Should I include personal letters with my

offer?

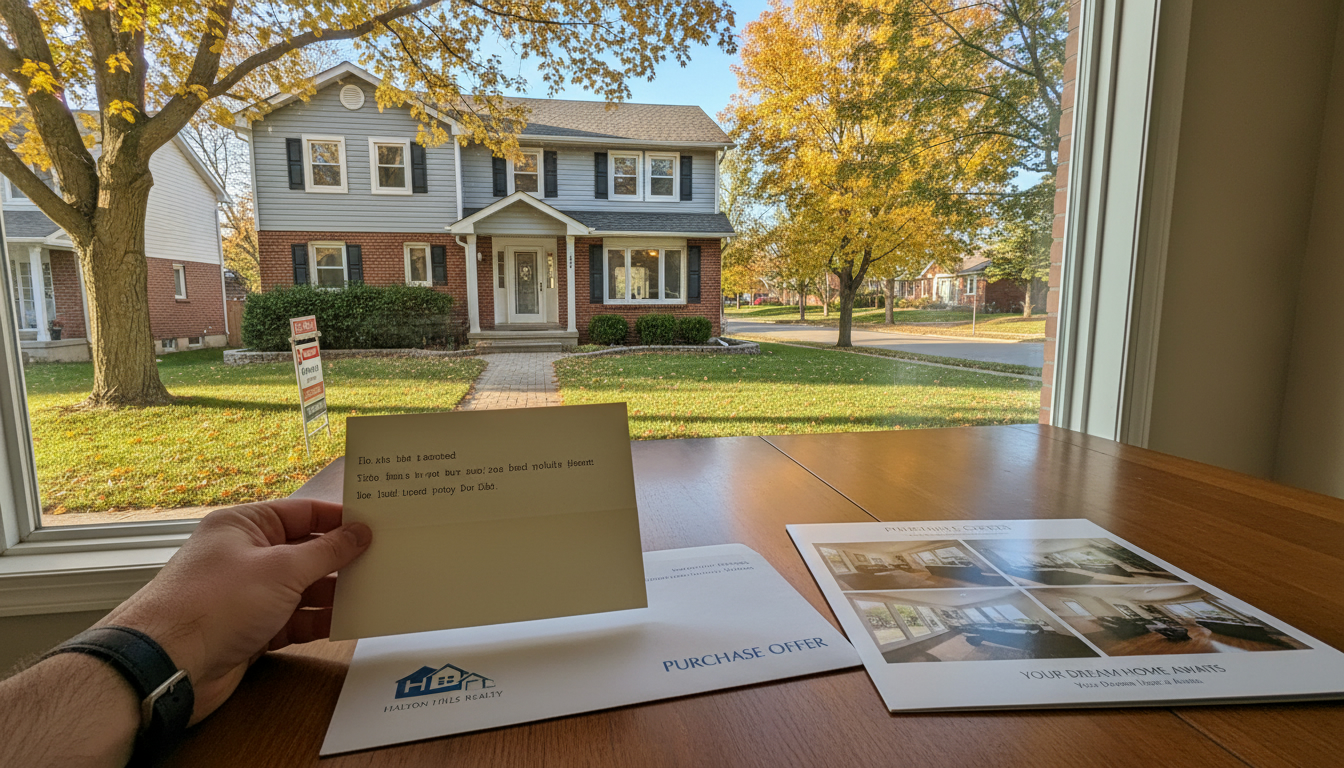

Should I include a personal letter with my offer? One simple move that can win Georgetown homes — and what actually works.

Quick answer for Georgetown home sellers

Yes — sometimes. But only if the letter is written the right way and used alongside smart negotiation moves. A heartfelt letter can tip the scales in a small-town market like Georgetown, ON. Alone it rarely wins a bidding war. Together with proof of funds, clean conditions, and a fast closing, it can turn a maybe into a signed contract.

Why this matters to Georgetown home sellers

Georgetown is not Toronto. Buyers and sellers here still have local ties, schools matter, neighbours matter, and emotions run high when a family wants the same house. That creates an opportunity.

- Emotional connection matters: Sellers who lived in a home for years often care who moves in next.

- Competitive market reality: Multiple offers are common on desirable Georgetown streets. Small advantages matter.

- Local reputation: Word-of-mouth in Halton Hills and Georgetown is powerful. A respectful letter fits the local DNA.

For sellers, understanding how buyers use personal letters helps you evaluate offers beyond price. For buyers, knowing when to include a letter can increase your odds without overspending.

What a personal letter actually does — and what it doesn’t

What it does:

- Humanizes the buyer. Sellers see a family, not just a number.

- Signals commitment. A personal story paired with solid financing shows serious intent.

- Creates an emotional preference. If two offers are equal, the seller often picks the one they like.

What it doesn’t do:

- It won’t replace the money. The highest, cleanest, fastest offer usually wins.

- It won’t magically remove legal or financing risks. Letters are persuasion, not guarantees.

- It can’t include discriminatory promises. Mentioning protected traits or preferences can create legal issues.

How to write a letter that helps — Georgetown-specific tips

If you decide to include a letter, follow this structure. Keep it short. Keep it local. Keep it factual.

- One paragraph: Who you are.

- Names, job, how long you’ve lived in Georgetown or nearby (if true). Keep it simple.

- One paragraph: Why this house.

- Be specific: “walking distance to Centennial Park,” “near Georgetown District High School,” or “love the mature maple trees on Maple Ave.” Local details show sincere interest.

- One paragraph: How you’ll make this easy for the seller.

- Mention pre-approval, cash deposit amount, flexible closing dates, willingness to accommodate minor seller requests. This ties emotion to capability.

- Final sentence: Thank the seller and keep it brief.

Do not include: race, religion, family status intentions, or other protected characteristics. Don’t promise to use or not use the property in a way that discriminates. Avoid overly personal or sentimental appeals that sound manipulative.

Example (short):

Hello — we’re Mark and Aisha, teachers who’ve lived in Acton for five years. We fell in love with your house because our kids can walk to school safely and the backyard is perfect for after-school play. We’re pre-approved and can close in 30 days or on your timeline. We appreciate the care you put into the gardens and would love to keep them thriving. Thank you for considering our offer.

When a letter helps most in Georgetown

- Competitive multiple-offer situations where offers are close in price.

- Homes with clear emotional value (historic bungalows, well-loved gardens, custom finishes). Sellers of these homes often care who moves in.

- Neighborhood-sensitive listings where the seller is particularly invested in the community.

When it helps least:

- All-cash high offers that blow others out of the water.

- Institutional investors or sellers looking only for the highest safe price.

- Offers that contain risky financing or too many conditions — the letter can’t fix those.

Risk and legal considerations — don’t ignore this

Canada and Ontario have human rights protections. A buyer’s letter that mentions protected characteristics (e.g., religion, family status, race) could create problems. Some real estate professionals in North America now leave personal letters out of the process to avoid legal exposure.

Recommendations:

- Keep letters factual and non-discriminatory.

- Realtors should review letter content before it’s submitted.

- Consider anonymized letters that focus on the house and closing strength instead of personal identifiers.

Negotiation moves stronger than a letter (use together)

A letter is persuasion. Negotiation wins come from strategy. Combine the letter with these playbook items that matter more to sellers:

- Strong deposit and proof of funds.

- In Georgetown, a clean, sizable deposit signals seriousness.

- Pre-approval and lender details.

- Include lender contact or pre-approval letter. If you have private financing or a mortgage broker, name them.

- Clean conditions.

- Shorten or eliminate conditions when safe (e.g., waive financing only if you truly can). Sellers value certainty.

- Flexible closing date.

- Ask the seller what timeline they prefer. Flexibility often beats a small price increase.

- Escalation clause.

- Use when comfortable — it automatically bumps your offer over competing bids to a cap.

- Inspection and repair approach.

- Offer a limited inspection window or commit to handle minor repairs yourself to reduce post-offer friction.

A Georgetown seller’s checklist for evaluating letters

If you’re selling in Georgetown, use this quick checklist when you read an offer that includes a letter:

- Does the letter show local ties or knowledge?

- Is there evidence of financing and a good deposit?

- Does the buyer match the seller’s timeline or show flexibility?

- Does the letter avoid protected or discriminatory language?

- Is the price and conditions competitive? If not, the letter is fluff.

If the answer is yes to the first three and the offer is competitive, the letter should influence your choice.

Real examples — what worked and what didn’t

Worked: Two offers within $5,000. Both had solid financing. The seller chose the buyer whose letter described how their elderly neighbour would be able to handle snow days, and who offered the seller a 45-day occupancy window. The emotional tie + practical flexibility sealed the deal.

Failed: A buyer sent a long, emotional letter but had a weak financing condition and a small deposit. Seller picked a slightly lower offer with a full mortgage pre-approval.

Backfire: A buyer’s letter included religious details and asked the seller to let them host large religious gatherings. The seller declined and later consulted the listing agent about legal risk — the letter created friction and was ignored.

Step-by-step playbook for Georgetown buyers

- Get pre-approved and proof of funds.

- Decide if the letter adds value to this specific property.

- Keep the letter short, local, and factual.

- Include closing flexibility and deposit details in the offer paperwork — not just the letter.

- Have your agent review the letter for legal safety.

- Combine the letter with at least two of the negotiation moves above.

Closing argument — direct and plain

A personal letter is a tool, not a tactic. In Georgetown, it can move a seller from “maybe” to “yes” when the money and terms are close. It never replaces clean, strong financial terms. Use it when the house has heart, the neighborhood matters, and your financing is solid. Keep it brief. Keep it local. Keep it legal.

If you’re selling in Georgetown and want help evaluating offers, or you’re a buyer thinking of including a letter, get professional advice so you don’t leave money on the table or create legal exposure.

FAQ — Offers, negotiation tactics, and personal letters in Georgetown, ON

Q: Are buyer letters allowed in Ontario?

A: Yes, but they must be handled carefully. Avoid discriminatory language. Your agent should screen the letter. Anonymized letters focused on logistics and appreciation of the home are safer.

Q: Will a letter get an offer accepted over a higher bid?

A: Rarely. A letter can break a tie or sway a seller when offers are close in price and terms. It’s a tie-breaker, not a price-maker.

Q: What should be in a letter if I want to win a Georgetown home?

A: Short intro, local reason this home fits your life, proof you can close (pre-approval, deposit), and a thank-you. Mention local specifics (school, park, commute) to show sincerity.

Q: Should sellers consider a buyer letter when choosing an offer?

A: Yes — if the offers are similar. Use the letter to assess buyer commitment and fit with seller needs (timing, occupancy, flexibility). Also ensure the letter doesn’t contain discriminatory language.

Q: How do letters affect negotiation power?

A: They add soft power — emotional preference. Hard power comes from price, deposit, and clean conditions. Use both together.

Q: Are there safer alternatives to personal letters?

A: Yes. A buyer packet that includes pre-approval, proof of funds, a concise cover note about timing and intentions, and references from a realtor or employer can be more effective and safer.

Q: Can a buyer waive conditions and still include a letter?

A: Yes. But only waive a condition if your financing is secure. Waiving financing or inspection conditions increases seller confidence but raises buyer risk.

Q: How should agents handle letters to avoid legal trouble?

A: Agents should review and, if needed, redact or advise edits for letters that include protected attributes. Some agents advise against letters altogether; others accept anonymized, factual notes.

Q: Who can I talk to for help with offers and negotiations in Georgetown?

A: Contact a local realtor who knows the Georgetown market and current multiple-offer dynamics. For direct, practical help, reach out to Tony Sousa at tony@sousasells.ca or 416-477-2620, or visit https://www.sousasells.ca. He can review offers, draft competitive strategies, and guide buyers on letters that help without harming the offer.