How do property taxes vary within regions?

Want to pay less tax because of where you live? Here’s exactly how neighbourhoods change property taxes — and what Milton, Ontario sellers must do today.

Quick answer: neighbourhoods change taxes — not always the way you think

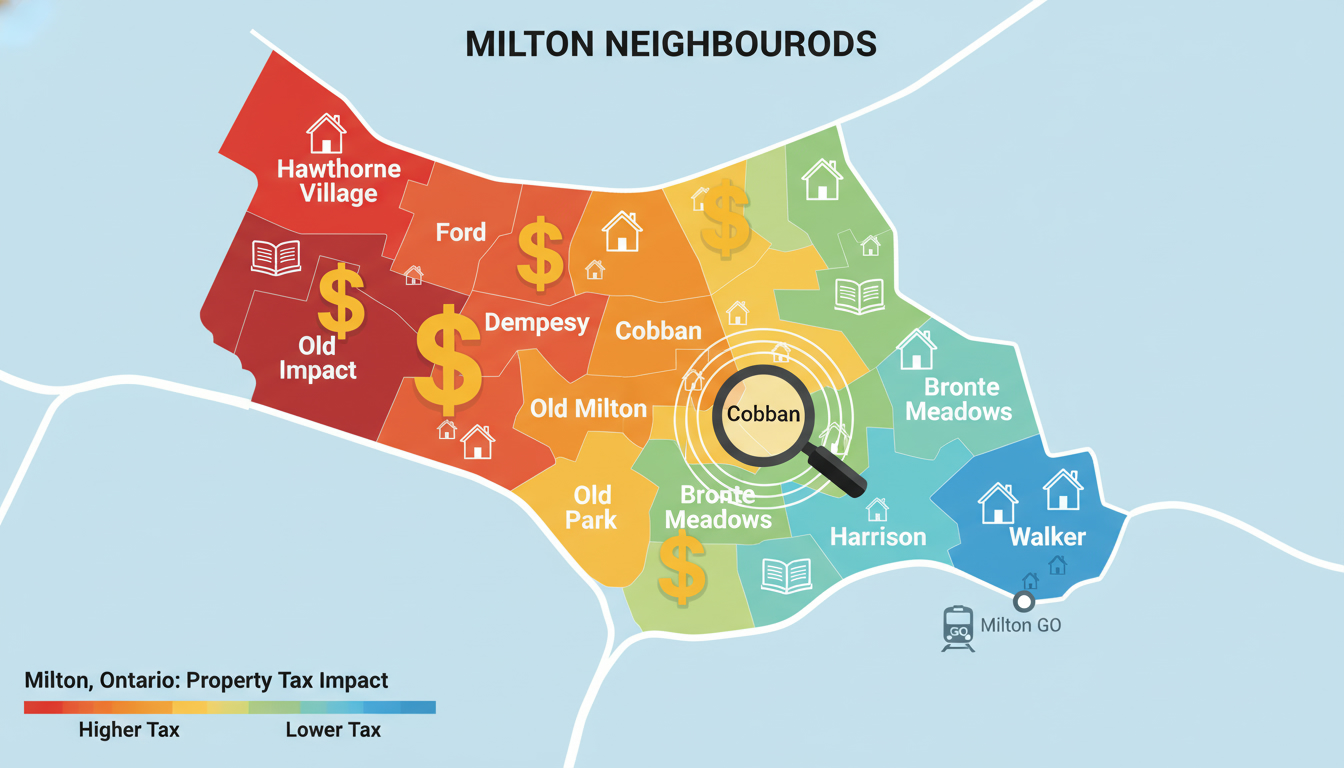

Property taxes are a function of three things: assessed value, the municipal tax rate, and special local charges. Neighbourhoods influence the first two. In Milton, that means your street, development type, and proximity to services (GO, schools, parks) can move your tax bill thousands of dollars a year.

How property taxes are built — the simple formula

Taxes you pay = Assessed Value × Tax Rate (mill rate) + Local Levies

- Assessed Value: MPAC (Municipal Property Assessment Corporation) estimates market value.

- Tax Rate: set by Town of Milton + Halton Region + Provincial education rate (applies across Ontario).

- Local Levies: sidewalk, water, stormwater charges, special area charges, and business improvement charges.

Because the tax rate applies to assessed value, two houses with different assessed values in the same town can pay very different dollar amounts even if the rate is identical.

Why taxes vary inside the same region

- Assessment differences: newer subdivisions can have higher market values. Older homes in mature neighbourhoods may be assessed lower relative to market.

- Property class: residential, multi-residential, commercial and industrial have different rates. A converted duplex or short-term rental can be taxed differently.

- Local services and special charges: neighbourhoods with new infrastructure or local improvements can carry additional levies.

- Municipal budget choices: councils set tax rates. Higher spending in one ward (libraries, parks, road work) can shift rates for the whole town but affect neighbourhoods differently depending on assessed values.

- Provincial education rates: uniform across municipalities but the education portion can be a meaningful share of your bill.

Milton specifics — what matters for sellers

Milton sits in Halton Region. That means your bill combines:

- Town of Milton tax rate (local services)

- Halton Region rate (regional services like transit, social services)

- Provincial education rates

Key local factors Milton sellers must track:

- Rapid growth and new builds: Milton’s expansion means many new subdivisions. New homes often come with higher assessed values. That raises dollar taxes even if tax rates are stable.

- Transit and GO access: homes near Milton GO or planned service upgrades usually have higher market value — higher assessments, higher taxes in dollars.

- Infill vs. greenfield: older downtown Milton homes may have lower assessments than large new builds in subdivision tracts.

- Local improvement projects: new roads, sewers, or park projects in certain neighbourhoods may create special charges or influence future budgets.

Real-world impact: how big is the difference?

Don’t get hung up on percentages. Think dollars. A $100,000 difference in assessed value at a 1% effective tax rate is $1,000 a year. In Milton’s fast-moving market, neighbourhood value spreads of $100k–$300k between pockets are common. That becomes $1,000–$3,000 a year in tax difference — predictable money that changes how buyers and sellers price deals.

What sellers need to know before listing in Milton

- Pull the last three years of tax bills for comparables. Match homes by neighbourhood, lot size, and class.

- Show net-of-tax price comparisons. Buyers care about monthly carrying costs. Present property tax per month alongside mortgage estimates.

- Highlight neighbourhood tax advantages. If your area has low effective taxes for comparable value, make it a selling point.

- Plan for reassessment timing. If MPAC reassessment is pending, disclose or position price strategically.

- Challenge incorrect assessments. If MPAC has overvalued your home, file a Request for Reconsideration (RFR) — do it before listing to avoid souring buyers later.

Tactical pricing moves that boost buyer confidence

- Convert annual tax to monthly cost in your listings.

- Provide a one-page tax comparison: your home vs. 3 nearby comps showing assessed value, tax rate, and annual tax.

- If your neighbourhood has upcoming tax-funded projects, disclose them and explain the upside (better amenities) and downside (temporary levies).

Negotiation edge: how taxes shape offers

Buyers price-in carrying costs. If your neighbourhood has higher taxes but superior transit and schools, an informed buyer will accept higher carrying costs. If you hide higher taxes, buyers will use that as leverage. Make tax transparency a negotiation strategy: show taxes, show value.

How to analyze neighbourhood tax impact — a checklist

- Get MPAC assessed value and the municipal tax bill.

- Calculate effective tax rate = annual tax / assessed value.

- Compare effective rates across target neighbourhoods.

- Check for special local charges on tax bills.

- Look up recent municipal budgets and capital projects for Milton and Halton Region.

- Confirm property class (residential vs. multi-residential).

Steps to lower tax surprises for Milton sellers

- Order a property tax history and a comparable tax sheet from your agent.

- Run an MPAC assessment check. If over-assessed, file an RFR.

- Time the market: sell before a known assessment spike if feasible.

- Factor taxes into staging and pricing. Show the value of upgrades that defend price even with higher taxes.

- Use a local realtor who knows Milton zones and recent budget impacts.

Common myths — busted

- Myth: “Tax rate is higher in neighbourhood X.” Truth: The rate is town-wide. What changes is assessed value and special levies. Two homes can face very different bills because one is worth more.

- Myth: “New developments always pay more tax.” Truth: New homes are assessed at market value and may carry special charges, but tax rates and phased-in adjustments can moderate this.

- Myth: “You can’t challenge your assessment.” Truth: You can — file an RFR with MPAC. Many successful adjustments go through each year.

Action plan for Milton home sellers (playbook)

- Get your last 3 tax bills and the MPAC assessment today.

- Ask your agent for a neighbourhood property tax comparison sheet.

- If numbers look high, file RFR before listing.

- In your listing, show monthly tax cost and highlight nearby value drivers (GO transit, schools, parks).

- Price with net-of-tax messaging: show buyers the true monthly cost.

Local insight that wins offers in Milton

Buyers coming from higher-tax areas (e.g., parts of Toronto) may see Milton taxes as a bargain compared to housing value. Flip that perception: show monthly taxes versus commute savings and quality of life gains. That message closes faster.

Final straight talk

Property taxes vary inside regions not because councils secretly play favourites, but because property value, class, and local charges diverge by neighbourhood. For Milton sellers, the math is simple: higher value areas = higher tax dollars. Use transparent numbers in listings, challenge bad assessments, and make taxes part of your sales story.

FAQ — Milton home sellers (direct answers)

How do I find my exact property tax rate in Milton?

Check your Town of Milton tax bill. It lists Town, Halton Region, and education portions. Your agent can pull the last tax bill if you don’t have it.

Why do new subdivisions in Milton often show higher taxes?

New homes often appraise higher because of size, finishes, and lot premiums. Higher assessed value = higher dollar tax. Sometimes special area charges or phased development levies can add costs.

Can I lower my property taxes before selling?

You can request an MPAC review (RFR) if you believe your assessment is wrong. Challenge obvious errors — incorrect square footage, wrong property class, or erroneous lot details.

Will property tax differences scare buyers away?

Not if you present the numbers. Show monthly carrying costs and offset with commute time savings, school ratings, and amenities. Educated buyers pay for net value.

Are school taxes different by neighbourhood in Milton?

Education rates are set provincially and apply across all Ontario municipalities. The difference in dollar terms comes from assessed value differences across neighbourhoods.

Does Halton Region’s budget affect my property tax immediately?

Yes. Regional and town budgets determine the tax rate each year. New capital projects can increase the levy. Check council budget notes and recent mill rate changes.

Should I price my house based on taxes?

Price on comparable solds first. Then show taxes to justify monthly carrying costs. If your taxes are unusually high or low, call it out with context.

What neighbourhoods in Milton tend to have lower effective taxes?

Older, established pockets with smaller lot sizes often have lower assessed values and thus lower dollar taxes compared to new-build subdivisions with larger homes. Ask a local agent for current comparables.

If my MPAC assessment goes up, does my tax bill automatically spike?

Tax bills change when the municipality sets new rates each year. A higher assessment increases your share, but municipalities balance budget needs and may adjust rates. Still, higher assessed value usually leads to higher taxes in dollars.

Who can help me analyze Milton tax impacts for my sale?

A local real estate agent who knows Milton zoning, recent MPAC trends, and Halton Region budgets. If you want direct help, contact the local realtor below.

Contact: tony@sousasells.ca | 416-477-2620 | https://www.sousasells.ca

Need a custom neighbourhood tax comparison for your Milton home? Reach out and get one before your next listing. I provide clear numbers, fast analysis, and a plan to protect your price.