Q: What is a reserve fund study and why does it matter?

A: It is a report that tells when major repairs are due and how much money the condo needs to save. A healthy reserve fund lowers the chance of special assessments.

Q: Will condo fees go up after I buy?

A: They can. Fees rise when the building needs repairs or when costs increase. Check past fee history and reserve fund health.

Q: Should I sell my house in Georgetown and buy a condo to protect retirement income?

A: There is no one answer. If a condo reduces your big repair risk and fits your budget, it can protect your retirement. If condo fees eat too much of your income, it may not help.

Q: How can a realtor help 55+ sellers in Georgetown evaluate condo fees?

A: A local realtor can show fee history, compare nearby buildings, get the needed documents, and help you run the monthly cash flow numbers. Use a realtor who works with older buyers and sellers.

Q: How do special assessments work?

A: If the condo corporation needs extra money, owners share the cost. This can be a one-time bill or a temporary increase in monthly fees.

Q: Can I negotiate condo fees when buying?

A: You cannot change the fee set by the condo. But you can negotiate purchase price based on fee history and reserve fund issues.

Need local help? Quick contact

If you want a local Georgetown expert who knows 55+ moves, budgets, and condo fees, get help. I work with sellers and buyers to protect retirement income and make moves simple.

Contact:

Tony Sousa — Local Realtor, Georgetown, ON

Email: tony@sousasells.ca

Phone: 416-477-2620

Website: https://www.sousasells.ca

Make the math. Protect your monthly cash flow. Sell smart. Buy safe.