How old should a house be for me to buy it

safely?

“How old should a house be for me to buy it safely?” — Here’s the answer you didn’t know you needed.

Quick answer you can act on now

If you want low risk, look for homes built or extensively renovated within the last 20–30 years. But age alone isn’t the decision-maker. Condition, upgrades, inspection reports, and the neighbourhood matter more. In Milton, ON, where new subdivisions sit beside century-old downtown homes, the right buying decision is about known problems — and known costs — not a birth year on a deed.

Why house age matters — and why it shouldn’t be the only filter

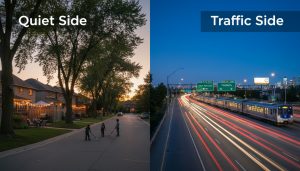

Age gives you a probability map of what will fail next. Systems like roofs, furnaces, windows, and plumbing have predictable lifespans. Older homes are not automatically bad; they can offer character and location advantages. But they often carry deferred maintenance. In Milton, proximity to transit (GO), highways (401/407), and schools drives value more than age. That means an older, well-maintained downtown home can outperform a newer house in a less desirable pocket.

Practical age buckets and what they mean for buyers

- New: 0–10 years — Minimal near-term capital expenses. Expect warranty coverage on many systems. Best for low-maintenance buyers.

- Young: 10–30 years — Possible minor upgrades (roof, windows, garage door). Systems often near mid-life.

- Midlife: 30–50 years — Expect at least one major system replacement (roof, furnace, water heater). Budget for updates to electrical and insulation.

- Older: 50+ years — High chance of foundational, plumbing (cast iron), or electrical (knob-and-tube or old panels) work. Historic charm, higher maintenance.

In Milton, most rapid growth has produced many New and Young properties, especially in North Milton and newer subdivisions. The historic downtown core and rural pockets contain Midlife and Older houses.

Cost estimates — replace smartly (Canada pricing, ballpark)

- Asphalt roof replacement: $8,000–$15,000+ depending on size and pitch.

- Furnace replacement: $3,000–$7,000.

- Hot water tank: $800–$2,000.

- Windows (per unit): $400–$1,200.

- Electrical panel upgrade: $1,500–$4,000.

- Repiping (partial): $4,000–$12,000; full repipe: $8,000–$20,000.

- Foundation repairs: $5,000–$30,000+ depending on severity.

Those ranges are what buyers use to quantify risk during offers. In Milton’s market, labour and permit costs can push the high end of these ranges.

The smart inspection playbook — what to insist on in Milton

- Standard Home Inspection (licensed): Structure, roof, insulation, visible plumbing, electrical, HVAC.

- HVAC specialist inspection: Furnace and AC performance and lifespan estimate.

- Sewer camera / septic inspection: Especially for older homes or properties off municipal sewer.

- Electrical panel check: Look for outdated panels, loose wiring, or illegal upgrades.

- Chimney and fireplace inspection: For older downtown homes.

- Moisture and basement check: Milton’s clay soils can cause hydrostatic pressure and water intrusion.

Make your offer conditional on these inspections. Don’t waive them to win a bidding war unless you accept the price of unknowns.

Renovation vs. Replacement — the ROI lens for Milton sellers and buyers

Buyers: If an older house needs $40k of work, negotiate a price reduction or buyer credit. Insist on contractor quotes for major items.

Sellers: Spend dollars that move the needle. Top investments that increase buyer confidence and sale price:

- Fix safety and code issues (electrical, gas leaks). High ROI.

- Replace worn roofs if close to failing.

- Update kitchens/bathrooms strategically. You don’t need high-end—clean, functional, modern colors sell.

- Provide documentation: permits, receipts, and warranties. This reduces buyer friction.

In Milton, buyers value move-in readiness and proximity to transit/schools over ultra-lux finishes. Sellers should prioritize removing risk — buyers pay a premium for certainty.

Insurance and mortgage impacts based on age

Older homes can face higher insurance premiums if they have outdated wiring, old roofs, or wooden shingle roofs. Lenders may require additional inspections or appraisals for very old homes or homes with non-standard systems. If the property needs structural work, some lenders limit financing or increase interest rates. Always confirm with your mortgage broker before committing.

Negotiation strategy tied to age

- Low risk (New/Young): Offer closer to list price, fewer contingencies, but keep inspection as a formality.

- Middle risk (Midlife): Ask for seller repairs or a closing credit equal to verified replacement costs.

- High risk (Older): Use inspection findings to negotiate price. Factor in permit history. Consider asking the seller to complete major safety fixes before closing or provide an escrow holdback.

Sellers convert more buyers by issuing a pre-listing inspection and fixing obvious safety/code problems. That reduces renegotiation at condition removal.

Local Milton market nuances that change the math

- Commuter demand: Buyers prioritize access to GO Transit and highways. Older homes near stations often sell faster.

- New builds flood certain price points: That puts upward pressure on renovated older homes in premium locations.

- School zones: Proximity to high-performing schools increases buyer tolerance for older homes needing cosmetic work.

- Soil & drainage: Certain Milton areas have clay soil; ensure proper grading and drainage to avoid basement issues.

If you list a home in Milton, highlight upgrades that buyers in this market actually value: new roof, recent furnace, insulation upgrades, certified electrical panel, and proximity to transit.

Checklist for buyers: Decide fast, act smart

- Check year built and major upgrade dates in the listing and with the seller.

- Request utility bills and maintenance records.

- Get a full home inspection and specialized reports where needed.

- Budget 1–3% of purchase price annually for maintenance on older homes.

- Factor insurance and lender requirements into your affordability.

Checklist for sellers: Remove buyer doubt before listing

- Order a pre-listing inspection and address safety/code issues.

- Collect permits and receipts for past renovations.

- Replace or repair items that fail inspections: roof, wiring, dangerous railings.

- Use professional photography and highlight recent system replacements in the listing.

Real examples — what I see in Milton (patterns, not anecdotes)

- New subdivisions: Buyers prefer move-in-ready. Minimal negotiation for known, recent builds.

- Downtown character homes: Buyers pay for location if major systems are updated. Deferred maintenance kills deals when buyers see mold, water intrusion, or old knob-and-tube wiring.

- Semi-detached/row houses near schools: Cosmetic issues forgiven if structure and systems are solid.

Final rule: Age matters, but condition and documentation rule decisions

A house’s age gives an expectation of maintenance needs. But the decisive factors are condition, upgrades, inspection reports, and location. In Milton’s mixed market, smart buyers use inspections and concrete cost estimates to negotiate. Smart sellers remove risk and present proof.

If you want local guidance tailored to your property — whether you’re buying or selling in Milton — get a clear, no-fluff assessment. I work with buyers and sellers across Milton to translate house age into actual dollars, risk, and strategy.

Contact: Tony Sousa | tony@sousasells.ca | 416-477-2620 | https://www.sousasells.ca

FAQ — Practical, local answers about house age and buying safely in Milton

Q: Is it unsafe to buy a house over 50 years old in Milton?

A: Not automatically. Safety depends on systems (electrical, plumbing, structure) and maintenance history. Older homes are safe if they’ve been updated and inspected. Factor in potential repiping, panel upgrades, and foundation checks.

Q: What’s the single biggest age-related risk buyers face?

A: Deferred maintenance that leads to hidden costs — especially water damage, poor electrical, and failing foundations. Use inspections to expose these.

Q: How much should I budget for repairs if I buy an older home in Milton?

A: As a rule of thumb, plan 1–3% of purchase price annually. For homes over 50 years old, have a short-term reserve of $15k–$50k depending on inspection findings.

Q: Can I get insurance for a 100-year-old house in Milton?

A: Usually yes, but premiums may be higher and insurers may require upgrades to wiring, roofing, or plumbing before issuing a policy.

Q: Should sellers disclose the year built and upgrades?

A: Yes. Full disclosure and documentation reduce buyer suspicion and speed up sales. Pre-listing reports provide confidence and help justify price.

Q: Do lenders care about house age?

A: Lenders care about condition. Very old homes or homes with structural issues may face financing limits or require additional inspections.

Q: Are recent renovations more valuable than a younger house?

A: Often, yes. A 60-year-old house with recent full-system upgrades can be less risky than a 15-year-old house with deferred maintenance. Buyers pay for certainty.

Q: What’s the best way to win a Milton bidding war without waiving inspection?

A: Offer a fair price, provide a flexible closing, and include a smaller deposit or an inspection time limit. Keep the inspection contingency but set a quick turnaround with trusted inspectors.

If you want a property-specific assessment — valuation, inspection guidance, or negotiation strategy — contact Tony Sousa at tony@sousasells.ca or call 416-477-2620. Get a clear plan for your Milton property, no fluff, no guesswork.