What Costs Should I Expect When Selling My Home?

Sell your Milton home? Don’t guess — know the costs before you sign.

Quick, Honest Answer

Expect selling costs between about 4% and 8% of the sale price in most cases. That range covers the big items — agent commission, legal fees, and routine closing adjustments. Add optional items (staging, repairs, mortgage penalties) and you can push toward 9–12% — or more if you make avoidable mistakes.

This article lays out every cost line-by-line, shows a clear net-proceeds example, and gives Milton-specific tips so you keep more cash at closing. Read it like your bank account depends on it.

Why this matters in Milton, ON

Milton is still a high-demand market in the Halton Region. Low inventory and strong commuter demand keep prices competitive. That helps sellers — but it doesn’t erase selling costs. Smart sellers focus on net proceeds, not just the headline sale price. Two homes can fetch similar prices but leave very different amounts in your pocket depending on costs and negotiation.

If you want to maximize net proceeds, understand each cost, and make every choice intentionally.

Line-by-line: What costs should you expect when selling a home in Milton?

-

Typical range: 4% to 6% of sale price (often split between listing and buyer agents).

-

HST: Real estate commissions in Ontario are subject to HST (13%). Some agents list commission after HST. Confirm how your agent quotes it.

-

Legal fees and disbursements

-

Typical range: $800–$2,000.

-

Lawyers handle title transfer, payoffs, and adjustments. Expect basic closing statements, HST on legal fees, and small disbursements.

-

Mortgage discharge or payout penalty

-

If you have a mortgage to pay off, the lender may charge a discharge fee ($200–$400) and potentially a prepayment penalty if you’re not at term.

-

Always get a mortgage payout statement before listing.

-

Adjustments at closing

-

Property taxes, utility bills, condo fees (if applicable), and prepaid items are prorated. Usually a small credit or debit at closing.

-

Home staging and professional photos

-

Staging: $500–$4,000 depending on scope. Virtual staging costs less.

-

Photos/video/drone: $200–$800.

-

High-quality media usually shortens time on market and can increase offers.

-

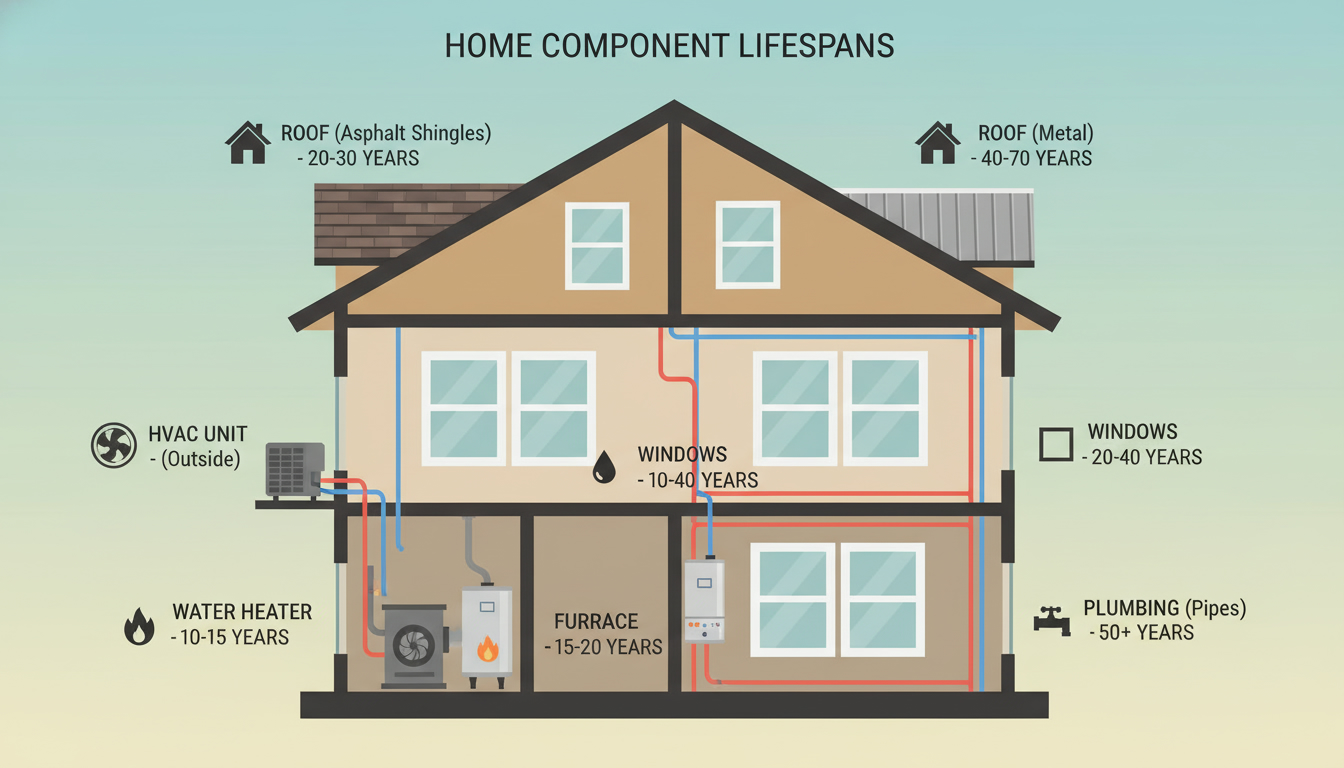

Repairs and pre-listing inspection

-

Simple repairs: $200–$2,000.

-

Pre-listing inspection: $300–$600. Optional, but it can speed sale and reduce renegotiations.

-

Moving costs

-

Local move: $300–$2,000 depending on size. Long-distance more.

-

Realtor marketing fees (if any)

-

Some agents include pro marketing. Others charge add-ons for premium brochures, targeted ads, or open house materials.

-

Holding costs if the house sits

-

Mortgage payments, taxes, utilities, and insurance continue until closing. The longer it sits, the higher these costs.

Example: How costs add up — real numbers, easy math

Example sale price: $900,000 (rounded, Milton market example)

- Commission (5%): $45,000

- HST on commission (13%): $5,850 (confirm if quoted in commission)

- Legal fees: $1,200

- Staging & photos: $1,500

- Repairs & inspection: $1,000

- Mortgage payout (balance): $450,000

Gross sale price: $900,000

Less mortgage payoff: -$450,000

Less commission + HST: -$50,850

Less legal & closing: -$1,200

Less staging/repairs: -$2,500

Net proceeds at closing: ~$345,450

This example shows commission is the biggest line item. Reducing costs or negotiating better terms can materially increase your net proceeds.

Smart ways to reduce selling costs (and increase net proceeds)

-

Price right from the start

-

A correctly priced home sells faster. Faster sales cut holding costs and reduce need for price drops.

-

Negotiate commission structure

-

Not all agents must charge the same. Negotiate based on services delivered and local performance. Don’t pick an agent just on the lowest percentage; net matters more than gross.

-

Bundle services with your agent

-

Many top agents include staging consults, pro photos, and targeted marketing without extra fees. Ask what’s included.

-

Do the small repairs yourself

-

Spend on high-impact, low-cost fixes: fresh paint in key rooms, fix visible hardware, clear gutters, and improve curb appeal.

-

Use a pre-listing inspection strategically

-

It can reduce renegotiations after offers and help you price with confidence.

-

Time the market if you can

-

Listing during stronger demand windows reduces time on market and holding costs. Your agent can advise local seasonality.

Mortgage tips specific to Ontario sellers

-

Ask for a mortgage payout statement early

-

It lists the exact payoff amount and any penalties. Use it to model net proceeds.

-

Check for portability options

-

If planning to buy another home, see if your mortgage can be ported to avoid penalties.

Milton market tips that impact costs and timing

- Inventory is tight compared to many surrounding areas. That can push sale prices higher and shorten marketing time.

- Commuter demand from the GTA keeps buyer interest strong. Homes in commuter-friendly neighbourhoods typically sell faster.

- Condos vs. freehold properties: condo sellers pay common element adjustments and could face reserve fund or condo document fees. Freeholds may have higher staging expectations.

Use a local agent who understands Milton micro-markets — that matters for price strategy and staging priorities.

How to compute your exact net proceeds — simple checklist

- Get your estimated sale price (market analysis).

- Subtract outstanding mortgage balance and payout penalty (ask lender for statement).

- Subtract estimated commission and HST.

- Subtract lawyer fees and disbursements.

- Add estimated repairs, staging, inspection, and marketing costs.

- Include prorated property taxes and utilities.

- The remainder is your estimated net proceeds.

Ask your agent for a written net sheet. If they won’t provide one, find someone who will.

When a lower commission hurts you

A low commission can mean low effort. The wrong agent can price you poorly, under-market your home, or miss buyers. That costs you more than a percentage point in commission. Always compare net proceeds under real listing plans, not just commission percentages.

Real negotiation levers sellers can use

- Offer a bonus to a buyer’s agent for faster results (rare, but sometimes used).

- Time the listing to create scarcity.

- Use conditional clauses that protect you (e.g., buyer financing deadlines).

Final step before you list: get a real net sheet

A credible agent prepares a net sheet showing expected proceeds under different sale prices and commission scenarios. This is non-negotiable. If you don’t get a transparent net sheet, walk away.

Strong local advice you can act on today

- If you want to know exactly what selling will cost in your situation in Milton, request a custom net proceeds analysis.

- Don’t let surprises at closing erode your profits.

- Remember: the right agent pays for themselves through higher offers, better timing, and fewer surprises.

Contact and next steps

If you want a free, accurate net proceeds estimate for your Milton property, email tony@sousasells.ca or call 416-477-2620. You’ll get a written net sheet and a clear plan to keep more cash at closing.

Frequently Asked Questions — Clear, concise answers for Milton sellers

Q: What percent is the typical commission in Milton?

A: Typical total commission ranges from 4% to 6% of the sale price. Always confirm whether HST is included.

Q: Who pays HST on real estate commission in Ontario?

A: HST applies to commission. Ask your agent how they quote their fee (inclusive or plus HST).

Q: Do sellers pay land transfer tax in Ontario?

A: No. Land transfer tax is paid by the buyer in Ontario.

Q: How much will legal fees be?

A: Expect $800–$2,000 depending on complexity and disbursements.

Q: Will I owe a mortgage penalty if I sell early?

A: Possibly. Check your mortgage contract and request a payout statement. Penalties vary by lender and mortgage type.

Q: Should I do a pre-listing inspection in Milton?

A: It can be smart. It reduces surprises, speeds negotiations, and gives buyers confidence. Use it strategically.

Q: How long does it take to sell in Milton?

A: It varies. Strongly priced homes in popular neighbourhoods can sell in days; others may take weeks. Inventory and seasonality matter.

Q: How can I lower selling costs without cutting sale price?

A: Negotiate commission, avoid unnecessary repairs, use included marketing packages, and price accurately.

Q: Are condo sellers charged extra costs?

A: Expect condo document fees, reserve fund clauses, and potential status certificates. Ask your lawyer for specifics.

Q: What should I expect on closing day?

A: Your lawyer handles final payouts: mortgage discharge, agent commission, adjustments, and funds release. You receive net proceeds via bank draft or wire.

If you want a no-obligation net sheet and a straight-talking plan for your Milton home, contact tony@sousasells.ca or call 416-477-2620. Local market moves fast; get clarity before you list.