Which areas in Ontario have the best property

appreciation?

Can you pick an Ontario neighbourhood today and watch your equity climb? Here are the areas doing it consistently—and how to buy smart.

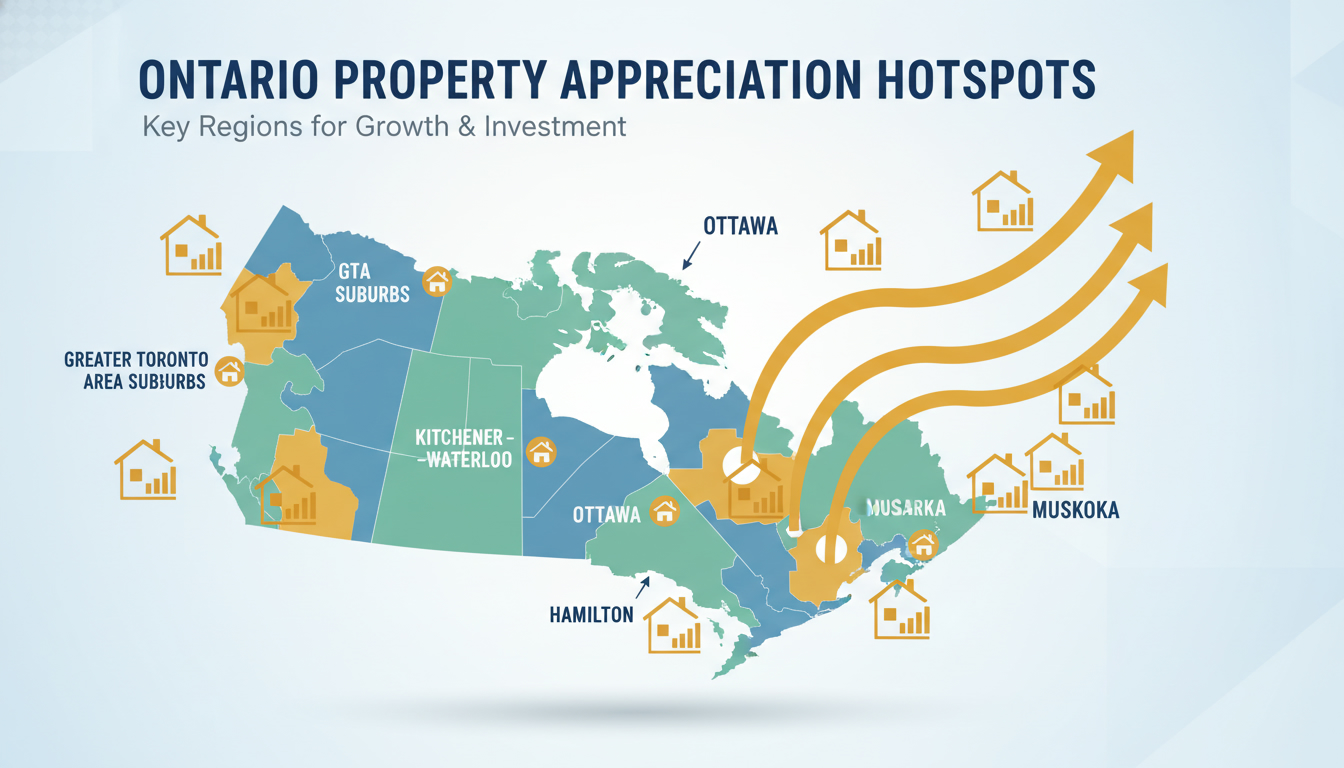

Quick answer: where appreciation is strongest

Greater Toronto suburbs, Kitchener–Waterloo, Hamilton, Ottawa, Niagara Region, London, Barrie and selected cottage-country pockets lead Ontario for property appreciation. These areas share the same drivers: job growth, transit and infrastructure, constrained supply, and investor demand.

Why these areas outperform (data-driven factors)

- Job and population growth: Cities near major job nodes or with tech/manufacturing expansion attract buyers and renters.

- Transit and infrastructure: GO expansion, light rail, highway upgrades and new stations raise values within 10–20 minutes of stops.

- Supply constraints: Municipal growth limits, protected greenbelt land and low new-build rates tighten supply and lift prices.

- Relative affordability shift: Buyers priced out of core Toronto push demand into suburbs and mid-sized cities, lifting appreciation there.

Top Ontario markets to watch (what makes each one win)

- Greater Toronto suburbs (Durham, York, Peel, Halton): Strong employment links to Toronto, transit expansions and sustained demand from commuters.

- Kitchener–Waterloo: Tech cluster, university talent pipeline and limited housing stock drive steady appreciation.

- Hamilton: Infrastructure investment and conversion from industrial to mixed-use make it a long-term winner.

- Ottawa: Stable government employment, tech growth and purposeful urban planning reduce downside risk.

- Niagara Region (St. Catharines, Niagara Falls): Affordability pull and tourism-driven demand; good for both resale and short-term rental strategies.

- London & Southwestern Ontario: Growing healthcare and education sectors, good affordability and rising investor interest.

- Barrie & Simcoe County: Commuter market with faster appreciation where transit and highway access improve.

- Select cottage-country pockets (Muskoka, Kawartha Lakes): Premium second-home demand and limited supply fuel appreciation for higher-end homes.

How to spot the next high-appreciation pocket (checklist)

- New major employer announcements nearby.

- Confirmed transit or highway projects with timelines.

- Low new-home permits relative to population growth.

- Strong rent growth and low vacancy rates.

- Municipal zoning favoring infill and higher density.

Tactical advice for investors and homeowners

- Buy near transit nodes or planned stations. Value upgrades arrive with connectivity.

- Favor supply-constrained towns with job growth over speculative suburbs with heavy new-build pipelines.

- Prioritize single-family homes in family-oriented neighbourhoods if long-term resale is your goal; condos can outperform short-term near transit and universities.

- Analyze price-per-square-foot trends and days-on-market for 12–24 month windows, not just single-month spikes.

Final: make decisions that compound equity

Property appreciation isn’t random. It’s predictable if you watch jobs, transit, supply and affordability shifts. If you want a tailored list of streets and segments in Ontario primed for the fastest appreciation, contact an agent who maps data to action.

Contact Tony Sousa for a market plan, neighborhood heatmap and focused investment picks: tony@sousasells.ca | 416-477-2620 | https://www.sousasells.ca