How does my debt-to-income ratio affect

mortgage approval?

“Is your debt-to-income ratio killing your mortgage approval? Find out what Milton buyers and sellers must do now.”

The blunt truth about debt-to-income ratio and mortgage approval in Milton

If you’re selling a home in Milton or helping a buyer, this matters more than staging or open houses. Lenders don’t look at emotion. They look at numbers. The debt-to-income ratio (DTI) is one of the first numbers they check. It decides whether a buyer gets approved, how much they can borrow, and whether an offer closes.

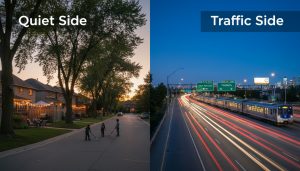

This isn’t abstract. In Milton‘s fast-moving market — where buyers commute to Toronto, competition is stiff, and inventory is tight — a high DTI can sink an otherwise solid deal. Read this. Do the steps. Close the sale.

What is debt-to-income ratio (DTI)? Two metrics lenders use

DTI measures how much of a borrower’s income goes to debt payments. In Canada lenders use two related ratios:

- Gross Debt Service (GDS): Percent of gross income used for housing costs — mortgage payments, property taxes, heating and 50% of condo fees. Industry benchmark: aim under 39% for insured mortgages.

- Total Debt Service (TDS): Percent of gross income used for all debt — housing plus credit cards, car loans, student loans and other obligations. Industry benchmark: aim under 44% for insured mortgages.

Lenders combine these ratios with the mortgage stress test to decide approval and loan size. If a buyer in Milton has GDS or TDS above those benchmarks, they’ll face limited borrowing options and higher interest rates.

Why DTI matters for buyers and sellers in Milton

- Approval risk: High DTI means lenders may decline or reduce the mortgage amount. That kills offers and delays closings.

- Bidding wars: Milton buyers often compete. Lenders cap borrowing based on DTI. A buyer at 45% TDS can’t bid as high as one at 35%.

- Faster closings: Offers backed by buyers with low DTI and pre-approval close faster. Sellers prefer them.

- Price pressure: Sellers holding out for top dollar can lose deals if most buyers in Milton are near lending limits.

Bottom line: DTI controls purchasing power. If you’re selling, you want buyers with low DTI. If you’re buying, lower DTI gets you a stronger offer and better mortgage terms.

How lenders calculate DTI and the role of the stress test

Lenders calculate monthly payments on the requested mortgage using the greater of the contract rate or the Bank of Canada benchmark rate (the stress test). They then add housing costs and other debts and divide by gross monthly income.

In practice in Canada:

- GDS target for insured mortgages: roughly 39% or less.

- TDS target for insured mortgages: roughly 44% or less.

- For uninsured or alternative lending, lenders may accept higher ratios but demand stronger credit or larger down payments.

The mortgage stress test often reduces what a Milton buyer can qualify for. It forces qualification at a higher rate, shrinking borrowing capacity and increasing the importance of lower DTI.

Real Milton market impact — tactical examples

Example 1 — The overreaching buyer:

A couple in Milton wants a $900,000 home. Their current loan payments, car payments and student loans push their TDS to 48% under the stress test. Even with a 20% down payment, most major lenders will refuse or slash the mortgage. The seller waits. The deal falls apart.

Example 2 — The prepared buyer who closes:

Another buyer in Milton reduces credit card debt and gets a pre-approval. Their TDS drops to 40%. They make a stronger offer and the seller accepts because financing risk is low. Closing happens on time.

These are typical Milton outcomes. Sellers working with experienced mortgage-savvy agents avoid wasted time on buyers who can’t qualify.

Action plan for buyers — lower your DTI fast (results in 30-90 days)

- Get a real DTI calculation from a mortgage broker or lender. Don’t guess.

- Prioritize high-interest debts: pay down or consolidate credit cards. Even a partial reduction helps.

- Delay non-essential credit — new loans or expensive leases increase DTI immediately.

- Increase documented income: overtime, bonuses, or a second job if sustainable and verifiable.

- Add a qualified co-signer or co-borrower if appropriate.

- Increase down payment to lower loan amount — reduces GDS and TDS.

- Shop lenders: some lenders treat variable income or bonus structure better.

Do these and you can move from a denied pre-approval to a firm approval within weeks.

Action plan for sellers in Milton — protect your sale

- Require a mortgage pre-approval with written DTI details as a condition of offer. Don’t accept vague ‘bank says OK’ notes.

- Ask for a larger deposit or shorter financing condition periods to reduce financing risk.

- Prioritize offers with lower buyer DTI or cash buyers. A slightly lower price from a strong buyer often beats a higher price from a risky buyer.

- Work with agents who understand local lending rules and stress test impacts.

- Consider a bridge financing strategy or selling incentives that attract buyers with strong financing profiles.

These steps reduce time on market and lower the chance of a collapsed sale due to financing.

What lenders look for beyond DTI

- Credit score and history. Late payments, collections, or high credit utilization hurt approval.

- Employment stability and history. Lenders like predictable, documented income.

- Down payment amount and source. Large down payments lower DTI and perceived risk.

- Property type and location. Unique properties or uninsurable builds may change underwriting.

In Milton, where many buyers commute to Toronto and buyer profiles include young families and professionals, lenders pay close attention to stable employment and mortgage stress-test results.

How a mortgage-savvy agent changes outcomes

A listing agent who understands DTI and the local lender landscape does three things:

- Screens buyers to reduce financing fallout.

- Advises sellers on price vs. risk trade-offs when comparing offers.

- Connects buyers to mortgage brokers who can structure a deal that gets approved fast.

If you’re selling in Milton, you don’t want theory. You want a proven approach that converts offers into closed sales.

Quick checklist: What buyers should bring to pre-approval in Milton

- Two most recent pay stubs and recent T4s or Notice of Assessments.

- Records of other income (rental, bonuses) if verifiable.

- Statements for all debts (credit cards, lines of credit, car loans, student loans).

- Bank statements showing down payment funds and source.

- ID and proof of residency.

Prepared buyers get faster, stronger pre-approvals. Sellers recognize that and prefer those offers.

Local insight: Milton’s housing market and why DTI matters here

Milton is part of Halton Region and the Greater Toronto Area’s commuter belt. Demand has been driven by families seeking larger homes and better value compared to downtown Toronto. Inventory remains tight in many price bands. That makes financing reliability a top priority for sellers.

- Buyers near lending limits lose bidding power.

- Sellers who accept conditional offers risk delays and backouts.

- Agents who screen for DTI win more predictable closings.

This is practical. If you want to sell quickly in Milton at the best net price, you need offers from buyers who meet GDS and TDS expectations and who pass the stress test comfortably.

Final move: What to do next

If you’re selling in Milton, insist on verified pre-approvals and work with an agent who understands DTI and lender behaviour. If you’re buying, calculate your DTI now, then follow the steps above to lower it.

Want one conversation that saves weeks and thousands? Reach out. Local market knowledge plus mortgage expertise stops deals from failing.

Contact: tony@sousasells.ca | 416-477-2620 | https://www.sousasells.ca

FAQ — quick answers Milton buyers and sellers search for

Q: What is a good debt-to-income ratio for mortgage approval in Milton?

A: Aim for a GDS under ~39% and a TDS under ~44% for insured mortgages. Lower is better and increases approval odds.

Q: Can a high DTI be fixed quickly before making an offer?

A: Yes. Pay down high-interest credit cards, consolidate debt, increase your down payment, or add a co-borrower. Changes in 30–90 days can make a difference.

Q: Does mortgage pre-approval consider DTI?

A: Absolutely. Pre-approval requires a DTI calculation. A pre-approval letter that doesn’t disclose DTI details may still be risky—ask for the numbers.

Q: How does the mortgage stress test affect DTI?

A: The stress test forces lenders to qualify buyers at a higher rate, lowering the affordable mortgage amount and effectively tightening the DTI limits.

Q: If a buyer’s DTI is too high, will the deal fail?

A: It can. Lenders can deny financing, causing offers to collapse. Mitigate risk by requiring strong proof of approval, larger deposits, and shorter financing conditions.

Q: Are there lenders in Milton who accept higher DTIs?

A: Yes. Alternative or private lenders may accept higher DTIs but at higher rates and fees. For typical buyers, conventional lenders offer the best long-term rates.

Q: What documents prove DTI for a seller reviewing an offer?

A: Ask for the lender or broker’s pre-approval letter showing GDS/TDS, income verification, and debt statements.

Q: How does credit score affect DTI impact?

A: Higher credit scores give lenders confidence to stretch DTI limits. Poor credit amplifies the negative effect of high DTI.

Q: Should sellers prefer cash buyers over buyers with strong DTI?

A: Cash buyers remove financing risk. However, a well-qualified buyer with low DTI and solid pre-approval often beats a cash offer with other risky terms.

Q: Who should I contact for mortgage and sale advice in Milton?

A: Use a local agent who understands Halton Region lending patterns and can connect buyers to mortgage professionals who know how lenders interpret DTI in Milton.

Contact: tony@sousasells.ca | 416-477-2620 | https://www.sousasells.ca