How do insurance premiums vary by location?

Why Your Zip Code Dictates Insurance Premiums — The Eye-Opening Truth

Quick answer

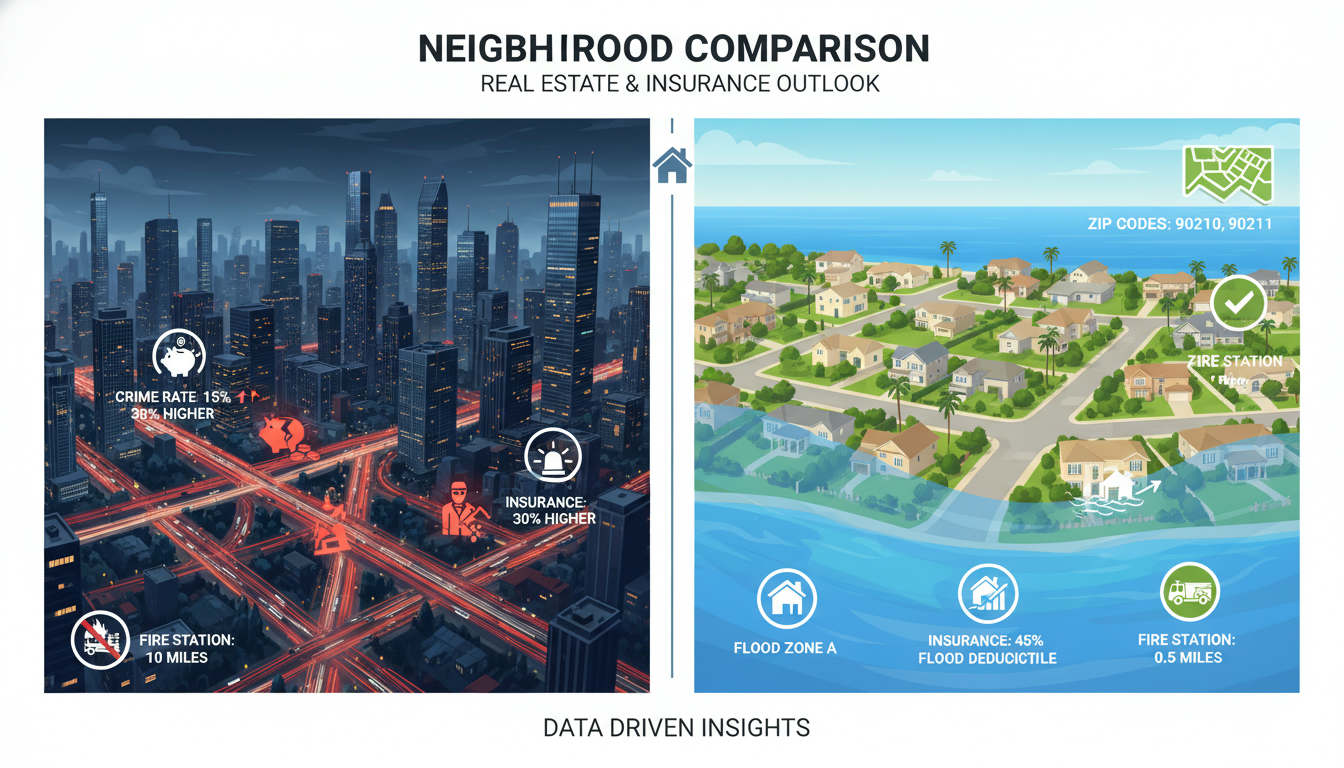

Location drives insurance premiums. Insurers price risk by address, not by feelings. Flood zones, crime, local building codes, and even how far the nearest fire station is will push your homeowners, auto, and renters insurance up or down.

Why location matters for insurance premiums

Insurance is risk math. Carriers use historical loss data and local risk indicators to predict future claims. That data is tied to geography: zip code, neighborhood, and municipality. The result: two identical homes can carry very different premiums if they sit in different places.

Key location factors that change rates

- Flood and hurricane zones: Properties in floodplains or coastal areas face higher premiums and may need separate flood insurance.

- Crime and vandalism rates: Higher theft or vandalism increases homeowners and auto rates.

- Fire risk and fire department response: Long response times or volunteer departments raise property insurance costs.

- Local construction costs and building codes: Areas with stricter codes or higher rebuild costs force insurers to charge more.

- Weather patterns and catastrophe exposure: Wildfire, hail, tornadoes concentrate risk and spike premiums.

- Population density and traffic: Urban areas often mean higher auto claims; suburban areas may see lower auto premiums but higher home values.

Real examples you can use right now

- Two identical houses, same square footage, different zip codes: One in a coastal city with a 1-in-100 flood risk will likely be 20–50% more expensive to insure than one inland.

- Urban driver vs rural driver: Urban auto insurance can cost up to 30% more because of traffic, theft, and claims frequency.

- Condo in a city center: Higher building replacement costs and condo association claims can raise condo insurance premiums compared to a similar unit in a smaller town.

Actionable steps to lower location-driven premiums

- Shop multiple carriers — rates vary widely by zip code.

- Raise your deductible if you can afford it — lowers premium across locations.

- Add safety features: alarms, sprinkler systems, and monitored devices reduce rates.

- Mitigate risk: install flood barriers, maintain landscaping to reduce wildfire risk.

- Bundle policies: combining home and auto often reduces location penalty.

How to use a local Insurance & Risk expert

A local expert reads the map, knows which insurers favor which zip codes, and negotiates discounts you won’t find online. They translate municipal data into dollars saved. That guidance is the fastest path to reducing location-driven premiums.

If you want a clear, no-nonsense assessment of how your address affects your insurance costs, contact Tony Sousa. He is a leading local Insurance & Risk expert who cuts through industry noise and finds the best rates for your location.

Contact: tony@sousasells.ca | 416-477-2620 | https://www.sousasells.ca

Keywords: insurance premiums, vary by location, homeowners insurance, auto insurance, flood risk, zip code insurance rates, insurance cost, property insurance, local risk assessment, insurance market.