How do I manage probate when selling a parent’s home?

Want to sell your parent’s house fast — even with probate? Read this and get a plan that actually works in Georgetown, ON.

Why probate matters when selling an inherited home

Probate isn’t paperwork for lawyers to hoard — it’s the legal clearance that lets an executor or estate trustee transfer title and close a sale. In Ontario, that clearance is the Certificate of Appointment of Estate Trustee (with or without a will). If the home was only in your parent’s name, most buyers and mortgage lenders will want proof the executor has authority to sell.

Skip the drama: understand probate early and the sale becomes predictable. Ignore it and the sale stalls, buyers walk, and legal headaches pile up.

The real, practical steps to manage probate and sell a parent’s home in Georgetown

This is the checklist you need. Do these steps and you’ll reduce delay, avoid unnecessary costs, and protect the estate.

1) Confirm ownership and the will

- Check the deed and title at the Land Registry. If the property was held in joint tenancy it may pass directly to the surviving owner — often no probate required. If it’s solely in your parent’s name, probate is likely.

- Locate the original will. The named executor is usually the one who applies for the Certificate.

2) Call an experienced estate lawyer in Halton/Georgetown immediately

You can’t DIY probate unless the estate is tiny and simple. A local lawyer who handles Ontario probate will:

- Prepare and file the probate application with the Superior Court (local registry for Halton/Georgetown).

- Calculate and advise on Estate Administration Tax (probate fee) and other costs.

- Help draft an executor’s plan for selling the property.

3) Secure the property and gather documents

- Change locks if necessary, clean up, and take inventory of contents.

- Collect mortgage statements, tax bills, utility bills, insurance, and any tenancy agreements.

- Preserve original keys and warranty documents.

4) Order a professional appraisal and home inspection

Get a local appraisal and a basic inspection. Appraisers and inspectors in Georgetown know the market and can flag issues buyers will use to lower offers.

5) Decide how to list the property: active listing vs. estate sale strategy

Options:

- Wait for probate, then list normally: clean title, easier for buyers and lenders, often gets higher offers.

- List before probate using solicitor’s undertakings or a ‘sale subject to probate’ clause: possible, but it narrows buyers to those comfortable waiting and adds legal risk.

- Sell to an investor or cash buyer: faster, less net proceeds in most cases.

I recommend listing after you have the Certificate of Appointment unless there’s a strong reason to rush. In Georgetown’s market, buyers expect clean titles.

6) Price and stage the home for the Georgetown buyer

Georgetown buyers value curb appeal, functional systems, and a clear maintenance history. Book a local realtor who understands tax assessments, comparable neighbourhoods (Acton, Norval, Trafalgar), and Halton school draws. Declutter, do small repairs, and stage selectively to maximize offers.

7) Disclose and resolve title and mortgage issues early

- Pay or negotiate outstanding property taxes and utilities.

- Talk to the lender about mortgage discharge. If a mortgage exists, it must be paid from estate proceeds at closing.

- If tenants or occupants remain, resolve tenancy agreements legally before listing.

8) Close the sale and settle the estate

After sale proceeds arrive, pay valid estate debts, fees (legal, realtor, certification), and Estate Administration Tax. Then distribute to beneficiaries according to the will or intestacy rules.

Timeline: what to expect in Georgetown, ON

- Initial lawyer consult: 1–2 weeks.

- Probate application filing and processing: typically several weeks to a few months depending on complexity and court workload.

- Preparing the home for sale: 2–6 weeks.

- Market time: depends on condition and pricing. Georgetown can move quickly for properly priced homes.

If the estate is contested, expect delays measured in months. If the court requires extra documentation, expect extra time. Plan accordingly.

Common obstacles — and how to handle them without freaking out

- Contested wills: move to mediation fast. Litigation kills timelines and consumes estate value.

- High mortgage or liens: negotiate with lenders; sometimes short-term bridging loans for the estate are possible.

- Missing beneficiaries or unknown heirs: a lawyer can help with searches and service requirements.

- Buyer demands to close before probate: get a solicitor’s undertaking or require stronger deposit/price concessions.

How to save money and speed up probate-related sales

- Use a local estate lawyer who files quickly and communicates in plain English.

- Prepare full documentation in advance to avoid court delays.

- Price the property correctly — an overpriced estate sits longer and costs more in carrying fees.

- Consider limited renovations that boost sale price but cost little (fresh paint, landscaping, minor kitchen/bath fixes).

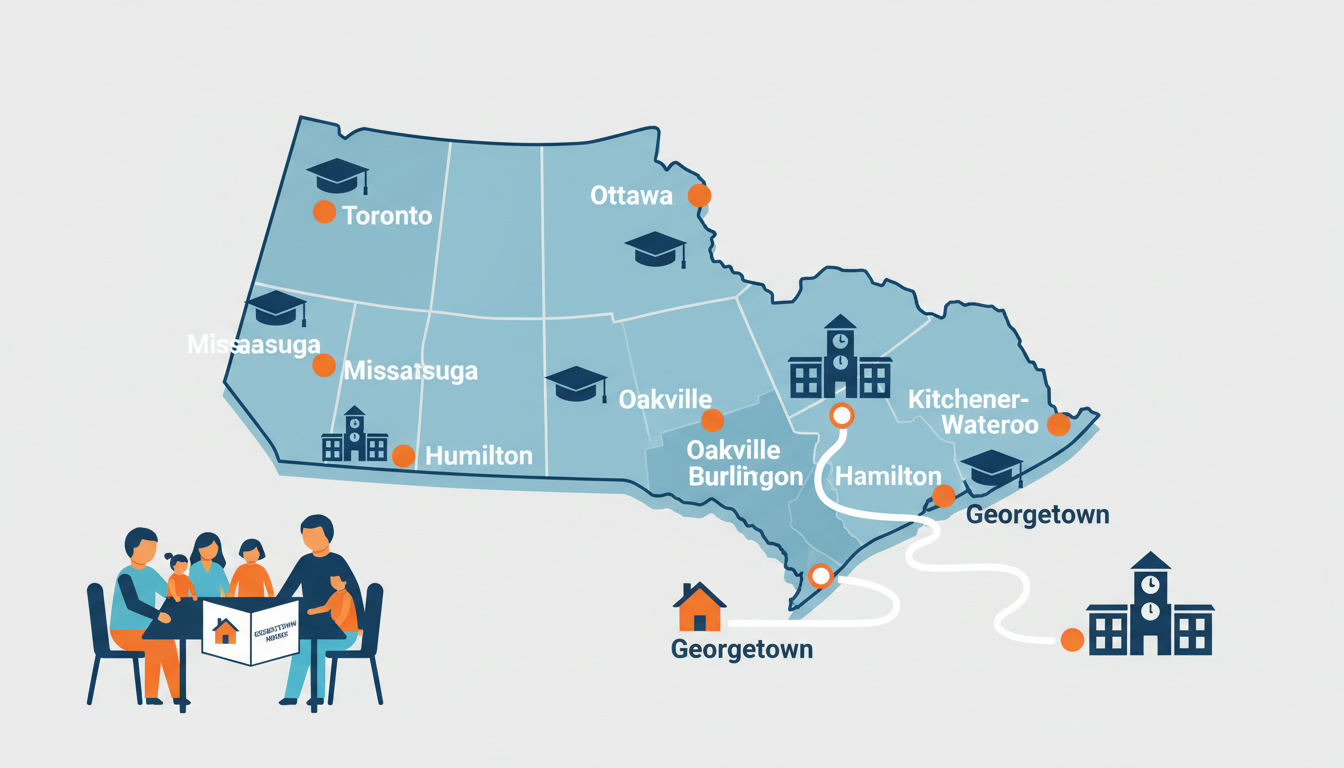

Why local expertise matters: Georgetown, Halton Region specifics

- Local courts, local buyers: the process runs smoother with someone who knows Georgetown’s buyers, school zones, and comparables.

- Neighbourhood nuance: Georgetown buyers prize heritage charm and commuting access to Toronto via Highway 7/Trans-Canada routes. Position the listing around those advantages.

- Local taxes and municipal requirements: confirm Halton property tax status and any local compliance (e.g., rental licensing, septic/well reports if applicable).

If you’re not local, you’ll miss small issues that cost thousands or slow a sale.

Real examples (what usually happens)

Scenario A — Clean will, no mortgage

Executor gets Certificate, lists property with a local agent, multiple offers appear, property sells in 2–4 weeks. Closing proceeds pay fees and beneficiaries receive their share.

Scenario B — No will, mortgage in arrears

Court appoints an estate trustee without a will. Mortgage lender requires resolution. The trustee negotiates payoff, lists the property, may accept a firm cash offer. Timeline grows because of lender requirements and possibly an application to pay urgent debts from the estate.

Scenario C — Buyer wants to close before probate

The buyer requests a solicitor’s undertaking or higher deposit. The estate lawyer can negotiate terms but beware added legal exposure for the trustee. Often best to wait for the Certificate.

How a local realtor and estate lawyer split responsibilities

- Executor/estate trustee: acts in good faith and directs the sale with legal guidance.

- Estate lawyer: handles the probate application, legal clearance, and title issues.

- Realtor: markets the property, advises on pricing and staging, negotiates offers, and coordinates closing with the lawyer.

You need all three to prevent costly mistakes.

Closing — a direct plan of action you can use today

- Find the original will and confirm who the executor is.

- Book a consultation with an estate lawyer familiar with Halton/Georgetown probate.

- Secure and inventory the property; handle urgent maintenance.

- Order appraisal and inspection.

- Decide on listing timeline (after Certificate vs. before) with your lawyer and realtor.

- List with a realtor experienced in estate sales and Georgetown neighbourhoods.

- Close, pay debts/taxes, and distribute funds.

If you want direct help for Georgetown: contact a local realtor who knows the probate process and how buyers in this market behave. They speed the sale and protect the estate.

FAQs — quick answers for the common probate and selling questions in Georgetown, ON

Q: Do I always need probate to sell a parent’s home in Ontario?

A: If the property is only in the deceased’s name, most lenders and buyers will require the Certificate of Appointment (probate). Joint tenancy or beneficiary designations can avoid probate.

Q: How long does probate take in Halton/Georgetown?

A: It varies. Simple estates often get cleared in a few weeks to a few months. Complex or contested estates take longer. Your estate lawyer will give a better estimate.

Q: What is Estate Administration Tax (probate fee)?

A: Ontario charges an Estate Administration Tax that is calculated on the value of the estate. The exact amount depends on estate value — ask your lawyer for a precise figure.

Q: Can I sell the house before probate is granted?

A: Sometimes. Buyers or lenders must agree to close post-probate or accept a solicitor’s undertaking. That narrows the buyer pool and adds legal risk for the executor.

Q: Who pays realtor and lawyer fees?

A: Fees are paid from estate proceeds before distribution to beneficiaries. Executor compensation may also be paid out of the estate according to the will or provincial rules.

Q: What if there is a mortgage or outstanding debts?

A: Valid debts are paid from sale proceeds. The mortgage will need discharge or payout at closing unless the buyer assumes it with lender approval.

Q: How do I find the right realtor for an estate sale in Georgetown?

A: Look for a realtor with estate sale experience in Halton Region, strong local comps knowledge, and clear communication. Ask for references and proven sales of similar properties.

Q: What happens if the will is contested?

A: Contested wills can delay probate and sales. Mediation can resolve disputes faster than court. Talk to your estate lawyer immediately.

Need help in Georgetown? Tony Sousa handles estate sales and probate-related listings in Halton. Email tony@sousasells.ca or call 416-477-2620. Visit https://www.sousasells.ca for local listings and faster answers.

If you want a straight, local plan — request a free consultation. I’ll connect you with the right estate lawyer and a step-by-step timeline tailored to your house and circumstances.