Why is Buying or Selling a Home in the GTA So Tough Right Now?

Are you struggling to buy or sell a home in the Greater Toronto Area (GTA)? You’re not alone. The real estate market here is dynamic and often challenging, with shifting trends and competitive pricing making it tough for buyers and sellers alike.

Understanding the 2025 GTA Real Estate Market

In 2025, the GTA real estate market continues to evolve. Home prices in Toronto have jumped by 10% over the past year, mirroring trends in Milton and Oakville, where home prices average $1,200,000 and $1,500,000 respectively.

Key Statistics:

- Toronto Home Prices: Increased by 10% from last year.

- Oakville Average Home Prices 2025: $1,500,000.

- First-Time Home Buyer Programs: Available across Ontario to assist new buyers.

Step-by-Step: Financing Your Home in Ontario

Navigating financing is crucial. Here are key steps:

- Check First-time Home Buyer Programs: These offer tax benefits and financial support.

- Get Mortgage Pre-approval: Secure a pre-approved mortgage to understand your budget.

- Consult with a Local Mortgage Specialist: Local experts can offer insights into trends and rates.

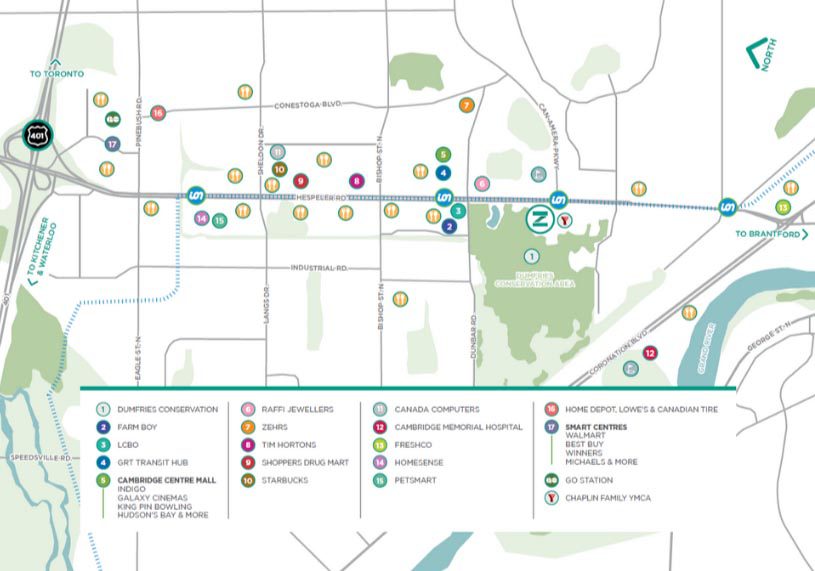

Finding the Right Property or Buyer in the GTA

Areas of Interest:

- Georgetown: Known for its community feel, perfect for first-time buyers and families.

- Guelph: Offers more affordable options with its growing economy and housing market.

Legal Steps and Paperwork

Be prepared for essential steps:

- Hire a Real Estate Lawyer: They will guide you through the paperwork.

- Understand the Agreement of Purchase and Sale (APS): This document outlines all conditions.

Moving Tips for GTA Home Buyers and Sellers

Moving can be stressful. Here’s how to make it easier:

- Plan Early: Start packing early and label boxes clearly.

- Hire Professional Movers: Choose reliable movers with experience in GTA relocations.

Expert Advice: Local Agent and Mortgage Broker Insights

According to Tony Sousa from SousaSells.ca, “Understanding the local market is crucial. Always work with an agent who knows the area inside and out.” Contact Tony Sousa at tony@sousasells.ca or 416-477-2620 for guidance.

Frequently Asked Questions

How do I find a top real estate agent in Guelph?

- Look for agents with local expertise and strong track records.

What’s the average home price in Oakville?

- As of 2025, it’s approximately $1,500,000.

How can I sell my house fast in Burlington?

- Price competitively and stage your home to attract buyers quickly.

Your Next Steps for a Successful Real Estate Journey in the GTA

Ready to dive into the GTA market? Start by connecting with local experts and take advantage of available programs to get the best deals. For in-depth guidance, visit SousaSells.ca or contact Tony Sousa for personalized assistance. Download our free checklist to help you navigate your journey.