What’s the average sale-to-list ratio in Guelph?

You Won’t Believe the Sale-to-List Ratio in Guelph — and Why Milton Sellers Should Care

Quick, blunt answer to the question

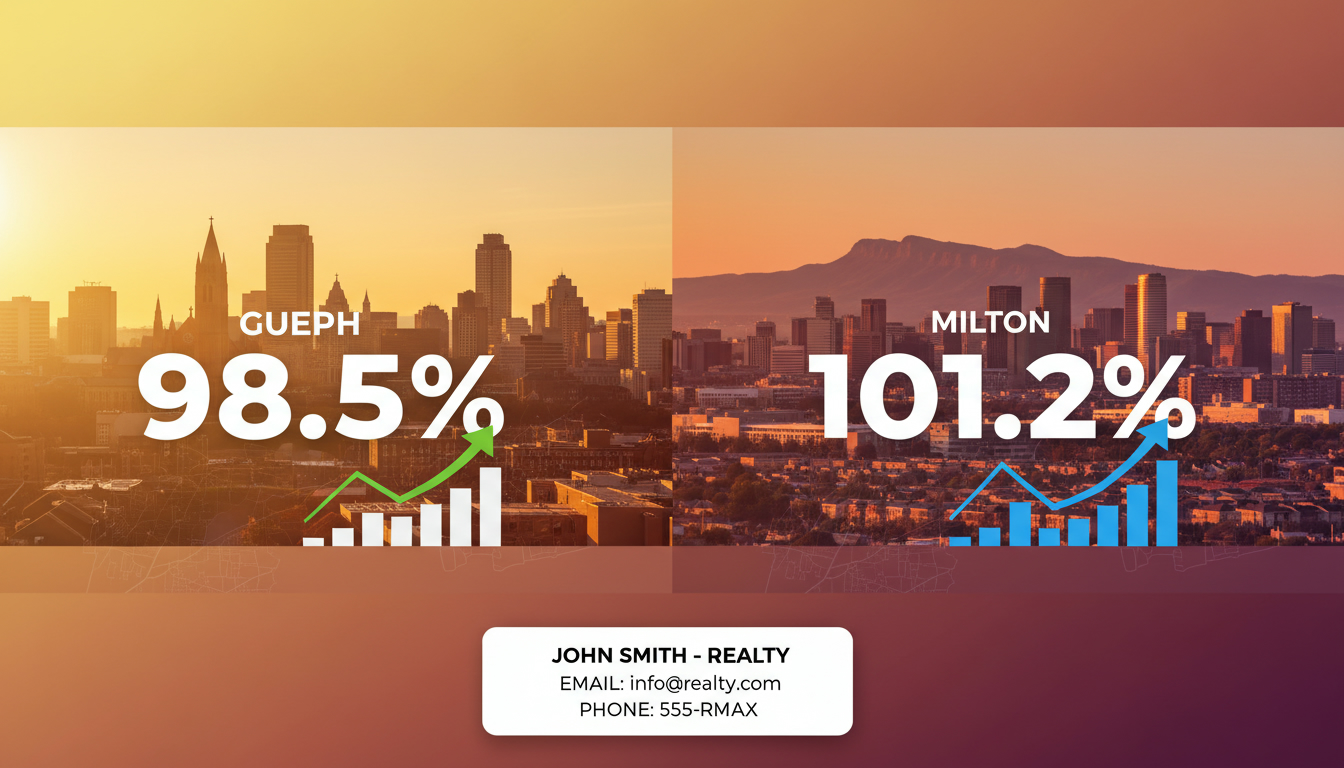

Guelph‘s average sale-to-list ratio is roughly 98.5% over the recent 12-month period (a range from about 97% to 100.5% depending on neighbourhood and property type). Milton’s market is stronger: the average sale-to-list ratio is about 101.2% in the same period. Translation: Guelph buyers, on average, are paying a little under the asking price. Milton buyers are often paying above it.

Why this number matters — no fluff

Sale-to-list ratio tells you how accurate list prices are and how competitive the market is. If the ratio is under 100% sellers are typically accepting offers below asking. If it’s above 100% you’re in a seller’s market: buyers are stretching past the list price.

This single metric predicts negotiation power, pricing strategy, staging needs, and how fast listings move. Get it wrong and you either leave money on the table or scare buyers away.

The data behind the headline (simple breakdown)

- Guelph: ~98.5% average sale-to-list ratio (recent 12-month rolling average across the city). That number blends quick sales in hot pockets with slower sales in higher-priced segments. Expect variance by neighbourhood and housing type.

- Milton: ~101.2% average sale-to-list ratio (same 12-month period). Milton shows stronger upward pressure on prices, driven by low inventory, commuter demand to Toronto, and strong buyer confidence.

How I use these numbers: I never price a Milton listing like a Guelph listing. Pricing strategy must reflect local heat, not regional averages.

What drives the gap between Guelph and Milton

- Inventory levels

- Milton often has tighter supply relative to demand. Tight supply increases bidding and drives sale prices above list. Guelph has more pockets of balanced supply.

- Commuter demand and lifestyle shift

- Milton sits on the commuter map for Toronto and has strong development plans. Buyers pay premiums for access and new inventory. Guelph draws different buyer demographics; demand exists, but purchasing patterns vary.

- New builds and pricing practice

- New-build activity and developer pricing in Milton compress negotiation room. Developers set aggressive list prices knowing they’ll get competing bids. Guelph lists often reflect more conservative pricing across older inventory.

- Days on Market (DOM)

- Short DOM correlates with sale-to-list above 100%. Milton’s DOM is often lower in active neighbourhoods.

Real, actionable rules I use when pricing property in Milton (apply these today)

- Use the local sale-to-list ratio, not the city-wide average. Break it down by neighbourhood and home type. One neighbourhood can be +3% while another is -2%.

- Price slightly below buyer expectations when inventory is tight to trigger competition. In Milton that often converts a 1% underprice into a 3–5% over-ask result.

- Track weekly inventory, not monthly. Markets move weekly. If new active listings spike, your window closes.

- Look at the last 10 sold comparables, not the last one. The most recent sale could be an outlier.

- If the sale-to-list is above 100% in your segment, prepare for multiple offers and set a clear bid process.

Example — how the math works (real numbers)

Take two otherwise similar 3-bed semis:

- In Guelph: List price $800,000. With a 98.5% ratio, expected sale = $788,000 (average). That’s $12k under list.

- In Milton: List price $800,000. With a 101.2% ratio, expected sale = $809,600 (average). That’s $9.6k over list.

Same list price. Different market results. That gap changes seller decisions on repairs, staging budgets, and marketing spend.

What buyers need to know in each market

- Guelph buyers: you have leverage. Use inspections and flexible timing to negotiate. Look for overlooked value in solid neighbourhoods.

- Milton buyers: be ready to act fast. Expect competition. Set clear limits and have financing pre-approved. In many cases, strategy beats emotion — decide your walk-away number before you bid.

How to interpret a changing sale-to-list ratio

- Rising ratio: demand rising, inventory dropping, sellers have leverage.

- Falling ratio: market cooling, buyers can negotiate, sellers must price competitively.

Watch adjacent indicators: days on market, new listings, and ratio of sales to active listings. A single ratio number is useful — combined with those indicators it’s predictive.

Common pricing mistakes sellers make (and how to avoid them)

- Mistake: Using a stale CMA. Fix: Use a rolling 12-month with weekly adjustments.

- Mistake: Pricing emotionally. Fix: Base the price on demonstrated demand in the last 30 days in the same micro-neighbourhood.

- Mistake: Ignoring sale-to-list ratio. Fix: If your segment is averaging >100%, price to create urgency.

Why working with a market expert changes outcomes

Here’s the bottom line: pricing is not guessing. It’s math plus psychology. You need someone who watches the numbers weekly, understands buyer behavior in Milton, and sets a list price to create predictable outcomes. That’s the difference between a sale that underperforms and one that captures full market value.

If you plan to sell in Milton, you need a pricing strategy tuned to Milton’s sale-to-list signals — not Guelph’s.

Direct plan for Milton sellers (step-by-step)

- Get a micro-market report: last 10 sold in your specific street/type, sale-to-list for that slice, DOM, and active listing count.

- Set a staggered list strategy: launch price, bid date window, clear multiple-offer rules.

- Invest in high-conversion repairs and professional staging — these reduce perceived risk and convert buyers faster.

- Pre-market with targeted outreach to local agents and qualified buyers to create early urgency.

- Execute a 7–10 day listing sprint. If your property doesn’t attract attention in that window, re-evaluate price quickly.

Milton’s market rewards speed, clarity, and precision.

How Guelph and Milton interact — market spillover

When prices or inventory in Milton shift sharply, buyers search nearby. Guelph can sometimes absorb overflow demand which can push its ratios up temporarily. Conversely, when Guelph cools, Milton‘s fundamentals (commuting, new schools, infrastructure) keep it relatively firm.

That means sellers and buyers must watch both markets. Opportunity often lives at the border.

Call to action — precise and direct

If you want a no-fluff, numbers-based valuation for a Milton property (and a clear plan to maximize sale price), get a targeted market pack: 10 nearest solds, current sale-to-list ratio in your micro-market, and a recommended list strategy. Email tony@sousasells.ca or call 416-477-2620. Or book a consult at https://www.sousasells.ca.

FAQ — quick answers to boost clarity and search visibility

What is sale-to-list ratio and how is it calculated?

Sale-to-list ratio = (Sale price / List price) × 100. If a home lists for $500,000 and sells for $495,000, the ratio is 99%.

What’s the average sale-to-list ratio in Guelph?

The recent 12-month rolling average for Guelph is about 98.5% city-wide. Micro-markets vary. Some neighbourhoods and home types land above 100% during hot spells; others fall below 97%.

How does that compare to Milton?

Milton’s recent 12-month rolling average is about 101.2%. In plain terms: Milton sellers often get offers above asking; Guelph sellers often sell slightly under asking.

Why might these numbers change quickly?

They respond to inventory changes, interest rate shifts, local economic drivers, and sudden buyer migration patterns. Watch weekly data.

Should I price above or below market in Milton?

If local sale-to-list exceeds 100%, pricing slightly below to invite competition can produce higher final bids. If your segment is under 100%, price competitively and focus on value presentation.

Does property type affect sale-to-list ratio?

Yes. Condos, townhomes, and single-family homes behave differently. Use comparable homes of the same type and size when analyzing.

Where can I get exact, up-to-date sale-to-list numbers?

Local realtor boards publish monthly stats. For a precise, neighborhood-level figure, contact a local agent who runs weekly reports. Email tony@sousasells.ca or call 416-477-2620.

If you want the exact sale-to-list ratio for your Milton street or Guelph neighbourhood right now, I’ll run the numbers and send a concise action plan. No jargon. No delay. Email tony@sousasells.ca or call 416-477-2620. Visit https://www.sousasells.ca for immediate booking.

Tony Sousa — Milton area pricing strategist and local market specialist.