Should I lower my price if no one’s making offers?

Why dropping the price first is the most expensive move most Georgetown sellers make — and what to do instead.

The quick truth

You’re listing in Georgetown, Ontario. You expected showings, offers, maybe a bidding war. Instead: views slow, showings happen, and no offers. Fewer offers doesn’t automatically mean you priced too high. It means your strategy needs fixing.

This guide tells you, step-by-step, how to decide whether to lower the price, and how to do it so you don’t leave money on the table. No fluff. Real tactics. Local market focus for Georgetown and Halton Hills sellers.

Understand the market signal — what silence means

When your listing attracts attention but no offers, the market is sending a specific set of messages. Read them before you cut your price.

- Buyer affordability: Mortgage rates and buyer budgets in Georgetown changed since 2021. Many buyers are rate-sensitive now. If median buyer purchasing power has shifted, your price might be out of reach.

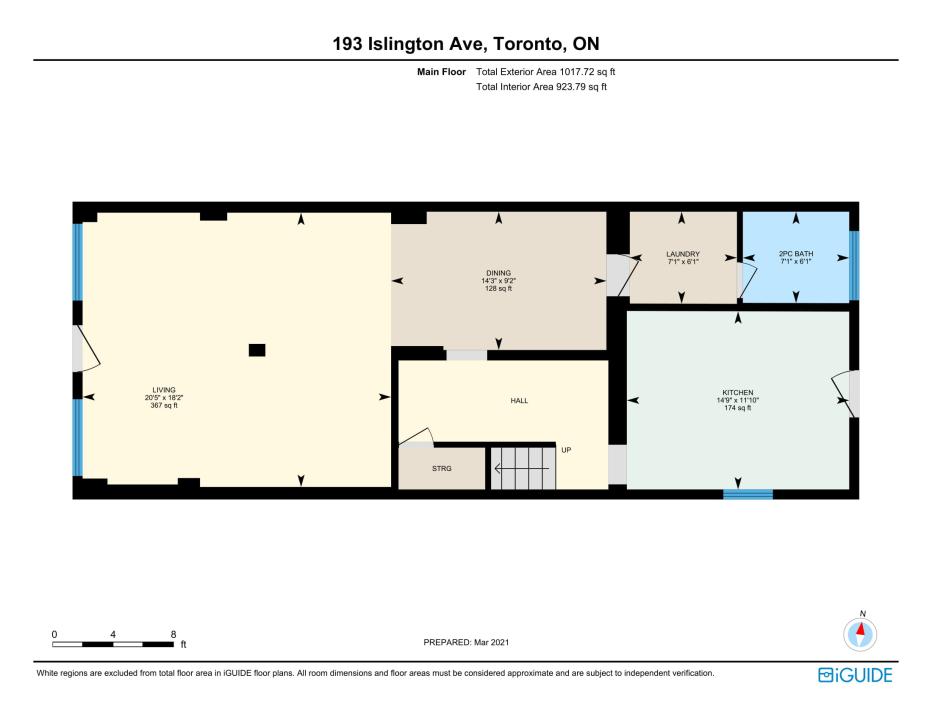

- Value perception: Buyers compare features, condition, and layout to active and recently sold listings. Poor photos, outdated staging, or bad floor plans kill offers faster than a price tag.

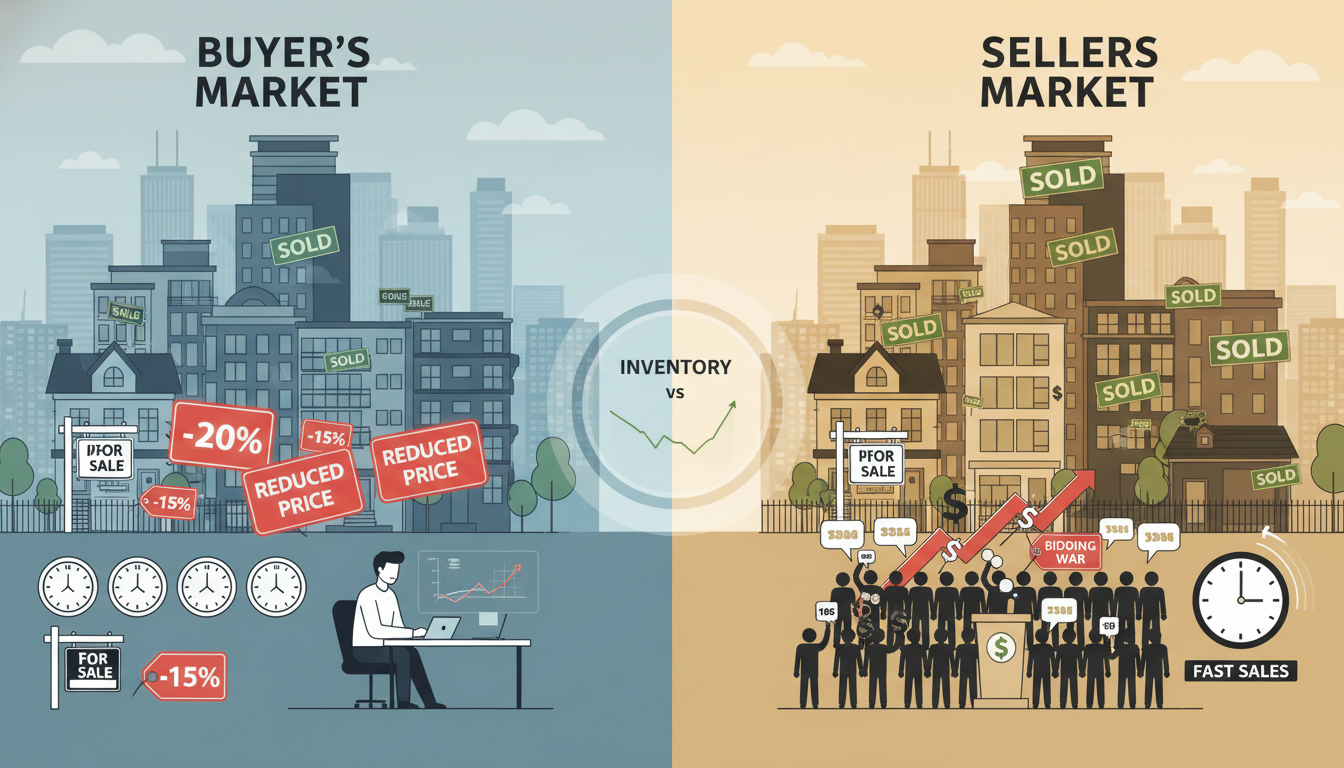

- Market liquidity: Inventory cycles matter. In a balanced market, homes sell within expected days-on-market (DOM). In slower times, sellers must be proactive with marketing and terms before slashing price.

- Search and exposure: Wrong price band, poor SEO, inaccurate remarks, or limited showing windows can hide your property from the right buyers.

Local data you must check (and where to get it)

Before you lower the price, pull these local metrics. Use Tony Sousa, your local Realtor, to pull the exact numbers for your neighbourhood.

- Active inventory in Georgetown / Halton Hills: rising or falling? An increasing supply suggests weaker seller leverage.

- Sales-to-list ratio (weekly/monthly): If under 80% consistently, buyers have leverage.

- Average days on market for comparable homes: compare by property type and price band (e.g., detached $900k–$1.5M vs townhomes $600k–$800k).

- Recent comparable sales (last 30–90 days): closed prices, not just list prices.

- Price reductions on similar listings: frequency and size show seller behavior.

Sources: Toronto Regional Real Estate Board (TRREB) reports, local MLS stats via your Realtor, Halton Hills municipal market snapshots. These tell you whether price is the main issue or if other factors are at play.

The 3-question test: Should you lower your price now?

Run this quick test before dropping the price.

- Were you getting qualified showings? If yes, buyers see value but hesitate—don’t cut price first. If no, change exposure or price band.

- Are comparable homes selling for your list price? If comps close near your number, don’t reduce—fix presentation or terms.

- Has market data shifted in the past 30 days (inventory up, DOM rising)? If yes, consider small, strategic adjustments.

If you answered “no” to question 1 or “yes” to question 3, you might need a price move. But the size and timing matter.

Pricing mistakes I see Georgetown sellers make (and how to avoid them)

-

Mistake: Cutting price 5–10% immediately after two weeks. Result: Buyers assume desperation.

-

Fix: By week two, change marketing, tweak remarks, and host targeted broker previews. Drop the price only after data supports it.

-

Mistake: Pricing just above a search band (e.g., $799,900 when most buyers search under $750k or over $800k).

-

Fix: Price intentionally at search milestones to capture more buyers (e.g., $749,900 or $799,900 depending on band behavior).

-

Mistake: Lowering price without improving presentation.

-

Fix: Invest in professional photos, virtual tour, quick cosmetic fixes, declutter, and targeted social ads. Presentation increases perceived value.

The price-reduction playbook: how to cut without cutting your profit

- Wait for data — 10–21 days. Let the listing fully hit the market cycle. If activity is low, review showings and feedback.

- Improve instantly. Update photos, adjust showing availability, and rewrite the listing description with buyer-focused benefits (schools, commute times to Mississauga/Toronto, parks, GO access).

- Reposition before you reduce. Move the property into a different buyer pool by adjusting terms (closing flexibility, including appliances, offering incentive for quick closing).

- Small, targeted reductions. If a reduction is needed, drop price in 1–3% increments. Big cuts signal failure and encourage lowball offers.

- Re-launch: When you do reduce, treat it like a re-list. New photos, new open house, fresh marketing, and broker outreach. Buyers search by new listings; a relaunch captures attention.

Pricing psychology — what buyers do in Georgetown

Buyers in Georgetown are practical. They compare commute times to Toronto and Mississauga, school ratings, lot sizes, and basement suite potential. They respond to clarity and urgency.

- Anchoring: Set the perceived market range with nearby comparables. A slightly lower price but superior presentation will win more offers.

- Scarcity: Proper timing (weekend open house, targeted social ads) creates urgency. Price alone without urgency rarely produces multiple offers.

- Certainty: Buyers pay more for certainty—clean seller conditions, clear title, and pre-inspections. Offering a pre-inspection or firm closing window increases perceived value.

When to cut quickly: red flags that mean price must move

- No qualified showings after 21 days and comparable inventory is increasing.

- Feedback consistently says “too expensive” from agents and buyers.

- New similar listings undercut your price and offer better condition or terms.

If you hit two of these, move fast: adjust price 2–3% and relaunch with improved marketing.

When not to cut: signs you should hold or change strategy instead

- You have steady, qualified showings and one or two conditional offers are possible with small changes in terms.

- Comparable sales are still closing near your asking price.

- Your marketing is weak — bad photos, limited showing hours, or your property is listed in the wrong search segment.

In these cases, change presentation and terms before price.

A simple pricing decision flow (3 steps)

- Data: Pull 30–90 day comps, active inventory, and DOM for your price band.

- Diagnose: Are buyers seeing value? Use feedback and agent reports.

- Act: Improve presentation and terms. If needed, reduce price in a controlled 1–3% step and relaunch.

Use this every time you evaluate a price change.

Quick tactical checklist for Georgetown sellers (do this now)

- Order a comparative market analysis tailored to your street and price band.

- Get professional photos and a virtual tour within 72 hours of listing.

- Confirm showing availability on weekends and evenings.

- Offer a pre-inspection or provide recent inspection and permit records.

- Price to the buyer pool: pick the search band that matches demand.

- Consider a small seller credit for closing costs instead of a price cut to keep MLS stats stronger.

Why a local Realtor matters here

Georgetown is not Toronto. Price sensitivity, buyer types, and inventory cycles differ. A local expert will:

- Pull accurate, neighborhood-specific comps.

- Read agent feedback and know local buyer psychology.

- Time price changes to local open-house traffic and school calendars.

- Run targeted digital ads aimed at buyers who commute to Toronto and Mississauga or who value Halton Hills lifestyle.

That’s where Tony Sousa comes in: deep local experience, daily MLS access, and a repeatable pricing playbook for Georgetown sellers. For a no-nonsense CMA and pricing plan, contact Tony at tony@sousasells.ca or 416-477-2620, or visit https://www.sousasells.ca.

Example scenarios (realistic moves)

-

Scenario A: You listed at $899,900. After two weeks you have good showings but no offers. Comps are selling at $905k. Action: Hold price, improve marketing, offer a flexible closing date. Likely result: an offer within 1–2 weeks.

-

Scenario B: You listed at $1,150,000. No showings after 21 days. Similar homes in the area are priced $50k lower and converting. Action: Reduce price 2–3%, relaunch with new photos and a weekend broker open. Likely result: Return to showings and an offer pipeline.

-

Scenario C: High traffic online but low in-person showings. Action: Adjust asking price to hit a different search band, update listing copy to highlight commute and schools, and increase showing availability.

Final rule: price is one lever — use all of them

Price matters. But it’s one lever among marketing, terms, and timing. Lowering price without improving perceived value or exposure is a fast way to sell for less. Use data, run the 3-question test, and take controlled, strategic action.

FAQ — Georgetown sellers’ top questions about pricing & market value

Should I drop my price after two weeks with no offers?

Not automatically. Wait 10–21 days, analyze feedback, and improve marketing first. If local data shows rising inventory or you have no qualified showings, consider a small, strategic reduction.

How much should I lower the price if I decide to cut?

Aim for 1–3% per reduction and relaunch the listing. Large, sudden cuts invite lowball offers.

Will a price drop reset buyer interest?

Yes, if you relaunch it. Treat a reduction like a new listing: new photos, open houses, broker outreach, and fresh marketing.

Should I offer incentives instead of lowering price?

Sometimes. Seller credits for closing costs, paying for a home warranty, or offering flexible closing can attract buyers without changing MLS price.

How do I know if my home is priced in the wrong search band?

Look at buyer search behavior and comparable listings. If most buyers search under a threshold that your price exceeds, you’ll miss them. Your Realtor can identify the best price point to capture the largest qualified audience.

How important is staging and photography relative to price?

Very. Strong presentation can justify a higher price. Poor presentation often drives low offers, even if the price is fair.

What local indicators should I watch in Georgetown?

Active inventory, days on market, sales-to-list ratio, and recent closed prices in your neighbourhood and price band. Your local Realtor can pull weekly snapshots.

Ready to price smart and sell for more in Georgetown? Get the precise CMA and a pricing playbook tailored to your street. Email tony@sousasells.ca or call 416-477-2620. Visit https://www.sousasells.ca for more local market insights.