How do economic cycles affect property prices?

Shocking Truth: How Economic Cycles Can Tank or Skyrocket Your Property Value — What Every Homeowner Must Know

Why economic cycles matter for property prices

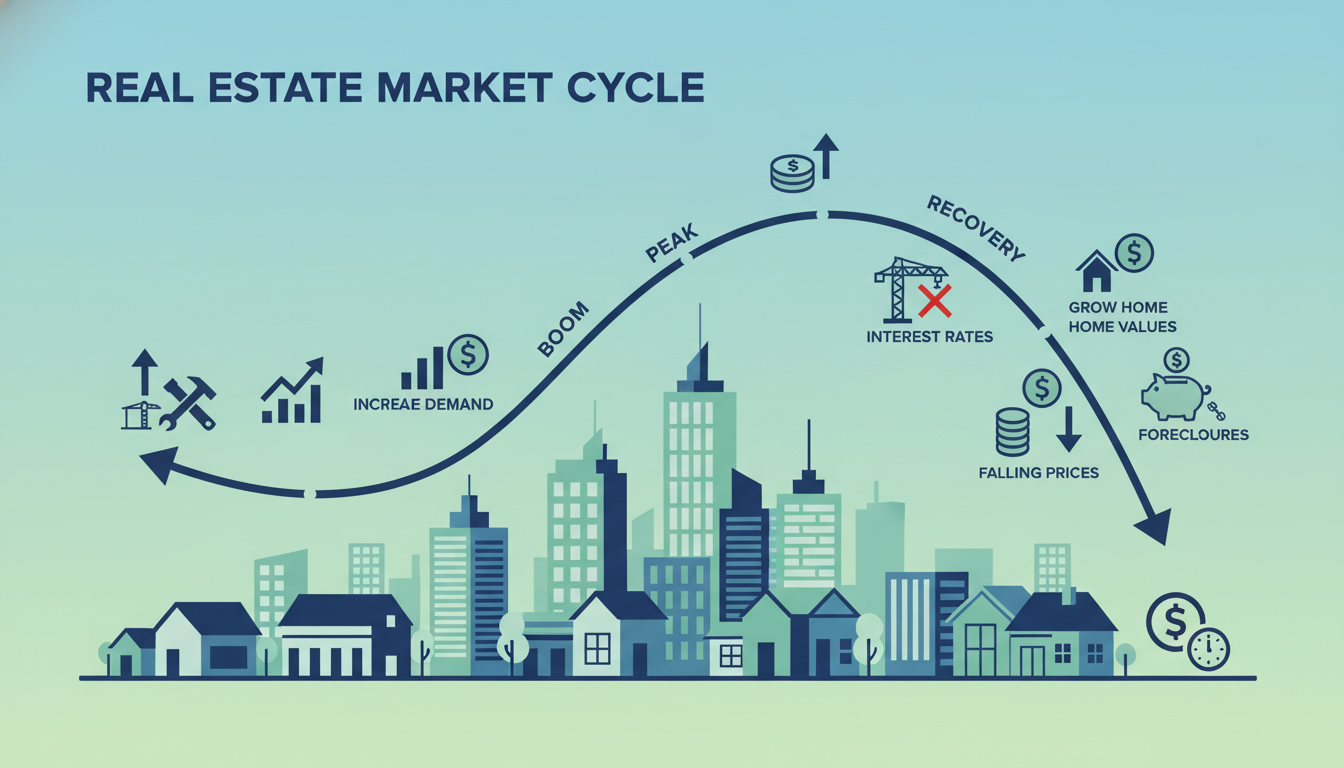

Economic cycles — expansion, peak, contraction, trough — drive demand, credit, and buyer psychology. When the economy expands, jobs rise, incomes grow, and more people buy homes. When it contracts, demand collapses, credit tightens, and prices fall. This is not theory. It’s predictable cause and effect.

The mechanics: interest rates, supply, demand

- Interest rates: Central banks raise rates to fight inflation. Mortgage costs rise. Higher monthly payments reduce buyer affordability and cool prices. When rates fall, buying power expands and prices climb.

- Supply and construction: Housing supply takes time to change. Permits and new builds lag demand by months or years. Tight supply during expansion amplifies price gains. Excess supply during a downturn amplifies losses.

- Consumer confidence and employment: Employment and wages underpin buying power. Rising jobs push prices up. Rising unemployment accelerates listings and discounts.

Real examples that prove the point

- 2008 financial crisis: Credit contraction and job losses triggered steep national price drops. Markets with excess leverage and new home oversupply saw the largest declines.

- 2020–2022 pandemic period: Rapid monetary easing and record-low mortgage rates plus a supply shortage sent prices higher in many regions despite short-term economic disruption.

Data you should watch weekly

Track these leading indicators: mortgage rates, 30-year fixed rate trends, unemployment claims, building permits, housing inventory (months of supply), price-to-rent ratios, and consumer confidence. These metrics signal where the market is in the cycle.

What investors should do now

- Focus on cash flow and fundamentals. If rental income covers debt and expenses, the investment tolerates price swings.

- Buy quality location and supply-constrained markets. Good fundamentals outlast cycles.

- Use rate locks and fixed-rate mortgages to protect against rising rates.

- Don’t chase peaks. If valuations are extreme versus local income and rent, pause and wait for weakness.

Local matters more than national headlines

National cycles set the direction. Local economics set the magnitude. Job growth, transit, zoning changes, and supply pipeline change local outcomes. An expert local agent reads both macro data and neighborhood signals.

Why working with an expert matters

Market cycles are predictable, but execution is not. You need clear indicators, local context, and timing tactics. Tony Sousa combines macro analysis with deep local market tracking to advise buyers, sellers, and investors. If you want a practical plan tied to real indicators, contact: tony@sousasells.ca or 416-477-2620. Visit https://www.sousasells.ca

Make decisions from data, not headlines. Economic cycles steer property prices. Smart investors see the curves coming and act before the crowd.